The “effect of uncertainty of objects” makes a company suffer. Without prior knowledge of possible risks and ways to mitigate them, companies and organisations often incur losses.

These risks could be legal risks, credit risks, risks from natural calamities, attacks from adversaries and many others.

In order to have a profound understanding of these risks and identify them beforehand, the business of “risk management” comes into existence.

Risk management is simply identification, assessment and mitigation of possible risk factors, and to ascertain them, highly qualified, skilled and trained individuals are needed.

What risk management certification does is develop and build upon the existing risk management aptitude of professionals.

So, if you want to be a successful risk management professional, you need to have the required education, knowledge, and, experience.

Most of the courses outlined below can be pursued while holding on to a job and a fair timeline is given to complete them.

This guide is created to give the readers, YOU, a brief but concise understanding of the top risk management courses in the world in terms of what they mean, their eligibility factors, pass percentage, average salary and career scopes.

We hope you enjoy reading it.

What is the Best Risk Management Certification?

Let’s find out from these risk management certifications as to which certification or education is best.

1) Chartered Enterprise Risk Analyst® (CERA)

A CERA professional is a person who offers a 360-degree view of risks. The person blends both qualitative and quantitative aptitudes to analyse risks and takes integral actions.

The CERA credential is offered by the Society of Actuaries (SOA) and over the past decades, the portfolio of a CERA professional has evolved from helping clients to understand risks to actively working with organisations’ risk management policies.

CERA professionals work in high-risk competitive business environments to offer a holistic understanding of the risk profile.

Such professionals have strong ERM knowledge, ethics and leadership skills to don multiple roles in the organisation.

In the CERA course, the person learns;

- Qualitative aptitude

- Quantitative aptitude

- ERM – practical and theoretical

- Understanding the actuarial approach to risk

- General risk management

A maximum of 4 years period is there to complete CERA.

CERA Eligibility

Unlike other finance certifications, CERA is a little less strict. People with degrees in Finance, Mathematics, Economics and Business have higher chances of clearing CERA.

There are certain skills required:

- Keen business sense and knowledge of Economics, Finance and Accounting

- Good written and oral communication skills

- Familiarity with spreadsheets, word processing, databases and programmed statistics

- Problem-solving and analytical skills

CERA can be pursued on-the-job and with a dedicated focus, CERA can be attainted with self-study too.

Why Pursue CERA?

Every risk management course has its benefits.

Employers hire CERA professionals to receive comprehensive outlook towards enterprise risk management.

It helps them to strengthen internal ERM programs and enhance the output of human capital.

Sometimes CERA professionals are instrumental behind setting up ERM programs and the company benefits in the form of strong financial assessment skills.

If we talk about the risk management professional ecosystem as a whole, a CERA on-board helps the company to maintain strong financial control and reporting.

They are able to identify and assess security issues, identify business volatility and undertake rectifying measures.

CERAs help companies to maintain global competitiveness.

There isn’t much clear data on what CERA professionals earn but going by the statistics available on SimplyHired.com which pins the average salary as 89,000 USD in the US, with Illinois and Chicago being popular cities.

According to Payscale.com, the average pay package is 185,250 USD with 80% of CERA certification holding possessing 1-9 years of experience and 20% with 20+ years of experience.

2) Certified Risk Manager (CRM)

The National Alliance for Insurance Education and Research grants the CRM status to qualified individuals.

An individual with CRM certification is equipped to handle risks and exposures.

It makes the person aware of operational risks (identifying, controlling and administering), catastrophic exposures, political risks, fiduciary exposures, legal risks and others.

The job of the CRM/ Certified Risk Management Professional is to realise the occurrence of such risks and protect the company against it.

CRM Eligibility

Active risk managers are eligible to join the CRM certification course.

Anyone else associated with the risk management professional industry such as insurance professionals, legal experts, accountants and loss control professionals can join too.

An individual whose current career can benefit from CRM certification is encouraged to apply.

There are 5 CRM courses and each of the courses has to be cleared to achieve the CRM designation.

- Principles of Risk Management – testing the overall knowledge of the participant about risk management.

- Analysis of Risk – is about analysing and measuring risk, along with possible loss of data.

- Control of Risk – is about managing risks with crisis management policies, safety proficiency, dispute resolution and Employment Practices Liability

- Financing of Risk – is about finding various financing options to ensure minimisation of operational losses.

- The practice of Risk Management – is about strategizing and implementing the risk management professional process within the organisation.

Mastering all of the above CRM courses makes the individual a qualified professional to handle risks.

Each of the 5 courses is separate yet they sync to give the person a complete understanding of the risk management business.

They are rigorous in nature and as such, only if the person has 2-3 years’ experience in the risk management field is urged to apply.

The course can be pursued through classroom training, online training and in-house training.

The average salary of a Certified Risk Manager is 63,000 USD, according to SimplyHired.com.

But, if the designation of a ‘Risk Manager’ is considered in general, the salary packages vary between 80,000 USD – 111,000 USD (source).

Why Pursue CRM?

Once a person becomes CRM certified, the designation changes to “Planners, Protectors and Guardians” of a company.

It’s a professional stamp enabling the person to manage risk exposure and hazards, and equipping the professional to conform to excruciatingly demanding performance heights.

With an in-depth knowledge of priorities defining today’s companies, the CRM certification gives skills to become a proactive value addition to the organisation.

The new industry knowledge and practical skills are instantly implementable.

