A multidisciplinary field, Financial Engineering uses computational and mathematical finance knowledge to determine the potential and risks of a financial investment instrument.

FinanceWalk presents a detailed Financial Engineering career guide to finance aspirants.

What is Financial Engineering?

The Norman and Adele Barron Professor of Management at Boston University, Zvi Bodie, defined Financial Engineering as:

“the application of science-based mathematical models to decisions about saving, investing, borrowing, lending, and managing risk”

The field of Financial Engineering is regulated by the International Association of Financial Engineers established in 1992 and the first approved curriculum was at the Polytechnic Institute of New York University.

Financial engineering is applicable to derivatives pricing, financial regulation, execution, corporate finance, portfolio management, risk management, trading, and structured products.

Financial Engineering Career Overview

The financial engineers are specialists making use of mathematical formulas, programming and engineering methods in financial theories, and analyses market trends to build data-backed financial models.

Companies often employ people with an advanced degree in Financial Engineering and these specialists work as investment managers, bankers or traders using their financial engineering background to improve the quality of existing investment products.

The primary responsibility of a financial engineer is to have a thorough knowledge of financial markets, its volatility, and knowledge of financial theories.

This knowledge is used by engineers to develop simulations and predict market behavior.

Of course, the predictions aren’t always accurate, any unexpected issue may happen in the financial market but the risk potential reduces.

Since a financial engineer knows about market trends and previous market performances, the knowledge is used to make future investment predictions.

Apart from knowledge in finance, the engineer needs to possess sufficient computer programming skills.

Programming skills are needed to build simulating financial models to learn about market behavior.

Through these simulations, the financial engineer is expected to generate results, as much as accurately possible.

Most of the financial engineers work in the field of financial risk management and as a financial analyst.

With the knowledge of computer simulations and market trends, the engineer helps to develop profitable investment plans for individuals and companies.

Often, these investment plans have high-risk factors, which might seem counter-productive to the goal of hiring financial engineers, but that’s a strategy used by risk management firms to yield higher returns than comparatively stable investments.

Companies and high net-worth individuals often take help from financial engineers to design a portfolio that places the complete investment capital at risk.

As a financial analyst, the financial engineer creates real-time financial simulations to predict the future behavior of the market.

In the last decade, governments and financial institutions have started to actively hire financial engineers for advising or consulting governments (local, state or central) with market economies.

As a financial engineer, you can associate yourself as an employee of any reputed financial institution or set up your own consultancy, or do both.

Financial engineers are popularly known as “quants”.

Preparing for Financial Engineering Career: Education and Skills

If you really want to establish a career in financial engineering, you need to know various things to become a preferred job candidate.

In qualifications, a Bachelor’s in Science, a Master’s in Science or a Masters in Financial Engineering (MFE) will gear you towards quantitative roles such as delivering risk models and trading directly, library control, model validation, risk management, and programming.

Many of the financial engineers don’t hold a Ph.D. as some employers feel the degree will have a detrimental impact.

A master’s degree in computer engineering and electrical engineering with strong programming skills and data handling ease is recommended.

Mathematical geniuses can go for Ph.D. Knowledge in programming like SAS, MATLAB, S+ or RAD or other statistical packages will place you at a disadvantage as higher advanced languages like Java and Scala are used.

The financial engineering coursework generally consists of Applied Mathematics, Operations Research, Theoretical Physics, Mathematics, Computer Science, Computer Engineering, Mechanical Engineering, and Electrical Engineering.

There is a high need for qualified quants in the market. The demand for new quants is particularly high in structured finance establishments.

Over time, as the market gains higher traction, the demand for quants will increase. Emphasis will be on credit and risk ventures.

Moreover, the world of systematic, quantitative, algorithmic and automated trading offers various openings for quants.

The level of competition is high for entry-level quants as they need to display programming skills, knowledge of artificial intelligence methods and statistical theories.

