Are you new to investing or possibly a veteran investor using valuation techniques?

In either case, you may have noticed that there are two different numbers (Equity Value Vs Enterprise Value) used to calculate the total value of a company – the Equity Value (or market capitalization) and the Enterprise Value.

While both serve the purpose of putting a value on the company, they are calculated differently and give you a slightly different picture of the company’s share price, tag, or worth.

However, it is not a surprise that these different value measures sometimes lead to confusion also.

In this article, you will get clarity on one of the most confusing / misunderstood topics for many professionals, i.e., the fundamental difference between the two – equity value and enterprise value.

1. Equity Value Vs Enterprise Value- Differences

The ‘Equity Value’ refers to the value held by its equity holders. In contrast, the ‘Enterprise Value’ refers to the total value of the business, including the value held by its equity owners and debt owners.

| Basis | Equity Value | Enterprise Value |

| Value | The total value versus equity available to equity holders | The total value available to all shareholders |

| Accuracy | May not be accurate as it is just a snapshot of current and future values | More accurate method |

| Significance | Helpful in investing in equity and equity valuations | Preferred in processes like mergers, acquisitions, and leveraged buyouts |

| Debt and cash | Debt is deducted from bank account, and cash is added | Debt gets added to cash on balance sheet, and cash gets deducted |

| Formula | Equity Value = Total Assets -Total Liabilities | EV = Market Cap + Total Debt -Cash & Cash Equivalents |

| Comparison | Allows for comparing companies based on their common ownership without considering debt | Facilitates comparisons between companies with different capital structures |

Now let me give you a live example to make you understand better:

A few weeks back, a friend of mine bought a house.

He was happy to share the news with all his friends.

He threw a big party and celebrated the purchase of this true asset. While discussing the cost of this asset, he explained the various costs attached to it.

The actual acquisition cost of the house was 10% more than the list price.

Why 10%?

Well, it included hidden costs like repairs to be done, unpaid bills, different obligations, and various registration costs.

But, my friend benefited from furniture that he got free with the house.

Okay! You will ask me what this house story has to do with this article’s headline, right?

Now, imagine you are an equity research analyst working on the valuation of a company to be acquired.

Take the essence of the house story in this context, and you will understand the difference between equity value and enterprise value clearly.

Understanding these key differences is essential for you, as a financial analyst, investor, and professional, to make informed decisions related to the following:

Now that you know the differences between enterprise value versus equity, let’s understand how to calculate both.

2. Meaning of Equity Value and Enterprise Value

2.1 What is Equity Value?

Equity Value represents the value of a company’s shareholders’ equity, which is the residual interest in the entire value of the business’ assets after deducting liabilities.

In simpler terms, it is what the shareholders would receive if all the company’s assets were sold and its debts paid off.

Here’s a breakdown of the components involved in the formula that you will explore in the next segment:

1. Total assets: Represents the sum of all the company’s assets, including tangible assets (e.g., buildings, equipment, inventory) and intangible assets (e.g., patents, trademarks, goodwill).

2. Total liabilities: Includes all the company’s debts and obligations, such as loans, accounts payable, and other liabilities.

2.2 What is Enterprise Value?

Enterprise Value (EV) is a vital financial metric used to determine the total value of a company, representing what it would cost to acquire the entire business, including both equity and debt.

As an essential measure in finance and investment analysis, understanding enterprise value and its calculation is crucial for you as an investor, analyst, and corporate finance professional.

3.How to Calculate Equity Value and Enterprise Value?

3.1 Equity Value Formula

In finance and accounting, two essential concepts are used to describe the value of capital structure of a company’s equity and operating assets:

Book Value

Market Value

Step 1. Book value

Book Value, also known as “Net Asset Value” or “Carrying Value,” represents the value of a company’s equity according to its financial statements calculated by subtracting its total liabilities from its total assets.