The professional comes across cutting-edge information and new ideas beneficial for the company.

The certification improves career and earning potential by leaps and bounds. Even though there is stiff market competition, there is strengthened job security.

All these benefits make the CRM certified professional an asset to the company, which in turn, works towards improving the reputation and profitability of the company.

3) Financial Risk Manager (FRM)

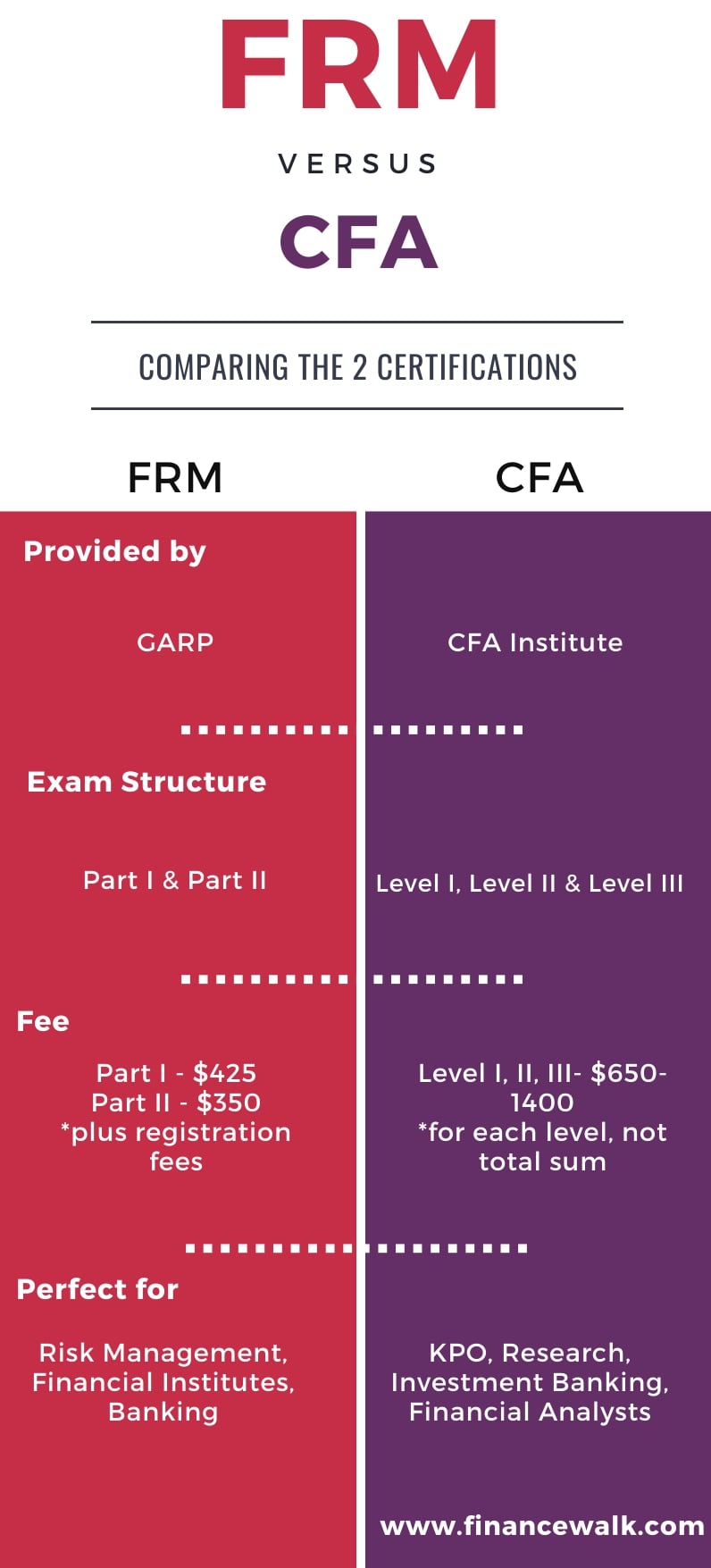

The Global Association of Risk Professionals (GARP) grants the FRM certification to candidates on becoming specialists in financial risk management.

The professionals handle market risks (liquidity risks, credit risks) and event non-market financial risks.

The first FRM designation was given in 1997 and presently, FRM professionals belong from Asia, Europe and USA.

The elite GARP network is 30,000 members strong.

FRM Eligibility

The exam measures the ability of an individual to recognise, analyse and manage risks.

This is a paper-based exam, which happens on the third Saturday of May and November every year, in a single sitting.

There are multiple-choice questions and the format is practical-oriented.

The professional needs to devote at least 150 hours on each paper to clear the exam.

The Part I exam consists testing of core areas of risk management such as financial markets, risk modelling and quantitative analysis.

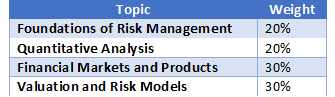

There are 100 multiple choice questions to be answered over a 4-hour period. The weightage given to each section is as follows.

The Part II exam tests the practical implementation of concepts, tests knowledge of market and operation risks.

There are 80 multiple choice questions to be answered over a timeline of 4 hours. The weightage given to each section is as follows.

Examinees need at least 46% in Part I and 52% in Part II to get the certification.

Why Pursue FRM?

The certification gives the person a competitive advantage over peers.

The world is increasingly becoming risk-centric, thereby increasing the demand for risk professionals, and the certification is a part of this.

As a certified professional, he/she able to distinguish himself/herself from other professionals.

