Are you interested in building a successful career as a Hedge Fund Consultant?

Here is some good news for you!

According to research industry statistics by IBISWorld, the hedge funds market size in the US is worth $103.1 billion, with over 86,912 people employed by firms in the hedge fund industry in 2021.

A study by PREQIN reveals that Hedge fund assets under management are likely to increase 19.6% to $ 4.28 trillion from 2020 to 2025, at a CAGR of 3.6%.

Source: Preqin

Yet (this is a crucial observation), the study above notes that they expect AUM to be boosted by performance (dependent on labor from experts like you), with hedge fund returns beating the AUM growth rate over the next five years.

So, what does this mean?

The hedge funds industry in the US is labor intensive, meaning businesses rely more on work than capital.

In this transformative landscape, technology emerges as a crucial protagonist.

Now, more than ever, Hedge Fund Consultants have the opportunity to thrive as a freelancer.

But how can you navigate this new terrain and succeed in a career requiring expertise and adaptability?

If you could get a roadmap for your career—something that could show you how to get from A to B and what to expect along the way—you’d want to see it, right?

This practical action guide gives you the insights, strategies, and tools to survive and thrive as a Hedge Fund Consultant.

Ready to learn? Let’s get started.

Hedge Fund Consultant Industry

In finance, hedge funds stand out as a unique investment, also known as alternative investments. They’re like a toolbox of strategies that traditional investment funds don’t usually have.

These strategies cover a wide range of options:

Handling debt, taking advantage of market shifts, and

Investing in stocks

Their active approach sets hedge funds apart—they aim to make more money than the usual managers on market trends.

Hedge funds are characterized by active management, where, as an investment manager, you choose a wide range of investment strategies such as the following areas:

Equity strategies

Your goal here as investors is to make the investment grow more than it would in traditional ways.

As such, clients rely on you as a Hedge Fund Consultant to understand these different tactics and choose the right ones—that can give them huge returns on their investments and maintain investor relations.

It’s the essence of active management, a pursuit of both returns and enhanced returns. This pursuit distinguishes hedge funds’ business models from their traditional counterparts.

Take a macro hedge fund as an example for raising capital.

Like a seasoned detective, the fund scrutinizes:

Global economic trends

Political shifts and

Market Indicators

Armed with these insights, it formulates a calculated strategy to invest in foreign currencies.

The goal?

To harness potential gains from currency fluctuations while mitigating risks.

Unlike conventional mutual funds, hedge funds are structured to provide flexibility to investment managers in pursuing diverse investment strategies different from fixed income.

Here’s where the term “hedge” comes into play: Hedge funds employ a variety of tactics, including short selling, options trading, and leveraging, to hedge against market risks.

Consider a long/short equity hedge fund in different asset classes.

As this fund manager, you simultaneously take long positions in undervalued stocks while shorting overvalued ones.

This strategy allows the fund to potentially profit regardless of market directions—a unique advantage compared to traditional investment opportunities.

Moreover, hedge funds often cater to accredited institutional investors with a higher net worth and more significant risk tolerance.

As the hedge fund manager, this exclusivity allows you to explore unconventional strategies (as discussed above) that may yield substantial rewards while maintaining due diligence.

Therefore, it is correct to say that the hedge fund industry thrives on strategic agility, business plans, innovative thinking, and calculated risk-taking.

As such, are the consultants clients want to hire.

Your advice isn’t just words; it’s a pathway connecting what clients want with the world of hedge fund options.

But how do you gain all this knowledge?

How can you leverage technological advancements to advance your digital Hedge Fund Consultant career?

What must you learn to thrive as a consultant working from anywhere?

I’ve explained the process in detail in the next section.

Essential Qualifications for a Hedge Fund Consultant

Before embarking on a career in the hedge fund industry, you must ensure that this is the path you truly want to pursue.

While there are various financial sectors to explore, such as:

Having a clear focus on hedge funds will make navigating the steps toward landing your dream job easier.

Your passion, self-discipline, networking skills, industry knowledge, and actions will reflect your commitment to this career path.

To excel in the hedge fund industry, one must possess specific skills and qualifications that employers value.