Equity Value Formula based on Book Value:

Equity Value = Total Assets – Total Liabilities

By subtracting the total liabilities from the total assets, you arrive at the value left for the shareholders if the company liquidates all its assets and pays off its debts.

For example:

Let’s consider a fictional company called “TechX, Inc.” Assume the financial statements of TechX Inc., show the following:

Total Assets = $700 million

Total Liabilities= $300 million

To calculate the book value of TechX Inc.’s equity:

Book Value = Total Assets – Total Liabilities

Book Value = $700 million – $300 million

Book Value = $400 million

In this example, TechX Inc.’s book value of equity is $400 million.

If TechX were to sell all its net operating assets now and pay off all its debts, the remaining value, amounting to $400 million, would belong to the shareholders.

Unlike the market value, book value is relatively stable and changes only when there are significant events such as:

Mergers

Acquisitions

Major asset write-downs

For instance, in 2016, when Verizon Communications acquired Yahoo Inc., the book value of Yahoo changed due to the merger because the acquisition impacted the valuation of Yahoo’s assets and liabilities, leading to a change in its overall book value.

Over time, a company’s book value may deviate from its market value due to factors such as:

Inflation

Changing market conditions

Shifts in industry dynamics

Step 2. Market value

Market Value is the current value of a company’s equity in the stock market that represents the price at which a company’s shares currently trade in the open market.

Market Value Formula:

Market Value = Number of Outstanding Shares × Current Stock Price

The Market Value is determined by the interaction of supply and demand forces, reflecting equity investors’ perceptions of the company’s future prospects, performance, and overall sentiment.

For example:

Continuing with TechX Inc., let’s assume that its total outstanding shares in the market are 10 million (outstanding shares are basically the number of shares held by the company’s owners).

Its current stock price is $50 per share.

To calculate the market value of TechX Inc.’s equity:

Market Value = Number of Outstanding Shares × Current Stock Price

Market Value = 10,000,000 shares × $50 per share

Market Value = $500,000,000

In this example, TechX Inc.’s market value of outstanding equity is $500 million.

Market value fluctuates in real time based on market dynamics and investor sentiment.

Positive news about a company’s products or earnings can increase its stock price, raising the market value of its equity.

Conversely, adverse events or poor financial performance may cause the stock price to decline, reducing the market value of the company’s equity.

For instance, in 2008, during the global financial crisis, the market value of Lehman Brothers, a central investment bank, fluctuated dramatically due to investor panic and loss of confidence, leading to its eventual bankruptcy.

Unlike its counterpart (book value), market value is a dynamic metric continually changing as new information becomes available.