For the employer, it translates into seriousness to handling risk management tasks.

According to “Wikipedia: The World’s Largest Banks”, the certified professionals find takers in the top 10 brackets of companies and banks.

The top 10 companies with the highest number of certified working professionals are:

- Industrial and Commercial Bank of China

- Bank of China

- HSBC

- Agricultural Bank of China

- Citigroup

- KPMG

- Deutsche Bank

- Credit Suisse

- UBS

- PwC

The top 10 banks employing the highest number of certified working professionals are:

- ICBC

- China Construction Bank

- Agricultural Bank of China

- Bank of China

- JP Morgan Chase

- Wells Fargo

- HSBC Holdings

- Citigroup

- Bank of America

- Banco Santander

The person works under massive pressure and handles high-value transactions.

Joining one of the elite groups of the world is an added incentive.

Leadership skills, high reputation, more opportunities and a distinctive edge over other risk professionals are a given benefit.

Every top employer in the world recognises the value of this certification.

In terms of salary, 900,000 INR is the average salary of Risk Manager in India and in the US, it is between 100,000 USD – 250,000 USD.

Take a look at the recommended career path of certified professionals in India.

Source: Payscale.com

There are varied career prospects after getting certified such as Analytics Client Consultant, Risk Qualification Manager, Corporate Risk Director, Risk Management Analytics Consultant, Credit Risk Specialists, Operational Risk Analysts, Regulatory Risk Analysts, Enterprise Risk Manager, Risk Quantification Manager and Large Enterprise Commercial Risk Manager.

Become a FRM Professional with this Course!

4) Professional Risk Manager (PRM)

The Professional Risk Managers’ International Association (PRMIA) grants the PRM certification.

It’s similar to FRM in many respects.

The choice between either of these courses will depend on exam flexibility, geographical location, career focus and market understanding.

The first PRM designation was awarded in 2004 and since then the PRMIA community has evolved magnanimously.

Both the PRM and the FRM are considered as two “definitive risk management” designations of the risk management industry.

PRM Eligibility

PRMIA brought a lot of changes in PRM eligibility in 2014.

A professional with Bachelors’ degree needs 2 years of experience whereas, without Bachelors’ degree, 4 years of experience is mandatory.

Moreover, someone with professional designations like CAIA, CFA and CQF doesn’t need any experience.

Unlike earlier where exams can be taken “on-demand”, there are fixed exam timelines now.

Here is a tabular representation of the exam schedule.

The passing percentage is 60%. All the questions are multiple-choice questions and a candidate needs to pass all the four exams – PRM I, PRM II, PRM III, PRM IV- in a span of 2 years.

PRM I covers three modules – financial markets, financial instruments and finance theory.

This module is devoted to basic financial concepts like Futures, Value of Money, Interest rates, Bonds and so on.

There are a total of 36 questions to be answered in 2 hours.

PRM II covers the mathematical foundation and statistical analysis aptitude.

PRM III module is all about risk management practices such as market risk, operational risk, capital adequacy, economic capital and regulatory capital.

Again, there are a total of 36 questions to be answered within 1.5 hours.

PRM IV modules are on case studies and testing the professional’s understanding PRMIA code of ethics, conduct and bylaws.

Why Pursue PRM?

A person pursues PRM most for the same reasons why FRM is pursued.

90% of the syllabus is the same and in terms of future prospects, a person with PRM can go into senior risk analyst, predictive analyst, investment risk manager jobs.

5) Risk and Insurance Management Society Fellow (RIMS Fellow)

The Risk and Insurance Management Society (RIMS) confers the Fellowship to any professional of the risk management industry willing to enhance skills and industry knowledge, along with demonstrating a high ethical behaviour.

The RIMS Fellow gives the professional competitive advantage over other colleagues and places the person in a position of leadership.

Upon completion of the RIMS Fellow, the person can add ‘RF’ next to the name and it works like a ‘stamp of approval’ indicating that the person has adequate tools and skills to manage external, operational and financial risks.

RIMS Fellow Eligibility

There are educational and experience criteria to follow.

On the educational side, the person needs to complete at least 3 courses – Risk Financing, Risk Assessment and Risk Control – in college.

On the other hand, a person with Associate in Risk Management (ARM), ALARYS Certificate, Certified Risk Manager (CRM) and Canadian Risk Management (CRM) credentials are automatically eligible for RIMS Fellow application. Lastly, 5 years of industry experience is mandatory.

Surprisingly, for RIMS Fellow, we couldn’t find any salary or pass percentage indication.

Now that we have covered all the popular risk management courses, here’s a lowdown on the popular communities associated with them.

Risk Management Communities

In the previous section, we covered the topmost risk certification courses and certifications in the world.

This section is about communities.

When these courses are pursued, you’re enrolled in specific societies that are active communities to network and engage with similar professionals.

For instance, with CERA you join the SOA community.

Here is a brief on some of the relevant societies.

1) Society of Actuaries (SOA)

SOA is the result of the merger between the American Institute of Actuaries (AIA) and the Actuarial Society of America (ASA).

Initially, memberships were based on “by invitation” mode only but now, qualified professionals are automatically inducted.

The CERA, Associate of Society of Actuaries (ASA) and Fellow of the Society of Actuaries (FSA) are the three available designations.

Interested members have to clear actuarial exams which include subjects such as Economics, Mathematics, Insurance, Finance, Interest theory, Actuarial sciences and Life models.