Here are some credentials and qualities that many top hedge fund managers and employers look for:

1. Academic credentials in finance and economics

A bachelor’s or master’s degree in finance or economics provides you with a comprehensive understanding of:

These programs help you grasp the intricacies of the financial industry and develop a strong base for your Hedge Fund Consulting career.

2. Professional certification: Chartered Financial Analyst (CFA)

The Chartered Financial Analyst (CFA) designation is a highly regarded certification in the financial realm.

While not explicitly focused on hedge funds, the CFA program covers many financial topics that can complement your expertise as a Hedge Fund Consultant.

It equips you with analytical skills, ethical standards, and investment knowledge crucial for success.

3. Proficiency in financial modeling and analysis

Mastering financial modeling and analysis is essential. This skill allows you to dissect data, forecast market trends, and make informed investment decisions.

It’s like having a toolkit for deciphering complex financial puzzles, guiding you in creating strategies that align with clients’ goals.

4. Hedge fund career courses

Here are some career-specific courses you can take to supplement your knowledge.

#1. Hedge fund strategies

This comprehensive course offered by NYIF delves into the various hedge fund strategies and how they are managed.

It covers essential topics like long/short equity, event-driven approaches, and global macro strategies.

By the end of the course, you’ll have a solid understanding of the intricacies of hedge fund operations and their application in different market conditions.

#2. Hedge fund fundamentals course

This course by the Corporate Finance Institute (CFI) covers a comprehensive overview of hedge funds.

You will learn the common characteristics of hedge funds, how they are structured, and the mechanics of management and performance fees.

You will also learn to measure performance using metrics such as the Sharpe and information ratios.

#3. Hedge fund regulation and compliance course

Vanderbilt University offers a Hedge Fund Regulation and Compliance Short Course designed to introduce you to the structure and goals of hedge funds and the relevant laws and regulations that govern them.

The course covers topics such as:

Failure to disclose information to investors

Presentation of the fund’s performance

Essential Skills and Attributes of a Successful Hedge Fund Consultant

As you step into this role, specific skills will play a pivotal role in your success:

#1. Analytical acumen

The ability to analyze data, spot trends, and make informed investment decisions is essential.

Mastery of tools like Excel and financial modeling software is your magnifying glass, enabling you to uncover valuable insights.

#2. Effective communication

Articulating complex financial concepts clearly and concisely is crucial when interacting with your clients, fund managers, and colleagues.

#3. Market knowledge

Staying updated on market trends, economic indicators, and geopolitical events is imperative.

Your ability to interpret these factors and assess their impact guides your investment recommendations.

#4. Problem-solving prowess

The hedge fund industry presents challenges that require innovative solutions.

Your knack for thinking critically and devising strategies to mitigate risks or exploit opportunities for your clients sets you apart.

#5. Adaptability

Markets evolve, strategies shift, and new opportunities emerge.

Your ability to embrace change and swiftly adjust your approach positions you as a resilient and sought-after Hedge Fund Consultant.

That’s it. We’ve covered pretty much the academic skills you need to become a Hedge Fund Consultant—but two things are missing:

How to start your career and gain experience.

How to exit into freelancing as a Hedge Fund Consultant, working from anywhere in the world.

That’s precisely what I’ll cover in the following sections.

How To Gain Practical Industry Experience as a Hedge Fund Consultant

To excel in the hedge fund industry, it’s crucial to immerse yourself in the world of hedge funds.

Create daily habits that revolve around your goal of working in hedge funds.

Subscribe to free hedge fund newsletters, read books and articles about hedge funds, and join local associations or clubs.

Here are critical differentiators for you if you want to gain experience and a competitive edge in the industry:

#1. Gain practical experience through internships

Internships offer an excellent opportunity to gain hands-on experience in the hedge fund industry while in college or as a graduate.

Even if you’re currently employed in a different field, consider dedicating 5-10 hours a week to research and working for a hedge fund.

This exposure will help you understand how hedge funds operate and generate trading ideas.

While on-site internships are preferred, don’t hesitate to seize remote internship opportunities if they offer valuable learning experiences.

Aim to secure multiple internships to broaden your knowledge and enhance your qualifications.

#2. Seek hedge fund mentors

Building relationships with experienced professionals in the hedge fund industry can be invaluable for your career growth. Identify potential mentors who can guide you on your journey.