Step 3: Equity Value Formula

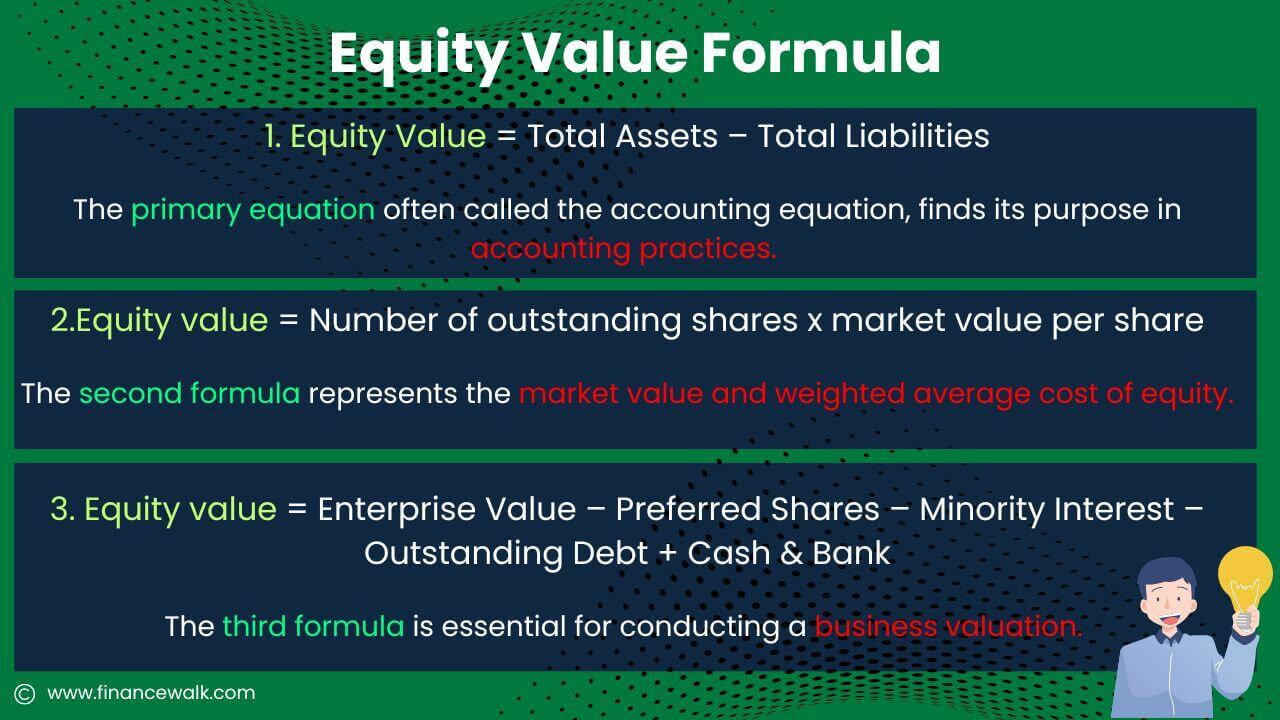

1. Equity Value = Total Assets – Total Liabilities

Or,

2.Equity value = Number of outstanding shares x market value per share

Or,

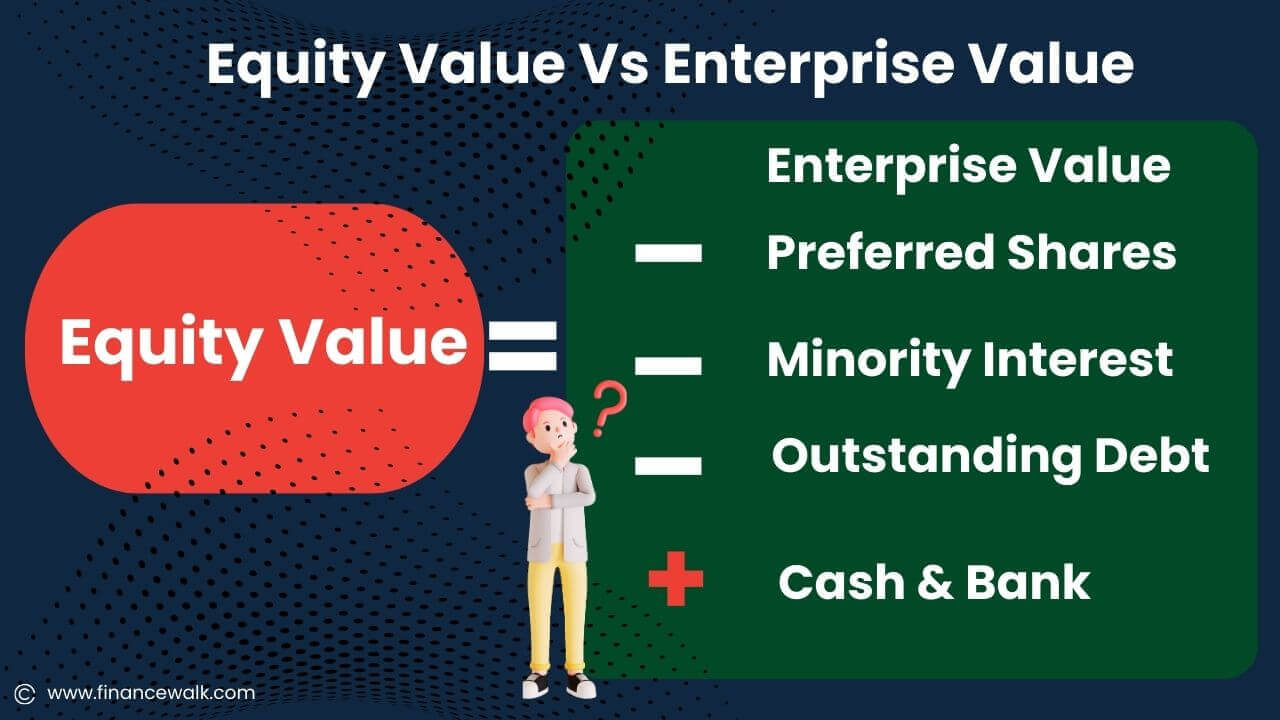

3. Equity value = Enterprise Value – Preferred Shares – Minority Interest – Outstanding Debt + Cash & Bank

Step 4: Interpretation of Equity Value formula

The primary equation often called the accounting equation, finds its purpose in accounting practices.

The second formula represents the market value and weighted average cost of equity.

The third formula is essential for conducting a business valuation.

Suppose your objective is to assess the worth of a business. In that case, you’ll rely on the third formula, which provides valuable insights—more about this when we get into enterprise value.

Note: Equity Value is not the same as a publicly traded company’s market capitalization (market cap).

Equity Value is often used to determine the market value of a company. It is a critical metric for investors and research analysts assessing a firm’s worth.

For instance, in 2016, Tesla’s Equity Value and market perception were influenced by its acquisition of SolarCity. This major solar energy firm was crucial for investors and analysts.

This merger aimed to strengthen Tesla’s clean energy vision.

3.2 Enterprise Value formula

Let’s examine the process of calculating the Enterprise Value and everything you need below.

Step 1: Calculate Enterprise Value

To calculate Enterprise Value, you will need the following information:

Market capitalization (Market cap)-The total value of a company’s outstanding shares in the stock market, calculated by multiplying the current stock price by the number of outstanding shares.