Currently, the CERA is a network of over 23,000 actuaries with SOA.

2) Global Association of Risk Professionals (GARP)

Headquartered in New Jersey, the GARP is a not-for-profit membership organisation for risk professionals from over 195 countries and 150,000 members strong.

It grants the Financial Risk Manager (FRM) and Energy Risk Professional (ERP) certifications and the only organisation to do so.

GARP members are often employed by investment banks, government agencies, management firms, central banks, commercial banks and academic institutions.

The GARP community supports its members to improve their risk management career opportunities, worldwide.

It also offers some risk education programs which are the International Certificate in Banking Risk and Regulation (ICBRR) and Foundations of Banking Risk (FBR) Program.

The GARP community consists of thousands of professionals, FRMs, ERPs, staff and practitioners.

The GARP community is deeply connected with the core industries.

There are 3 kinds of memberships available – Affiliate, Student and Individual.

Every year, GARP presents the ‘Risk Manager of the Year Award’ to either a group of individuals or an individual who has shown stupendous progress in the profession of financial risk.

In 2013, the Partner and Chairman of the Risk Committee and Advisory Panel of Kepos Capital LP, Robert B. Litterman, received the award.

3) Professional Risk Managers’ International Association (PRMIA)

PRMIA is a non-profit organisation founded in 2002 which focuses on the “promotion of sound risk management standards and practices globally”.

Apart from PRM certification, there are other educational programs conducted by them, which is the Associate PRM and the Operational Risk Manager (ORM) certification.

PRMIA offers membership of three kinds – Individual Membership, C-Suite Membership and Corporate Membership.

In the Individual Membership, the person is given access to all certification programs, risk management practices, an active community and a big scope for continued networking.

In the C-Suite Membership, advanced professionals participate to discuss risk-related issues in the open forum.

The programs are matched to meet the requirements of the C-Suite professional.

The membership includes invites to C-Suite events to share their thought leadership.

Lastly, members are selected on the basis of responsibility, experience and company size.

In the Corporate Membership, PRMIA offers a professional solution to corporate members in terms of front-line staff, back-end support, risk resources, networking, educational resources and mentoring.

4) The Risk and Insurance Management Society (RIMS)

Founded in 1950 and headquartered in Manhattan, the RIMS is a professional association devoted to the risk management industry.

Getting the RIMS Fellow status automatically inducts you into the active community of 10,000+ globally located risk management professionals.

RIMS is associated with more than 3500 charitable, services, non-profit, industrial and government entities.

The RIMS membership is open to anyone handling risk responsibilities. The professionals get access to high-end resources and learning opportunities.

Takeaway

Which of these risk management courses should be pursued completely depends on career goals.

Suggested Read: You can read our financial analyst job description guide.

On the look of it, there may not seem much difference in job prospects and benefits but there are, and the best way to know more in detail is to talk to professionals from these industries.

Find and read online interviews, network with them on professional websites like LinkedIn or simply join the communities listed above to network and know.

Hello,I have over 14 years Banking experience from cashier >customer service>retail banking and now AML with specialization in EDD -Enhanced Due Diligence and really want to go into mainstream risk and take exams.What exams will be most suitable for me please.

It’s fantastic that you want to transition into mainstream risk after 14 years of diverse banking experience, especially with your specialization in EDD-Enhanced Due Diligence! Your background positions you well for this move, and taking the right exams can significantly boost your resume and credibility.

To recommend the most suitable exams, I need to understand your specific career aspirations within mainstream risk. Here are some questions to help clarify your goals:

What specific area of risk management are you most interested in? Credit risk, operational risk, market risk, or something else?

Are you aiming for a specific role or position within risk management? This could be risk analyst, risk officer, compliance officer, or something else.

Do you have any geographical preferences for your career? Are you open to relocating or do you prefer staying in your current location?

Once I have a better understanding of your career goals, I can suggest relevant exams and certifications aligned with your desired path. Here are some general options to consider based on your current experience:

Professional Certifications:

GARP FRM (Financial Risk Manager): This globally recognized certificate focuses on financial risk management, including credit risk, market risk, and operational risk. It’s a demanding exam, but highly respected within the financial industry.

PRMIA Certified Risk Management Professional (CRMP): This certification covers the fundamentals of risk management across various industries, including financial services. It’s a good option if you’re looking for a broad-based foundation in risk management.

CISI Investment Operations Certificate (IOC): This UK-based certificate focuses on the operational aspects of investment banking, including risk management. It’s relevant if you’re interested in risk management within the investment banking sector.

Industry-Specific Certifications:

ACAMS Certified AML Specialist (CAMS): This globally recognized certification validates your expertise in Anti-Money Laundering (AML) and financial crime compliance. It’s highly valuable for those specializing in AML and financial crime risk.

Institute of International Finance (IIF) Certified Professional in Bank Risk Management (CPBRM): This certificate focuses on risk management specifically for banks, covering credit risk, market risk, operational risk, and other banking-specific topics.

Additionally:

Chartered Institute for Securities & Investment (CISI) qualifications: CISI offers various risk-related qualifications like the Certificate in Private Client Investment Advice and Management (CeFA) and the Diploma in Investment Management (DipIM). These can be relevant depending on your specific risk management goals.

Your local banking association or financial regulatory body might offer risk-related certifications. Explore options relevant to your location and career aspirations.

Remember, your experience in EDD is a valuable asset. Highlight it when taking exams and applying for jobs, as it demonstrates your knowledge and expertise in a critical area of risk management.