Show commitment, patience, humility, and a hunger for learning to impress your mentors.

Developing a solid relationship with a mentor who can provide you with valuable insights and industry connections is vital for potential references in the future.

#3. Embrace the three-circles strategy

In his book “Good to Great,” author Jim Collins introduced the Hedgehog Concept, which can be applied to the hedge fund industry.

This concept suggests that to make wise decisions and achieve success, you should focus on positions that align with three critical circles:

Passion

Expertise, and

Profitability

While the original context of the concept may have been in the context of business strategy, it can certainly be applied to various industries, including the hedge fund industry.

By aligning your activities with these three circles, you can find the intersection where you are most likely to excel and achieve significant results.

Identify roles that align with your passion, leverage your education and natural strengths, and have the potential to generate high profits.

Following this strategy will increase your chances of excelling in the hedge fund industry.

Now, let’s look at what it takes to be and do all of the above as a Hegde Fund Consultant working from anywhere in the world.

Is it possible?

What do you need to know and do?

More information is in the next section.

How To Master Remote Work Skills as a Hedge Fund Consultant

Embracing remote work as a Hedge Fund Consultant promises newfound freedom and flexibility.

Just as freelance artist crafts their masterpiece on a blank canvas, you too can master the art of remote work, creating a successful career on your own terms.

Why?

Freelancing is no doubt the future of the work environment. But you don’t have to take my word for it.

According to industry reports:

The majority of the US workforce will be freelancers by 2027.

A report by Forbes reveals that Fiverr found that 78% of companies will rely on freelancing in 2023 rather than adding staff.

41% of freelancers plan on freelancing forever, and 45% feel more secure about their independent employment.

How about the productivity of working away from a traditional work environment?

One study by the Stanford Graduate School of Business shows that working from home improves work performance by 13%, and the company also saw a $2,000 increase in annual profit after letting employees work from home.

So, what does that mean?

The time to invest your time, energy, and resources in aligning your career as a Hedge Fund Consultant with freelancing and remote work is now.

Through remote work, you’re not just another consultant; you’re a dynamic force, untethered by location yet deeply connected to the pulse of the hedge fund industry.

So, let me break the barrier now by introducing courses you can learn to hone your skills and adapt to the remote work set-up.

#1. General freelancing courses

Start by honing your freelancing skills. Engage in courses that transcend industry boundaries.

Digital marketing courses, for instance, can enhance your ability to market your services, attracting potential clients from around the globe.

On top of that, they will also teach you to adopt strategies that optimize your remote work schedule, allowing you to efficiently juggle multiple client engagements.

They emphasize the significance of consistent communication, sharing real-world examples of consultants maintaining a solid rapport with clients through virtual channels.

These skills transform you into a sought-after professional, one who not only excels in consulting but also in the intricacies of self-promotion.

I strongly recommend the following courses:

After mastering the art of freelancing and digital marketing, you next must train your expertise from a digital perspective—take industry-specific freelancing courses.

#2. Industry-specific freelancing courses for Hedge Fund Consultants

You need to enroll in hedge fund freelancing courses that can refine your expertise in sought-after skills.

Since I covered most of these courses in the previous section (and because I don’t want to sound repetitive), allow me to introduce you to one more for the sake of emphasis:

Certified Hedge Fund Professional Level 1

This course by Business Training Global provides participants with a thorough understanding of:

Industry best practices

Practical knowledge of hedge funds and

Greater familiarity with the tools that hedge fund managers employ

You will explore hedge fund structures, strategies, and trends that can help you stay abreast of this competitive industry.

#3. Stay updated with hedge fund industry trends

Let’s explore the resources that can keep you informed about the latest trends and developments in the dynamic realm of hedge funds.

1. Reputable financial news outlets

Subscribe to reputable financial news outlets such as Bloomberg, CNBC, and The Wall Street Journal, which offer real-time insights, market analyses, and expert opinions.

2. Industry-specific publications

Industry-specific publications like “Hedge Fund Journal,” “HFM Global,” and “Institutional Investor” offer in-depth articles, case studies, and reports tailored to the hedge fund industry.