Good experience with languages like Python, Java, C++, and Scala is essential for financial engineering.

If you’re looking for financial engineering jobs currently, search with hedge funds, asset management firms, banks, and proprietary trading companies.

Hedge funds and asset management firms are favorably positioned in the investment market in the next decade.

Banks are grappling with regulations and proprietary trading companies also suffer from regulatory issues, in countries like the UK and the USA.

Apart from qualifications, you need to possess skills for competitive advantage, it doesn’t matter which country you choose to work in.

Talent alone will not help in establishing financial engineering career.

To start with, we enlist some things which will get you through during job interviews and ensure a smooth career ahead.

1) Communication Skills

You’re not unique. Anyone working as a financial engineer is ‘smart’ and the only reason why some people move ahead in the career ladder is because of their articulate communicative nature.

A financial engineer should be thoughtful, inquisitive, outgoing and articulate.

You don’t need to be a refined public speaker but have the ability to communicate thoughts and ideas clearly.

The universal language of finance in English. If you aren’t a native English speaker, take some crash courses to help with speaking and writing abilities.

2) Programming

Every role of quant finance requires good programming skills. Join programming courses and concentrate on .NET, Hadoop, Java, C++, Perl, Python, C#, MATLAB, and other programming languages.

Your programming knowledge and expertise will work in your favor during job interviews.

3) Mathematics

Financial engineers need to be learned in linear algebra, stochastic calculus, spatial geometry and familiar with differential equations.

Mathematics is a part of the financial engineering curriculum and you need to gain expertise in these concepts as they will be frequently used in simulating financial models.

4) Finance and Economics

Finance and economics aren’t that important in quantitative trading, other than giving the professional a well-developed approach towards the finance markets.

Hedge funds and banks frequently seek financial engineers with a math background.

However, there are asset managers who choose to appoint trained economists, especially those with Ph.D., if it’s from premier institutes like Ivy League schools.

5) Crunching Information

A financial engineer needs to remain abreast of the latest market trends.

The engineer should have a habit of frequent reading, crunching information and applying them for developing predictive financial models.

Subscribe to magazines like Financial Times, The Wall Street Journal and Fierce Finance.

A well-trained and expert quant can easily separate him/her from the competition and rise higher in a financial engineering career.

Getting an Internship

The moment you become a college freshman, get an internship position with financial institutions. A lot of advantages are in store for you.

You get a glimpse of how it is going to work in a full-time atmosphere and learn from senior financial engineers.

Moreover, interns are rotated in departments so you get an idea of how departments work.

With a good working record, you can be retained by the investment banking company once the college years are over.

You meet and network with various professionals.

Engage with them even after they move to other companies because “it’s not what you know, it’s who you know”.

Getting an internship is highly recommended than getting a full-time financial engineering job.

Financial Engineering Courses

Here is a list of top universities offering financial engineering courses.

Note that no Indian university is listed because Indian courses are mostly Certificate courses and therefore if you’re from India, go for CFA, CQF, and FRM courses.

Globally top-ranked universities for financial engineering courses are as follows. Most of them are based in the USA and UK.