I am a graduate of Bachelor of Governance and International Relations, and currently Pursuing Masters in Human Rights and Development.

which course best suites me?

Hi Ukaa,

I suggest you take my Career Discovery Session. Click on the WhatsApp Button and start interacting.

Hello, I am a chartered accountant and studying for my masters in finance and investment. I have ten years experience in accounting, auditing, tax, administration and consultancy. Considering risk management. Please advise.

Sure. What’s your question?

Hallo Sir

Please advice. What is the duration of CERA? If I qualify as CERA, does it mean I am an Actuary?

Hi,

CERA Time: In order to earn the CERA credential , you must have attained “fully accredited actuary” status as per the organization you belong to, which usually is three to five years.

I am working for a Public sector bank since 6 yrs and now i would like to step into risk mgmt on operations side.Could you please suggest me courses which are in high demand in other private banks too,earning good scale of pay.

Hi Uma,

PRMIA certification looks good.

am olakunle from Nigeria,i have been in recovery for the past 5 year now but my career part is risk.

Please what aspect can you recommend for me.

Hi Olakunle,

Unfortunately, I don’t have enough information to give a personalized recommendation. To guide you effectively, I’d need details like your educational background, specific risk management experience, and desired career trajectory within the field.

However, I can offer some general suggestions for exploring risk management in Nigeria after recovery:

1. Start with self-assessment: Reflect on your strengths, weaknesses, and values post-recovery. What aspects of risk management align with your current goals and capabilities? Consider areas like operational risk, compliance, data security, or enterprise risk management.

2. Network and research: Connect with professionals in your field to understand the current landscape and potential opportunities. Utilize online resources like professional associations, job boards, and industry reports to identify suitable roles.

3. Highlight transferable skills: Focus on transferable skills developed during your recovery journey, such as resilience, problem-solving, communication, and adaptability. These are valuable assets in risk management.

4. Seek training or upskilling: Consider relevant certifications or courses to bridge skill gaps or gain expertise in specific risk areas. This can enhance your employability and marketability.

5. Start small and build gradually: Re-entering the workforce at your own pace might be helpful. Look for freelance projects, internships, or contract roles before seeking full-time commitments.

Remember, recovery is a strength, not a limitation. Leverage your experiences and newfound perspective to carve your unique path in risk management. Best of luck in your journey!

Dear Avadhut;

Good day,

I have 7 years in insurance sectors in insurance company as underwriter and claim supervisor and 2 years in charge of insurance for golden arrow as a head section, and I am holding MBA and BSc in science and mathematics what certificate it will suites me , as I am interesting in risk management.

Thanks ,

Ranya

Hi Ranya,

With your 9 years of insurance and risk management experience, plus an MBA, consider these certificates to boost your career:

1. Certified Risk Manager (CRM): The gold standard for risk professionals, demonstrating broad, deep risk management expertise. Ideal for career advancement to risk management leadership roles.

2. Associate in Risk Management (ARM): A stepping stone to the CRM, focusing on core risk management principles. Great for solidifying your foundation and exploring the field further.

3. Chartered Enterprise Risk Analyst (CERA): Emphasizes quantitative risk analysis techniques. Well-suited if you want to specialize in data-driven risk assessment.

Remember, research each program’s content, exam requirements, and cost to find the best fit for your goals and resources.

I hope this helps!

Hi,

I have over 8 years of accounting experience, precisely debtors’, creditors’, cash, and payroll management. I have also recently completed a post graduate diploma in risk management. Please kindly suggest a risk management certification for me.

Hi Silvian,

I need more information about your career goals to suggest the best risk management certification. However, with your accounting background and diploma, here are two broad options:

1. Financial Risk Management:

Certified Management Accountant (CMA): Ideal if you seek finance-focused roles managing financial risks. Requires relevant work experience and passing two exams.

Financial Risk Management (FRM) certification: Renowned global certificate for quantitative risk analysis in areas like credit, market, and operational risk.

2. Enterprise Risk Management (ERM):

Professional in Risk Management (PRM) certification: Comprehensive program covering all aspects of ERM, suitable for broader risk management roles.

Certified Associate in Enterprise Risk Management (CAERM): Entry-level certificate offering a foundation in ERM principles.

Further refine your choice by researching exam difficulty, specific industry relevance, and cost. Good luck!

I have been an Insurance Broker with for over 15years experience. I attained my Diploma of the Chartered Institute of Insurance UK. Which course can you recommend

Hi John,

Unfortunately, I cannot recommend a specific course without knowing your career goals. With 15 years of experience and a Chartered Insurance Institute diploma, you have a strong foundation.

To give you the best recommendation, I need to know:

1. What area of insurance do you want to specialize in? (e.g., life, health, property & casualty)

2. Do you want to move into management or leadership?

3. Are you interested in technical expertise or staying client-facing?

4. Are you considering international opportunities?

Once I have this information, I can suggest relevant courses aligned with your experience, qualifications, and aspirations.

Keep in mind:

Continuing professional development (CPD) is crucial for insurance brokers. Many professional bodies offer CPD courses.

Consider specialized certifications relevant to your chosen area.

Network with industry professionals to learn about emerging trends and career paths.

I look forward to helping you chart your future in the insurance industry!