Total debt- Includes the company’s long-term and short-term debt, such as loans, bonds, and other borrowings.

Cash and cash equivalents- The cash on hand and other highly liquid assets that can be readily converted to cash.

Step 2: Enterprise Value formula

Enterprise Value (EV) = Market Capitalization + Total Debt – Cash and Cash Equivalents

The first step to finding the Enterprise Value involves finding the market value, which involves determining the company’s number of outstanding shares and the company’s current stock price.

Market Cap = Number of Outstanding Shares x Current Stock Price

Step3: Illustration

1. Going by our fictional company called “TechX,” which has 10 million outstanding shares and a current stock price of $50 per share, to calculate the market capitalization of TechX:

Market Cap = 10,000,000 shares × $50 per share

Market Cap = $500,000,000

In this example, TechX’s market capitalization is $500 million.

2. The next step includes finding Enterprise Value.

Let’s assume that TechX has a total debt of $200 million and cash and cash equivalents of $50 million. To calculate the enterprise value of TechX:

EV = $500 million (Market Cap) + $200 million (Total Debt) – $50 million (Cash and Cash Equivalents)

EV = $650 million

In this example, TechX’s implied enterprise value is $650 million.

Step 4: Enterprise Value- Alternative Formula

Enterprise Value (EV) = Equity Value + Total Debt – Cash and Cash Equivalents

Using the alternative formula, you can calculate the Enterprise Value by finding the Equity Value.

Equity Value = Market Capitalization

Equity Value = $500 million (Market Cap, as calculated above )

Note: By adding Market Capitalization (part of Equity Value) to the formula, we ensure that the Enterprise Value calculation considers all equity components while accounting for debt and cash.