3. Webinars and podcasts

Webinars and podcasts provide a wealth of information through expert interviews, panel discussions, and market insights.

Platforms like Hedge Fund Association (HFA) and Hedgeye offer webinars covering various topics, from investment strategies to risk management.

Podcasts, such as “The Meb Faber Show” and “The Capital Allocators Podcast,” deliver thought-provoking discussions that keep you ahead of the curve.

4. Professional associations and networks

Joining professional associations like the CFA Institute, Alternative Investment Management Association (AIMA), or the Managed Funds Association (MFA) offers access to industry events, conferences, and webinars.

5. Online forums and communities

Online forums like Reddit’s r/HedgeFunds or LinkedIn groups dedicated to hedge fund consulting provide platforms to interact with peers, share insights, and ask questions.

These communities serve as spaces for collective learning and staying informed about the industry’s pulse.

6. Industry reports and research

Preqin, Eurekahedge, and Deloitte research reports offer comprehensive analyses of market trends, performance data, and emerging strategies.

These reports provide data-backed insights to inform your operational and consulting decisions.

Up to that point, you’ve covered everything you need to know and do to become a Hedge Fund Consultant working as a freelancer.

Regarding the section question, how do you market yourself as a Hedge Fund Consultant?

How To Market Yourself as a Hedge Fund Consultant

In the dynamic world of hedge fund consulting, showcasing your expertise isn’t just a choice—it’s a necessity.

Mastering the art of personal brand marketing can set you apart as a Hedge Fund Consultant, drawing clients to your expertise like moths to a flame.

I know what you’re thinking, but I’m new to the industry.

It’s not about being new; being different is better. Your brand’s origin holds the key to “thinking differently.”

That’s what will set you apart.

Let’s dive into the strategies that will help you illuminate your professional presence, captivate your audience, and close more clients.

Step 1. Developing a niche or specialization

Identifying a specific area of expertise within hedge fund consulting sets you apart from a constellation of consultants.

By honing in on a niche, you demonstrate a deep understanding of a particular aspect of the industry.

Whether it’s

Your specialization becomes a beacon that attracts clients seeking your distinct expertise.

Picture yourself as a trusted authority in a specific niche.

When you focus on a particular area, you invest time understanding its nuances, staying updated with its latest trends, and developing tailored strategies.

This commitment demonstrates your dedication, making clients more inclined to trust your guidance.

Why?

In the digital space, clients seeking precisely the expertise you offer are more likely to seek your services.

As such, your specialization acts as a magnet, drawing in engagements that resonate with your passion and proficiency.

As clients search for consultants who understand their needs, your specialization becomes a compelling reason to choose you over generalists.

As your reputation grows, your name becomes synonymous with excellence in your chosen field.

Step 2. Define your unique value proposition

After immersing yourself in hedge funds, completing internships, and developing mentoring relationships, it’s time to define your unique value proposition in the industry.

Identify a niche that aligns with your interests and expertise.

For example, if you aspire to be an emerging markets analyst, write white papers focusing on emerging markets and target companies specializing in related funds during your job search.

This should be your prime narrative.

Imagine your personal brand as a captivating story. Define who you are, your journey, and the value you bring.

Tailor this narrative to resonate with the specific needs of hedge fund clients.

Convey your passion for optimizing investments, your deep understanding of financial markets, and your track record of successful strategies.

Step 3. Build an online presence

Picture your online presence as a virtual storefront showcasing your skills.

As you launch into the digital space, create a professional website highlighting your expertise, services, and client successes.

Leverage social media platforms like LinkedIn to share insightful content, engage in industry discussions, and establish yourself as a thought leader.

But how do you go about it?

1. Crafting a compelling personal brand

Your personal brand is the essence of what you stand for in the industry.

Envision your personal brand as a mosaic of your values, strengths, and unique offerings.

Begin by defining your niche—the area in which you specialize (as discussed above).

Consider your mission, your passion for hedge fund consulting, and the solutions you bring to clients.

2. Craft your elevator pitch.

Imagine being in an elevator with a potential client, with only a short ride to captivate their interest.

This is where your elevator pitch shines.

Condense your brand into a succinct, engaging statement that communicates who you are, what you do, and the value you provide.