Hi,

I want to take my carrier more into risk side specially more into regulatory reporting. As I am a working professional please advise me what is the most easy learning risk certification as I from commerce background

Hi Girish,

With your commerce background and working professional status, consider these “easy learning” risk certifications for regulatory reporting:

1. Certified Associate in Regulatory Compliance (CARC): Focuses on core compliance principles, accessible and beginner-friendly.

2. Certified Anti-Money Laundering Specialist (CAMS): Industry-standard for AML/KYC regulations, relevant for financial roles.

3. Professional Certificate in Risk Management (PCERM): Covers broad risk management concepts, good foundation for further learning.

Remember, “easy learning” depends on your individual pace and resources. Research each program to see the syllabus, exam format, and study materials offered. Good luck!

This is very good. I have just completed my FRM.

Taking a break before moving to different sector.

I Have completed my graduation and 9 years exp in Compliance and Risk and 2 years with Audit with an Money exchange firm, can you suggest which course would like to advance my career.

Hi Praveen,

Unfortunately, I cannot give specific course recommendations without knowing your career goals within Compliance and Risk. However, considering your experience, here are two general paths:

1. Deepen Expertise:

Industry-specific certifications: Pursue certifications relevant to your industry (e.g., ACAMS for Anti-Money Laundering).

Master’s in Compliance or Risk Management: Gain advanced knowledge and leadership skills.

2. Broaden Skillset:

Data Analytics or Cybersecurity courses: Combine compliance with in-demand tech skills.

Internal Audit certifications: Expand your audit expertise for broader risk management roles.

Remember, research course content and career outcomes to ensure alignment with your goals. Best of luck!

Hi, I have completed B.com and persued MBA (General) in distance education. I experienced more than 13 years in retail banking – branch operations and as well as sales. Which risk management course will help for my carrier growth? Suggest me…

Hi Hariharan,

Given your background and career goals, consider these risk management courses for growth:

1. Certified Credit Risk Analyst (CCRA): Deepens credit risk assessment skills, ideal for aspiring credit analysts or loan officers.

2. Certified Operational Risk Manager (COPRM): Focuses on mitigating operational risks, relevant for branch managers or compliance professionals.

3. Certified Internal Controls Specialist (CICS): Strengthens internal controls expertise, valuable for risk management specialists or auditors.

4. Professional Certificate in Risk Management: Broader program for general risk management understanding, suitable for diverse career paths.

Choose the course aligning with your specific interests and desired career trajectory. Remember, practical application through projects or certifications can enhance your resume.

Thanks for this great information, and I want to consult you, I will be a risk manager for an investment company, however, I will not have time to go for FRM, and I am considering RIM-CRMP, will it be sufficient?

Hi Hadi,

Unfortunately, I don’t have enough information about your background to definitively say if RIM-CRMP is sufficient.

RIM-CRMP is a strong foundation for risk management but might not replace FRM for investment-specific roles. Consider these factors:

Your education: If you have a finance background, FRM’s quantitative focus might align better.

Investment company type: For specific areas like hedge funds, FRM holds more weight.

Your career goals: If you aim for broader risk management within the company, RIM-CRMP could suffice.

For a tailored answer, please share:

Your educational background (finance, risk management, other)

Previous work experience (risk-related or not)

Specific area within the investment company (trading, portfolio management, etc.)

With more details, I can advise you better.

Hi Avadhut,

I’m working in an Aluminum Smelter. I have experience in Maintenance, operation, and HSE. Holding Bachelor in Engineering and MBA. Recently I joined the Risk Team.

We are focusing on the Enterprise Risk Management.

Can you suggest me the best course in my case?

Hi Mujtaba,

Given your background and goals, consider these courses for Enterprise Risk Management (ERM) in aluminum smelting:

1. Institute of Risk Management (IRM) – International Certificate in ERM: Industry-recognized foundation, covering risk identification, assessment, mitigation, and communication.

2. Chartered Institute of Internal Auditors (IIA) – Certified Internal Auditor (CIA): Internal controls expertise valuable for ERM implementation.

3. National Association of Safety Professionals (NASP) – Certified Safety and Health Officer (SHOC): Integrates safety risk management with broader ERM practices.

4. American Society for Quality (ASQ) – Certified Manager of Quality/Organizational Excellence (CMQ/OE): Emphasizes risk-based decision-making for continuous improvement.

5. Industry-specific ERM programs: Tailored training from aluminum associations or consultancies addressing specific smelter risks.

Choose the course aligning with your preferred learning style, budget, and certification needs. Good luck!

Hie,

I have completed my Masters degree and have 3 yrs of experience in audit sector and 1.5 yrs of exp in Risk department.Total exp of 4.5 yrs. While going through all the courses can you suggest me which course will be best for me to go ahead in career in Risk department FRM or CRM?

Hi,

I suggest FRM.

Hi Avadhut,

I have 3+ years(2012-2015) experience in retail and institutional banking.After that till date I am on career break due to personal reasons.Now I want to resume back in Risk management and doing an executive program with IIM Kashipur.I found about PRM from PRMIA India.Is it worth to go for the certification for switching career from retail banking to Risk management with such huge career gap?

Please suggest whether I should do PRM or any other certification to make myself well versed to face interviews and get selected?

Thanks

Hi Diptimayee,

First of all, you need to reflect and check which career is right for you.

I suggest you read this career guide. Based on it, you yourself can decide where to invest your time, money, and energy.

Hi Avadhut,

Am an internal auditor, CISA certified….work experience in Tech and project audits, corporate banking. Want to shift to Risk management. Which certification to choose? Career aim to be in executive level. Now in Mid level management.