This way, you get a more comprehensive view of the company’s total worth, including outstanding equity and debt.

Step 5: Now, you can calculate the Enterprise Value:

EV = $500 million (Equity Value) + $200 million (Total Debt) – $50 million (Cash and Cash Equivalents)

EV = $650 million

The result is the same as the previous calculation, with TechX’s Enterprise Value being $650 million.

Step 6: Actual Equity Value

Having calculated all these essential business valuation metrics, it’s time to get the actual enterprise value and some of the same equity value using the values we’ve summed above.

Equity value = Enterprise Value – Preferred Shares – Minority Interest – Outstanding Debt + Cash & Bank

However, to determine the Equity Value, you must calculate the enterprise value (EV) first and then make adjustments for preferred shares, minority interest, outstanding debt, and cash & bank.

Step 7. Illustration

Let’s use some imaginary data to calculate the Equity Value of your company called “TechX Inc.”

Enterprise Value: $650 million

Total Debt: $100 million

Preferred Shares: $50 million

Minority Interest: $30 million

Cash & Bank: $100 million

Our equity target value, therefore, becomes:

Equity Value = $650 million–$50 million–$30 million–$100 million + $100 million

Our equity value is, therefore, $570 million.

For instance, Amazon.com‘s current Enterprise Value is $1,410,382 Million. Amazon.com‘s EBIT for the trailing twelve months (TTM) ended in March 2023 adds up to the quarterly data reported by the same company within the most recent 12 months, which was $6,166 Million.

The Enterprise Value above represents the theoretical takeover price for the entire business. It reflects the market’s perception of the company’s overall worth.

4. How Equity Value and Enterprise Value Work?

4.1 How Does Equity Value work?

Equity Value plays a central role in various financial analyses and decision-making processes. Here are some critical aspects of calculating how equity value works:

1. Valuation analysis: Equity value provides investors and analysts with a measure of what the company is worth in the market when you compare the value of a company’s stock to its peers or benchmark indices.

2. Mergers and acquisitions: When companies consider merging or acquiring another business, as the acquiring company, you need to evaluate the target company’s market equity value to determine the potential premium or discount it may pay in the transaction.

3. Investor decision-making: Equity value directly impacts investment decisions to assess the attractiveness of a company’s stock, potential returns, and overall financial health. A company with a higher equity value than its peers may be considered more valuable and desirable.

4. Capital structure analysis: As an investor or analyst, you evaluate a company’s capital structure which refers to its mix of debt and equity financing, to understand its financial risk and the proportion of ownership shareholders claim.

5. Fundamental analysis: Equity value is a foundational component of fundamental research, where, as an analyst, you study a company’s financial statements, industry trends, and macroeconomic factors to gauge its intrinsic value. This analysis helps in making long-term investment decisions.

4.2 How does Enterprise Value work?

Let’s take a look at some key reasons why enterprise value is significant:

1. Mergers and takeovers: Enterprise Value matters in mergers. When a company wants to buy another, they count the total cost, including the target firm’s equity and acquired company’s debt. Enterprise Value shows the actual cost.

Like Salesforce buying Slack for $27.7 billion in 2020. They aimed to make a high-tech ecosystem, grow customers, and earn more.

2. Comparing firms: The Enterprise Value formula helps compare firms with different debts. Companies with varying debts can seem different, but the same total Enterprise Value amount makes comparing fair.

3. Finding cheap stocks: Investors can find cheap or expensive stocks by looking at Enterprise Value versus market worth. Low market worth to Enterprise Value might mean a good chance.

4. Deciding on projects: Enterprise Value helps see total business worth with debts when checking new projects. Useful for capital decisions.

5. Equity Vs Enterprise Value- Applications

5.1 When to use Equity Value?

1. Stock valuation and investment decisions: Equity value is relevant when evaluating a company’s stock for investment purposes to:

Provide insight into the portion of a company’s value that belongs to its common shareholders.