Think of it as your verbal business card—memorable, concise, and impactful.

Step 4. Strategies to showcase your personal brand as a hedge fund consultant

#1. Content creation

Start a blog on your website where you share insights, industry trends, and analysis.

Consider creating videos, infographics, or podcasts that offer valuable information to your target audience.

Discuss market trends, investment strategies, and the intricacies of hedge fund management.

By generously sharing your expertise, you establish credibility and attract clients seeking guidance in the complex financial world.

Highlight how your strategies led to significant returns or helped clients navigate challenging market conditions.

These success stories are your portfolio—they demonstrate the tangible value you bring.

On top of that, request and showcase testimonials that highlight the positive impact you’ve made on their financial journeys.

These testimonials serve as powerful endorsements, reflecting the trust you’ve cultivated and the results you’ve delivered.

Remember, content builds relationships. Relationships are built on trust. Trust drives revenue.

#2. Webinars and speaking engagements

Host webinars where you dive deep into topics within your niche.

Share your expertise, answer questions, and foster engagement.

Seek speaking engagements at industry events, showcase your insights to a broader audience, and establish yourself as a thought leader.

#3. Social media engagement

Utilize platforms like LinkedIn, Twitter, and Instagram to share your insights, engage in discussions, and connect with peers and potential clients.

Consistently contribute valuable content to position yourself as an expert and foster meaningful connections.

#4. Network with intention

Engage in online communities, forums, and groups related to hedge fund consulting.

Contribute thoughtfully, provide value, and build relationships beyond superficial connections.

Your network can become a powerful support system and a source of opportunities.

#5. Collaborate and guest post

Consider guest posting on their blogs or platforms, sharing your insights with their audience.

This expands your reach, introduces you to new connections, and solidifies your position as a respected professional.

Step 5: Building and managing client relationships

Building and managing client relationships isn’t just a strategy; it’s a cornerstone of your career in hedge fund consulting.

Let’s explore how to cultivate these bonds.

1. Approaching Potential clients and establishing rapport

Approach them with authenticity, curiosity, and a genuine interest in their financial aspirations.

Begin by understanding their needs and challenges. Share your expertise without overwhelming them with jargon, translating complex concepts into relatable insights.

This approach creates a foundation of trust, setting the stage for meaningful collaboration.

Suppose you’re speaking to a potential client who seeks advice on risk management strategies.

Instead of delving into intricate details, offer a relatable analogy that illustrates the essence of risk management, demonstrating your ability to communicate effectively.

2. Maintaining long-term relationships and delivering value

To maintain relationships, consistently provide value beyond expectations to your clients.

Continuously assess their financial goals, adapting your strategies to align with their evolving needs.

Regularly share insights, tailored reports, and recommendations demonstrating your commitment to their success.

Act as a proactive partner, always ready to address concerns and seize opportunities.

3. Celebrate milestones and acknowledge achievements.

Start by celebrating your client’s milestones — reaching a financial goal or successfully navigating market challenges.

Acknowledge the team for their achievements, reinforcing the team and sense of collaboration and support, creating a positive client experience.

Step 6: Uncover unadvertised opportunities

Not all job openings in the hedge fund industry are advertised.

To uncover unadvertised opportunities, leverage your network of contacts and take advantage of industry directories, associations, and online platforms.

Cold calling companies listed in the Chamber of Commerce or contacting investment professionals through hedge fund groups and societies can lead to valuable connections and informational interviews.

Proactively seeking out opportunities increases your chances of discovering hidden job leads.

Step 7: Explore hedge fund service provider roles

While working directly for a hedge fund may seem like the ultimate goal, there are excellent career opportunities in hedge fund service provider roles.

These positions expose you to numerous hedge fund managers, allowing you to showcase your specialized expertise and build valuable relationships.

Consider roles in prime brokerage, which can serve as a stepping stone toward fund-of-funds marketing or third-party marketing careers.

In this section, I’ve covered a lot of things that can get you on your feet in the market as a Hedge Fund Consultant working from anywhere or as a freelancer.

But how do you get clients?

Are there freelancing platforms dedicated to helping Hedge Fund Consultants like you get clients?

For more information, join me in the next section.