Hi Madhu,

With your CISA, internal audit, and tech/project/banking experience, consider these risk management certs for your executive aspirations:

Broad-based:

1. Professional Risk Manager (PRM): Demonstrates global risk expertise across industries. Respected by executives.

2. Certified Enterprise Risk Manager (CERM): Emphasizes enterprise-wide risk identification and mitigation. Aligns with executive-level risk oversight.

Specialized:

1. Certified in Risk and Information Systems Control (CRISC): Deepens your IT risk expertise, valuable for IT-heavy roles.

2. Certified Risk Management Professional (RIMS-CRMP): Leverages your internal audit experience, recognized by risk management professionals.

Remember: Research exam difficulty, cost, and alignment with your specific goals before choosing. Good luck!

Hi Avadhut.

I’ve worked as a Credit Risk Manager and Collections Manager in Retail Banking for over 10 years… what certification would you recommend for me? My career goal is to become CRO.

Hi Ana,

It totally depends on the company/sector.

Generally, your expertise and experience (10-20 years) are enough if you have a relevant certification like CFA, CRMA, or FRM.

Hi Sir,

I completed my B Tech and i have 1 nd half year experience at FPG(Fraud Prevention Group) as a Risk analyst at ICICI Bank.

Hi,

What’s your query for me?

Hi Avadhut,

Please what’s your take on Institute of Risk Management (IRM)? I noticed you didn’t mention nor list it.

Hi,

I haven’t reviewed it yet. Will add it in the next update. Thanks.

Sir,

I am 4 year graduate in financial management (BBS) I have 2-year of work experience in accounting and finance and audit. Is FRM course are suitable for me.

Hi Ravi,

Please check the FRM Eligibility here.

Hi Avadhut,

My name is Arviind a commerce graduate with around 15 years experience into Operations & Operational Excellence(Process Improvement) with Bank of America. I want to move into a Risk domain and join the risk team within the bank. Request you to suggest a best risk certification program.

Hi Arviind,

FRM should come close to your career goal in this case.

Hi,

I have been working in Fraud risk management domain for about 6 years. can you please suggest if CRM/RIMS would be a good certification for me?

Hi Pinki,

What’s your future career goal?

Hi,

I have 10 years of experience in Accounting including five years working on Accounts Receivable and credit issues. I would like to get involved in the field of risk management and prepare for FRM. Do you recommend FRM for Accountants and if yes Am I eligible to prepare for the FRM with my experience.

Thanks,

Hi Salwa,

I suggest you get in touch with FRM officials once and check their eligibility.

Once they say yes, go ahead and start preparing with this course.

Hi! I have 3 years of work experience in Order to Cash (Account Receivables).. Please advise me the career path.

Hi Maninder,

You need to give some time and attention to decide your career interest. Based on that I can suggest you a course.

Email me for a detailed career coaching session.

Hi Avadhut sir,

My name is srikar. I am so happy to read your stuff above. I have some doubts regarding some courses from ”Institute of Financial Consultants (IFC)”. can u say that they are good one. I was Just interested to know about these.

1. Certified Financial Manager(CFM)

2. Certified Financial Risk Management Consultant(CFRM)

Hi Sai,

You need to give some time and attention to decide your career interest. Based on that I can suggest you a course.

Email me for a detailed career coaching session.

Hi

I have five years experience as an Operations Director for financing and Automobile leasing and 8 years in banking field as Credit Administration. I would like to enhance my career with Operational Risk Management. What is the pest way to achieve this goal. I have BA and MA in English literature , Modern Management and Administration, Graduated Certificate in Professional Financial Services (CFP) components. Do I am eligible for Operational Risk Management Designation? Or what do you advise me.

Hi Khalid,

The eligibility criteria are based on the hiring company, so one answer is: it DEPENDS. 🙂

Hi,

I have 12 yrs of Banking Exp, For last 5 yrs i am working on Credit Risk domine, please let me know which course suits only the Credit Risk broadly.

Hi Arun,

Read the guide again, word-by-word.

Hi,

I have 15+ years in Operations and am looking for a General Risk Management certification as I am not associated with finance domain. I would be keen towards operation risk, which certification you may like to suggest basis my profile

Hi Saurabh,

I suggest you read this guide once again. Based on your inclination, you will find a certification. 🙂

Hi Avadhut,

Iam a banker working in operations for one of the UAE banks.i wish to know the best certification course i can pursue to move into risk related fields.Also, i would like to how long it might to complete FRM and how many takes i can avail

Hi,

I suggest you to read this guide for FRM.

Hi ,

Thank you for the informative article. I have 15 years of WE in procurement and thus would like to know which Risk Management certification is best suited for me.

Hi Sherry,

Please read the article once again. I am sure you will find a certification suitable for your inclination. 🙂

I’m the branch manager for financial services

Kindly advise which certified can i do?

Hi Samson,

Email me for a detailed career coaching session.

I joined a leading large Public Sector bank as Po in 1981 and got superannuated in September’17 as General Manager. Never worked in Risk Management Department. Post superannuation, now I want to pursue some course on Risk Management for getting sound knowledge on the subject and good job prospects as well. Which course should I apply for and how to prepare for it successfully ? Please guide in detail.

Thanks.

Dear Honhar,

Please go for FRM. You can prepare well with this FRM Coaching.

I am a military personnel, I read accounting as a first degree and I have master in risk management and insurance, Please let me know which course is most suitable for me for my future career.

