In this post, I’m going to cover how to become a hedge fund analyst. In my previous article, I covered the Investment Banking Analyst’s role and responsibilities.

Let’s begin with the definition of a hedge fund.

What Is Hedge Fund?

Hedge Fund is the pooling of investments from high net worth individuals. These funds invest in equities, bonds, and commodities.

The funds use investment strategies as long, short, leverage and derivative positions.

They invest in local as well as international markets. They operate as a private investment partnership and investors are required to invest very large amounts initially.

The funds make investments for a minimum one year. They are similar to mutual funds in the concept of pooling the investments but differ in flexibility and approach.

The goal of the hedge funds is to minimize the risk and maximize the return on investment.

However, to fulfill this goal, hedge fund managers enter into speculative transactions sometimes.

There are certain characteristics of a hedge fund.

To begin with, a hedge fund has a wider investment span.

- They can invest in anything, such as mutual funds, currencies, derivatives, real estate, and stocks. The borrowed money is used to amplify investment returns.

- The investors in the hedge fund market need to have a high-value net worth, which could be above 1 million USD. A hedge fund charges two kinds of fees: performance fee and expense ratio.

- The “Two and Twenty” fee structure works where 2% is the fee for asset management and 20% is the fee from investment gains.

- Hedge funds are private investment vehicles, which are risky ventures. Recall the global financial crash in 2008. It wiped out the hedge fund market, almost, leading to severe financial losses.

The Hedge Fund Analyst Profile

The profile of a hedge fund analyst encompasses various roles and responsibilities. In brief, it includes:

- Maintaining financial models for current and prospective companies of the fund

- Performing valuation techniques

- Data mining

- Idea generation

- Assist portfolio managers

- Analysis of financial markets and institutional investors

- Preparation of proposals, marketing materials, client presentations, and client reporting

- Developing risk and asset class guidelines for managers

- Making on-site calls to investment managers

- Writing due diligence reports in an accurate and timely manner

- Developing a deep knowledge of the assigned hedge fund strategy

- Risk Management

Let’s see these tasks in detail.

You must work on new investments or investment memos.

This activity is number one on the list because your primary focus as a hedge fund analyst will be to research and evaluate investments.

Therefore, the best part of a day in the life of a hedge fund analyst will consist of finding information which he or she can use to that end.

Source and structure the deals which come your way.

Here is another type of activity you will be doing during a day in the life of a hedge fund analyst.

It requires you to structure the terms of the funds which focus on less liquid assets or private and semi-private deals.

Apart from that, great personal investments where either the fund you work for or a group which includes your fund is in negotiations with a company could turn into a problem for you as well.

Work on investment updates.

If we’re talking about current holdings, then you will have to come up with updates for all the events which could broadly impact the investment itself.

If you have started on this path, then you may even have to refresh the whole thesis to accommodate these updates.

You will also need to prepare a brief memo or maybe just an email.

Work on marketing materials.

Taking into account the size and the resources of which your fund disposes, you will have to put together marketing materials.

You then need to use them to pitch your ideas to prospective investors.

Apart from that, you will also have to send the following to existing clients: annual meetings, quarterly letters, updates on the performance, and everything else in between, as far as analysis and presentations are concerned.

Perform back office support.

Just like with the marketing materials, your involvement in back-office support as a hedge fund analyst will depend on your fund.

Still, if they will require you to perform these activities, you must take care of accounting and compliance.

Participate in strategy meetings.

The best part of all hedge funds hold weekly or even monthly meetings led by a PM.

They review the performance, provide updates on all investments, and discuss all the potential new ideas.

These projects are regularly the ones that you, the hedge fund analyst, have presented in the memos I detailed above.

Conference calls are a must. As are diligence calls.

When it comes to doing diligence, your private network is crucial.

However, you will need more accurate insights for all the distinct investments currently under your evaluation.

Cue other valuable sources of information, the likes of expert networks. Apart from that, you can also use the internet, LinkedIn, sell-side analysts, or even rating agencies.

If they ask you to participate in management calls, do it.

These particular conference calls are also called one-on-ones.

They are an excellent source of information for you on a personal level, which is why you should never shy away from one.

You can ask your managers everything you want to know about the hedge’s plans in general or for you.

You can also inquire about their strategy and anything they are willing to disclose.