Remote Job Platforms and Freelancing Websites for Hedge Fund Consultants

Let’s discuss online opportunities for Hedge Fund Consultants to work from anywhere. Where do you get them?

In this section, I’ll list some of the reputable sources I strongly recommend you check for opportunities.

1. Toptal

2. Glassdoor

3. Jooble

4. LinkedIn

You can join These professional sites to get real clients or jobs. Always check those sites to ensure you don’t miss out on opportunities.

Let’s now talk about real people who’ve succeeded in this industry, working as freelancers and Hedge Fund Consultants.

Success Stories and Case Studies from Hedge Fund Freelance Consultants

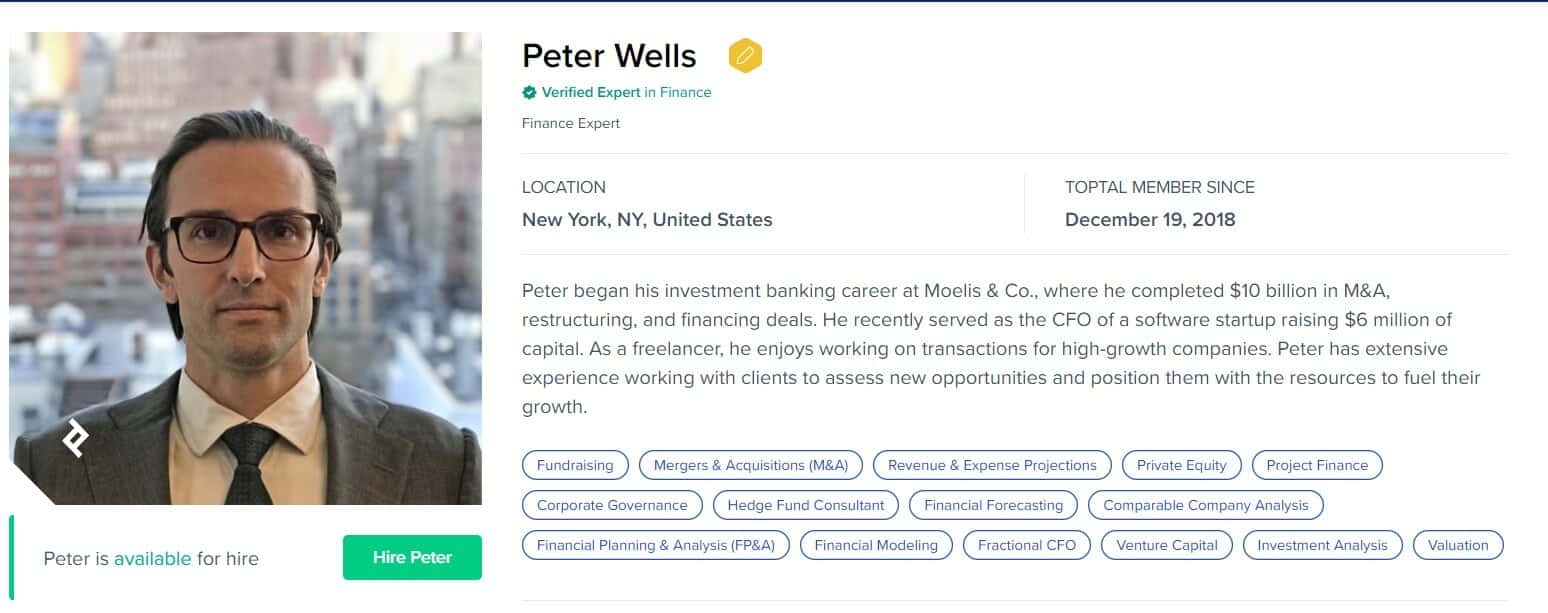

1. Peter Wells

Location: United States

Peter has extensive experience in his investment banking career at Moelis & Co., where he completed $10 billion in M&A, restructuring, and financing deals.

Beyond this, he undertook the role of Chief Financial Officer for a software startup, leading its efforts in securing an impressive $6 million in capital.

As a freelance compliance professional, he dedicates his expertise to navigating transactions for high-growth enterprises.