Hi Femi,

It totally depends on your future career goal. If it’s a financial risk, go for FRM.

What about ERMA Certifications by Enterprise Risk Management (ERM)?

Is it also a well-established and well-recognized risk management certification?

Hi,

I haven’t reviewed it yet.

Hi

I am a branding manager for a large mining company and work closely with the safety program. I want to possibly study the CRM course to further my knowledge. Can you possibly give me direction on how to register?

regards

Richard

Hi Richard,

Please Google for this.

Hi,

I have 12 years of experience in banking operations. I hold and MBA too, What do you recommend to move forward in my career?

Hi Rania,

What’s your career goal?

Email me for a detailed career coaching session.

hi – I would want to go for operational risk management – What should I go for

Hi Meenu,

Please read the guide again. You can contact me for career guidance.

Hi, I am a post graduate Mechanical engineer by training and profession with 27 years of all round experience in manufacturing industry. ie from project to operation , purchase and asset management currently. I would like to shift to my career to Enterprise Risk management. So which certification I should study to get in to the Risk management field?

Hi Thomas,

You can go for CERA mentioned in the above guide.

Hi,

I am yuvraj recently I m working in insurance company 3 year of experience in sales . Now I want to build career in risk management. Please guide!!

Hi Yuvraj,

Your question requires a detailed discussion.

Book a Career Coaching session with us.

I am currently working in retail branch in pvt sector bank. I am engineering graduate with diploma in banking management and finance. With experience around 3 years. Please guide me to focus towards which certification which might help me in attaining decent career growth in financial industry. Also will my banking experience will count.

Hi Prabhat,

Please read this and this guide.

hi,

I am a CA, working in an infra company and handling the insurance and banking aspects. I would like to pursue a career in enterprise risk, particularly infrastructure insurance and risk. Please suggest a course to best suit my interest.

Hi Shabana,

CERA would be a good option for you.

I am working as Risk Officer in Information technology.

But have no interest in Information technology as well as finance.

Then which course is good for me and what fields left for me as Risk Officer

Hi Abdul,

Your question requires a detailed discussion.

Book a Career Coaching session with us.

Hi, I have about 5 years of experience in IT Risk , want to move to Operational Risk management, what course would you suggest?Please advise.

Hi Reetu,

You can check CRM or PRM for your objective.

I want to enroll, Ple assist. Am a Nigerian. I will like to do online.

Hi,

Please check our Financial Modeling courses here.

Please check our FRM courses here.

Hi…I’ve an experience of around 5 years in banking industry.

I would like to pursue a course on risk management.

Can you explain in detail which course to choose and all the associated informations regarding this…

Dear Anuj,

Go for FRM.

I currently working in credit risk where i am analyzing the financial statements while granting a credit to the customers for An IT company. Please let me know which course is most suitable for me for my future career.

Dear Sohel,

What’s your career goal?

I want to make my career in risk management but not sure which course is beneficial for me.

Hi Sohel,

I suggest you read the article once again. Also, read my comments below the guide.

Hi Avadhut,

Thanks for great info.

There are different courses on different risk management.

But which one to choose, that’s the question.

i am working into risk management profile since 2 years but do not belong to finance background

Need your guidance-would you help

Dear Aman,

If you want to get into Financial Risk Management, then go for FRM.

I am a Chartered accountant, having 6 and half year experience in a private bank in accounts and business loans group and currently taking care of disbursement process of business loans. I want to built my career as risk analysis. Please guide.

Dear Rahul,

Please go for FRM.

Hi

I am Revati Deshpande. I have 12 years of experience in Insurance. Want to pursue FRM. Please let me know the details.

Dear Revati,

For FRM, read this guide.

We provide online and classroom coaching for FRM. Please contact me for more details.

I am a BBA graduate with experience in debt management operations for 18 months.

Am i eligible to pursue the FRM course?

Yes.

ok let me start, i have master of science of finance. Now i just got my first real job with one of the big four companies. i want to pursue my career and im really interested to take FRM exam 1 and 2 and then take the (IMC) is the benchmark entry-level qualification into the UK investment profession.

because my potianls is about Financial risk in making an investment and be an dealer in the treasury or in the asset mgmt. sector .

what you guys think ??

also im looking to get the highest salary i can get.

Dear Aziz,

Please go ahead. For FRM, go for online coaching.

I would like to pursue FRM.Please contact

Dear Adewusi,

Please check our FRM Online Coaching program.

have worked in a bank for more than five years and would like to build my career in risk management. Interested in enrolling for an online PRM certification course, kindly let me know how to enroll & what it takes, course length, any associated costs, certificates etc

https://www.prmia.org/

I would like to pursue FRM.Please contact

Dear Deepak,

Please check our FRM Prep course here.

Hi

I am a risk Professional , i want to do courses on Risk Management , please let me know how you guys can help me.

Dear Mayank,

Have you done FRM? Please check our FRM Prep course review.

I am having 6+ year experience in banking operation with AML certified from IIBF (Indian institute of Banking and Finance) so i want to know which course is suitable for my career

Hi Panab,

Your question requires a detailed discussion.

Book a Career Coaching session with us.

i am working as Asst Manager for a Nationalized bank for the past 18 mnts. i would like to expand my knowledge base and get into international banks with handsome pay and challenging job. which courses / certifications would help me achieve it . i am an MCA degree holder . i would also like to be an MBA . what would you suggest me?

Hi Pavan,

You can go for CFA/FRM.