Read. All the time if you can. It will set you apart from your fellow hedge fund analysts.

The best part of the investment analyzing process will ask you to read as much as you can about it.

It will help you a lot, especially if you’re trying to find things that your colleagues may have overlooked, such as the footnotes.

Don’t forget about the research reports, articles in the news, reports of the industry, emails, and fillings.

Stay on top of all the data coming from the market and of the relevant economic indicators concerning the fund in its entirety.

Every single bit of information that comes your way has the chance of turning into a great opportunity. Take advantage of it.

Handle the fund’s lawyers.

This situation is exactly like it goes into banking. Are you familiar with those moments when you upload a data room?

It renders a legal document which can sometimes be 300 pages long.

Evidently, since we are talking about a legal document, lawyers will handle much of this work.

Still, if particular problems should arise, they will hold you responsible.

The conclusion?

You must manage the fund’s lawyers.

You must perform modeling, even though it’s not such an interesting part.

This idea is a common saying in the world of investment banking.

Modeling is a fascinating part of it all. Even so, it’s not the same if we’re talking about a day in the life of a hedge fund analyst.

The concept of modeling becomes a methodical process, provided you have the basics locked down.

The reason is that you, as a hedge fund analyst, are a lot more interested in what that model can tell you and how it relates to the thesis you’ve just prepared than in how good you are at working with Excel.

If one part of the investments require you to read and perform diligence calls, the other part will ask some creative research of you.

If that is the case, then you must do one or several of the following.

- Diligence visits to the company which you are supposed to evaluate.

- Arrange and participate in meetings with the management.

- Call every one of their locations so that you can get all the data you need.

At the end of the day, go home, eat, rest, take a shower and go to sleep. This is how a day in the life of a hedge fund analyst typically ends. And then what? Then you get to do it all over again come morning.

Skills & Qualification of a Hedge Fund Analyst

A hedge fund researcher or a hedge fund analyst needs to fulfill certain educational and skill criteria for getting hired.

The career track of a hedge fund analyst spans differently from the sell-side career track.

In this, you ideally spend a couple of years as an analyst, about 2 or 3 years as a senior analyst and then move on to be a portfolio manager.

You need to have a Master’s degree and/or CAIA, CFA certification.

The job responsibilities of a hedge fund analyst vary as the career starts growing.

To illustrate in brief, you need to have deep knowledge of hedge funds, need to demonstrate accountability and responsibility, possess superior writing and analytical abilities, excellent interpersonal and communication skills, attention to detail, ability to deal with colleagues, investment managers, and clients, strong relationship building skills and ability to work independently, ability to handle leadership positions, take self-motivated initiatives and have the willingness to travel.

In an initial couple of years as an analyst, you are required to undertake fundamental research projects and work with the Sector Head, which includes attending industry conferences, attending management meetings, conducting field research and build financial models.

You are required to gain expertise over a sector, which involves developing proprietary tools for research, create sector surveys, conduct macroeconomic research and read sell-side equity.

A level of engagement is expected in a hedge fund analyst.

By engagement, we mean the ability to steer senior-level investment ideas, create your own network of management teams and buy-side analysts, take the initiative to work independently and analyze investments.

As you move upward in the career ladder, responsibilities include generating own investment fund ideas, find ways to improve sector performance, lead the investment team, add value to other others, be accountable towards investment plans, actively participate in a senior team meeting, remain thoroughly updated with stocks and other performances that impact your investment fund.