2. Evgeny Vostretsov, CFA, FRM, CAIA

Location: United States

A hedge fund analyst turned former startup CFO, he’s conducted in-depth research on 15+ public equities and assessed 30+ private equity and mezzanine debt transactions.

As an entrepreneur, he founded a global online retailer spanning 11 time zones. He advised on $5B+ valuations at E&Y. Today, as a freelancer, he has created an infrastructure to guide clients in investment evaluation, financial modeling, capital raising, and M&A.

3. Suhail Hafiz

Location: Canada

Suhail’s background spans prominent Canadian, private, and public equity firms, including Onex and Gluskin Sheff, with a track record of investing over $3 billion. In recent years, his career ignited in CIBC’s capital markets group, underwriting more than $5 billion in debt facilities.

Today, as a corporate director and finance professor at York University, he partners with global family offices and pre-series B tech firms, leveraging his expertise as a freelancer to secure capital.

Location: Spain

After completing his master’s at the LSE, he worked first as an analyst for a PE fund before switching to a global value hedge fund.

He is an expert in modeling, fundamental analysis, and valuation. He currently works as a freelancer and has completed the small business sale, advised on early-stage funding rounds, and acted as interim CFO for upstart companies.

Location: Cayman Islands

Caroline is a qualified chartered accountant with 20 years of industry expertise. She went from owner-operated businesses to listed entities and billion-dollar hedge funds.

Over time, she has successfully managed complex financial models and overseen the payment of nearly a billion in assets.

That’s it. All the information you’ve been exploring in this guide is designed for one reason: to help you grow your career as a Hedge Fund Consultant.

Therefore, put in the necessary energy to drive this from an action guide.

Before I finish, let me review frequently asked questions on this topic.

Hedge Fund Consultant Career – Frequently Asked Questions

Here are some frequently asked questions you need to be aware of.

1. How can I effectively communicate complex financial concepts to clients who may not have a background in finance?

Simplifying complex concepts requires practical communication skills. Use relatable analogies and real-world examples to explain intricate ideas.

Visual aids like charts and graphs can enhance understanding. Gauge your client’s level of comprehension and adjust your communication style accordingly.

Your ability to bridge the knowledge gap fosters confidence and trust.

2. What’s the key to maintaining a work-life balance as a hedge fund consultant?

Set clear boundaries for your work hours and personal time. Prioritize self-care and allocate time for activities that rejuvenate you.

Use time management techniques to enhance productivity during work hours, especially if you are working in family offices, allowing you to truly disconnect during your downtime.

3. How do I handle challenging market conditions when advising clients?

Provide transparent and honest communication about the situation. Present potential scenarios and their implications.

Offer alternative strategies that align with the client’s risk tolerance and long-term goals.

Being proactive, controlling emotions, and providing data-driven insights can help your clients navigate uncertainty.

4. How can I effectively manage my time while juggling multiple client engagements?

Prioritize tasks based on their impact and deadlines. Use time management tools to schedule your day, allocating focused time for each client’s needs.

Set boundaries to prevent burnout and communicate transparently with clients about your availability and project timelines.

5. What role does ethical investing play in hedge fund consulting, and how can I integrate it into my services?

Ethical investing is gaining prominence, and clients are increasingly interested in aligning their investments with their values.

Educate yourself about sustainable and socially responsible investment strategies.

Incorporate ethical considerations into your recommendations, offering clients opportunities to support causes they care about while pursuing financial growth.

My Exclusive Insights for You

That’s a wrap!

As the remote work model continues to gain popularity, hedge fund consultants have a unique opportunity to thrive in this flexible work environment.

By embracing this model and implementing the strategies outlined in this guide, you can become a successful Hedge Fund Consultant in the ever-evolving world of finance.

Let’s recap the key points that will set you on the path to success and encourage you to take action.

Nurture your expertise

Craft your personal brand

Build strong client relationships

Stay ahead of industry trends

In other words, always stay hungry for success.

As you navigate your career, remember the power of your Inner GPS—your inner guidance system.

During challenging moments, it helps you find direction and confidence. To harness this potential, consider our Inner GPS Career Coaching.

This transformative coaching program will help you uncover your inner self, overcome obstacles, and unlock your true potential.

As you tread on this exciting path, remember that success is within your grasp, waiting for you to seize it.

All the best!