Aids investors in assessing the company’s growth prospects and potential returns.

2. Comparing ownership stakes: Equity Value is instrumental in comparing the relative ownership stakes of different shareholders in a company for a clear understanding of how much ownership each shareholder holds.

For example: Imagine a publicly-traded company, TechX Inc., with 10 million outstanding shares. If an investor owns 1 million shares of TechX Inc., the equity value of their stake would be calculated as the number of shares they hold multiplied by the current stock price.

3. Employee stock ownership plans (ESOPs): Companies may use Equity Value to determine the value of shares or options granted to employees through ESOPs to help determine fair compensation.

4. Valuation of private companies: When valuing private companies or start-ups, Equity Value allows investors or potential buyers to understand the value of the common equity before considering additional factors like net debt only.

5.2 When to Use Enterprise Value?

1. Mergers and Acquisitions (M&A): By using Enterprise Value, acquirers can evaluate the total cost, including both equity and debt, of acquiring a company

2. Comparing companies with different capital structures: Enterprise value is practical when comparing companies with varying levels of debt and equity to allow for a standardized comparison of their total enterprise value vs equity amount.

For example: Consider two companies, TechX and TechZ, with the same market capitalization. However, TechX has a significantly higher level of debt than TechZ. Enterprise Value helps compare the two companies’ total worth by considering their debt levels.

3. Assessing leveraged buyouts (LBOs): Enterprise Value is crucial when evaluating leveraged buyout opportunities, where the buyer relies heavily on debt financing.

4. Financial analysis and ratios: Enterprise Value is used in various financial ratios, such as EV/EBITDA, to assess a company’s financial performance and compare it with its peers.

If you understand that, you’re in for a rewarding career and confidence when undertaking business valuations for yourself or your clients.

6. Practical Applications- Equity Vs Enterprise Value in Companies

Let’s explore two real-world scenarios where Equity and Enterprise Value are applied to evaluate companies and make informed financial decisions.

6.1 Valuing a publicly-traded company’s capital

A publicly traded company is valued through financial analysis and valuation techniques that aim to determine its intrinsic worth in the financial markets.

You can use several methods to value a publicly traded company, and the choice of method may depend on various factors, including the company’s industry, financial performance, growth prospects, and risk profile.

I’ll use market capitalization to put this into perspective.

Let’s go to our newly founded company, TechX Inc.

TechX Inc. is a publicly-traded company in the technology sector. Let’s see what we’ll get if its stock is currently trading at $50 per share price and has 20 million outstanding shares.

To determine the equity value of TechX, use the formula:

Equity Value = 20,000,000 shares × $50 per share

Equity Value = $1,000,000,000

The equity value of TechX is $1 billion. This share price represents the value of the company’s equity attributable to its common shareholders.

6.2 Mergers and acquisitions

In this case, we’ll assume our imaginary company, TechX Inc., is the acquirer, and TechZ Inc. is what we’re targeting for merging and acquisition.

Let’s see how that is done in real life.

Step 1: Basic information

TechX Inc., a large conglomerate, is interested in acquiring TechZ Inc., a fast-growing start-up.

TechZ’s market capitalization is $300 million, with $100 million in total debt.

The combined cash and cash equivalents of both companies are $50 million. TechX Inc. believes the merger will result in significant collaboration, potentially adding $200 million to the combined entity’s value.

Step 2: Calculating the combined Entity Value

To evaluate a fair deal for the acquisition of TechX Inc., you can calculate the Enterprise Value of TechZ Inc. as follows:

Enterprise Value (TechZ Inc.) = $300 million (Market Cap) + $100 million (Total Debt) – $50 million (Cash & Cash Equivalents)

Enterprise Value (TechZ Inc.) = $350 million

After considering the potential collaboration from the merger, the combined entity’s valuation is projected to be $550 million.