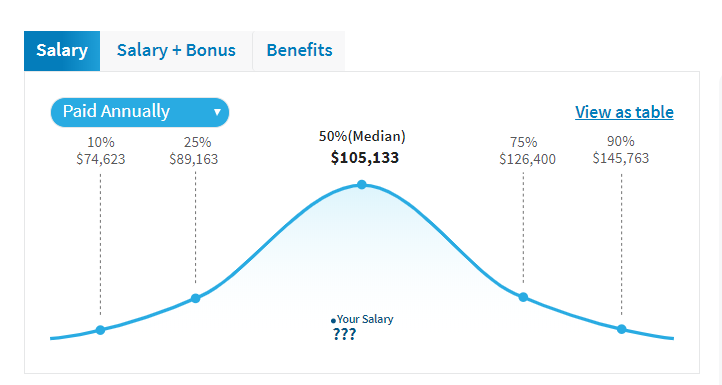

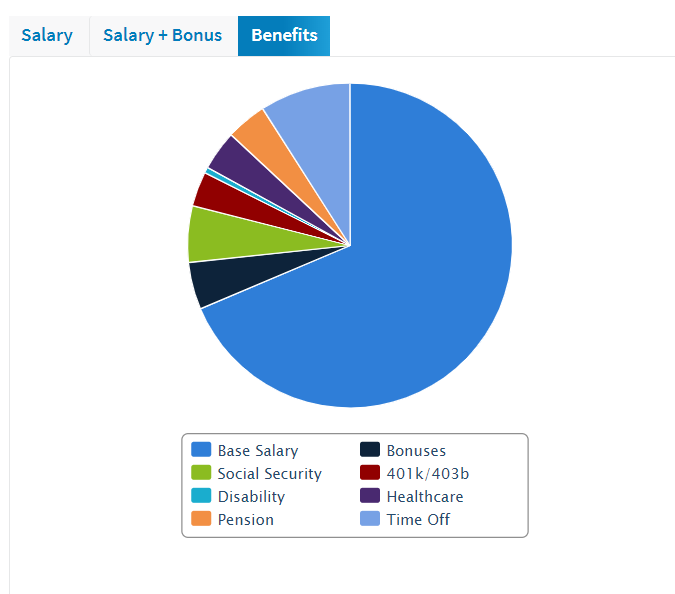

The Salary of a Hedge Fund Analyst in 2020

The average salary of a hedge fund analyst in New York is $105,133.

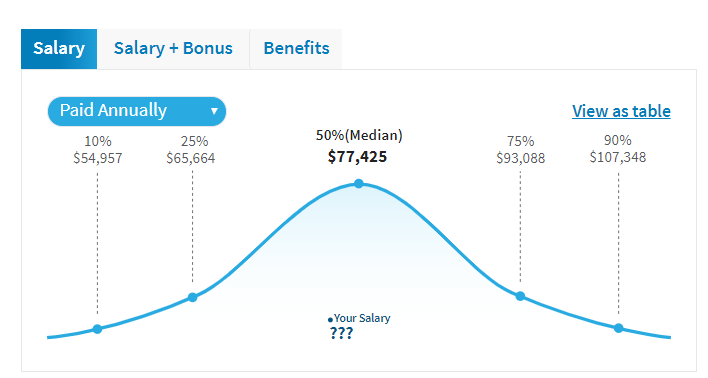

Hedge Funds in London pay for the same post around $77,425.

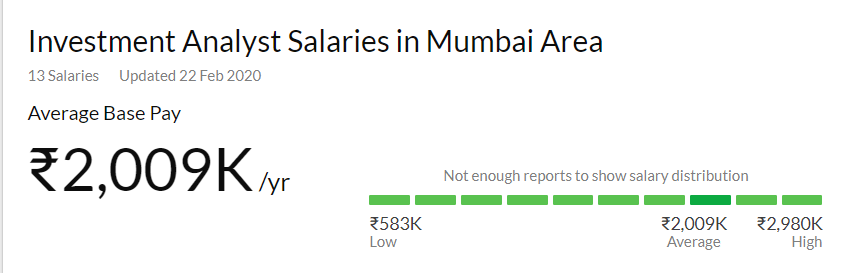

In India, the Investment Analyst in Hedge Funds gets average pay of INR 20,09000.

Source: Salary.com and Glassdoor.co.in

Note that the compensation of a hedge fund analyst heavily depends on performance.

If the entry-level salary is USD 90,000 – USD 120,000, then the compensation is twice the base amount.

Compensation in the hedge fund industry doesn’t follow any fixed benchmark.

It is tied to fund performance.

If a fund performs exceptionally well, the employees receive excellent compensation.

The top hedge funds in New York like Stark Investments, Davidson Kempner Advisors, and Wellington Management have around 10 Billion USD in Assets under Management (AUM).

In India, there are hedge funds like Karma Capital Management, Atyant Capital, and Atlantis India Opportunities Fund.

A career in a hedge fund is challenging and rewarding too.

As you go up the ladder and reach managerial position, you get a strong grip on different investment products and strategies and you get paid as per your performance, unlike that of mutual funds where the performance is compared with economic performance.