Step 3: Calculating the Acquisition Value

What is the acquisition price?

With the individual valuations and the combined entity’s value, TechX Inc. negotiates an acceptable purchase price for both parties.

Considering the potential growth prospects, strategic value, and cost collaboration, both companies agree on an acquisition price of $500 million.

The acquisition price is determined by assessing various factors, including:

Risk

Market conditions

Strategic importance

Potential future growth prospects

Using Enterprise Value, you can help TechX Inc. evaluate the total cost of acquiring TechZ Inc., considering both equity and debt.

The two case studies above demonstrate how Equity and Enterprise Value are applied in real-world scenarios.

7. Frequently Asked Questions- Equity Vs Enterprise Value

7.1 Why is Enterprise Value is preferred for company’s worth than market capitalization?

Enterprise Value is preferred over market capitalization because:

Enterprise value includes the company’s equity (shares) market value. It adds the total outstanding debt minus cash balances and cash equivalents. Whereas market capitalization (Market Cap) only considers the value of a company’s outstanding common shares.

By considering debt, cash, and equity together, Enterprise Value provides a more holistic view of a company’s total worth, reflecting the actual cost an acquirer would pay to take over the entire business. Market Cap, solely based on equity, does not consider the impact of net debt alone, making it less comprehensive in assessing the company’s overall financial standing.

7.2 Can the company’s Enterprise Value be negative? What does it indicate?

Yes, a company’s Enterprise Value can be negative in specific scenarios.

A negative enterprise value typically occurs when a company’s cash and cash equivalents exceed its debt and the market value of its equity.

It often indicates that the company’s cash position is strong enough to cover all its debts and still has surplus cash.

While rare, negative Enterprise Value can suggest the company may be undervalued or face financial distress.

That means investors should exercise caution and conduct thorough due diligence when encountering such cases, as negative Enterprise Value could be a red flag warranting further investigation.

7.3 How do debt and cash impact the Enterprise Value and Equity Value calculation?

In the calculation of Enterprise Value, both net debt and free cash flow will have a significant impact:

1. Debt : The inclusion of debt in Enterprise Value accounts for the company’s liabilities. It reflects the total debt net of value an acquirer would need to take over and assume the debt.

In calculating Equity Value, only the market value of equity is considered. Debt is not included in the Equity Value as it represents the value attributable to common shareholders after deducting all liabilities.

2. Cash and Cash Equivalents: Subtracting the cash(cash equivalents in balance sheet) accounts for the fact that an acquirer could utilize the company’s cash position to offset a portion of the acquisition cost.

Cash also does not impact Equity Value, as it is not distributed to shareholders but remains part of the company’s assets.

8. Equity Vs Enterprise Value-Which Is the Right Valuation Measure?

Remember my friend, at the beginning of this guide. He is happy with the newly acquired house.

As an Analyst, your role is to see your clients happy with the acquisition of the companies.

In light of the above, it can be concluded that:

Have you bought any asset that clearly explains these concepts- Equity Value and Enterprise Value? Share your experience here.

9. My Exclusive Insights for You

I hope you are now clear with Equity and Enterprise Value concepts.

In careers like Equity Research, Financial Modeling, and Investment Banking, you need to:

Calculate enterprise value vs equity value.

Understand the capital structure of the business, debt, and future cash flows if available, and

Use discounted cash flow valuation, valuation enterprise value multiples, and equity value multiples, in company analysis.

We cover all this in our financial modeling and investment banking training programs.

The way business valuation helps you value a company, you can revaluate your career goals.

If you find yourself wanting to change your career goals, consider seeking guidance through Inner GPS Career Coaching. Your Inner GPS helps you align your career choices with your authentic self.

Ask yourself what truly excites you in finance, whether it’s investment analysis, corporate finance, or any other area.

Once you have clarity, leverage your Inner GPS to navigate your career path confidently.

Happy investment in learning.

All the best!