- American University, USA

- Bar-Ilan University, Israel

- Baruch College, New York University, USA

- Bogazici University, Turkey

- Boston University School of Management, USA

- Carnegie Mellon University, USA

- Case Western Reserve University, USA

- Claremont Graduate University, USA

- Clark University, USA

- Columbia University, USA

- Cornell University, USA

- DePaul University, USA

- Dublin City University, Ireland

- Florida State University, USA

- Fordham University, USA

- George Washington University, USA

- Georgia Institute of Technology, USA

- Georgia State University, USA

- Hong Kong University of Science and Technology, China

- Imperial College Business School, UK

- Kent State University, USA

- Lehigh University, USA

- McMaster University, Canada

- Nanyang Technological University, Singapore

- North Carolina State University, USA

- NYU Polytechnic Institute, USA

- Oklahoma State University, USA

- Princeton University, USA

- Queens College, USA

- Rensselaer Polytechnic Institute, USA

- Stanford University, USA

- Stevens Institute of Technology, USA

- Technical University, Austria

- University of Alabama, USA

- University of Arizona, USA

- University of Birmingham, UK

- University of California (Berkeley, Los Angeles, Santa Barbara), USA

- University of Connecticut Storrs, USA

- University of Dayton, USA

- University of Florida, USA

- University of Illinois, USA

- University of Limerick, USA

- University of Minnesota, USA

- University of Neuchatel, Switzerland

- University of Oxford, UK

- University of Southern California, USA

- University of Technology, Australia

- University of Witwatersrand, South Africa

- University of Tulsa, USA

- University of Twente Enschede, The Netherlands

- University of Waterloo, Canada

- University of Western Ontario, Canada

- University of Wisconsin, USA

- Washington University, USA

- Worcester Polytechnic Institute, USA

- York University, Canada

- IIT Kharagpur, India

Long list!

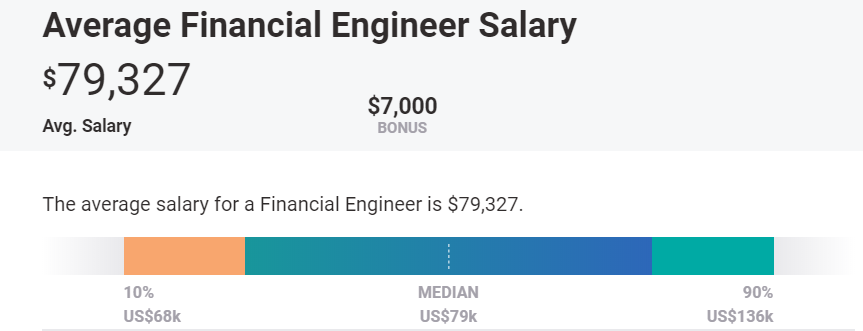

Financial Engineering Salary Scales

A comparison between two countries – USA and India – is presented here to show the financial engineering salary scales and other factors like job satisfaction, gender ratio, and other benefits.

All data is sourced from PayScale.com.

Financial Engineering in the USA

The average salary of financial engineers in the USA is 79,327 USD.

The minimum and maximum salary ranges are 68,000 USD and 136,000 USD with a bonus amount between 4000 USD and 31,000 USD.

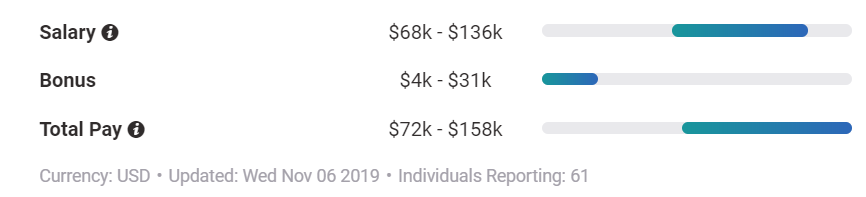

The individual experience level and location impact the salary range, with experience years wielding the highest influence.

The data below shows how experience impacts the salary scale of financial engineers.

In gender ratio, 32% and 68% are the figures of female and male financial engineers.

Also, common health benefits offered to financial engineers in the USA are mentioned below.

Financial Engineering in India

Coming to India, PayScale.com doesn’t give us much data as financial engineering is a relatively new field.

However, going by Glassdoor India website, average base pay is INR 17,09000.

Endnote

A financial engineering career has immense potential in the future financial market.

If you’re interested to enter the finance industry and possess good mathematical and scientific knowledge, go for a financial engineering career.

All FinanceWalk readers will get FREE $397 Bonus – FinanceWalk’s Prime Membership.

If you want to build a long-term career in Financial Modeling, Investment Banking, Equity Research, and Private Equity, I’m confident these are the only courses you’ll need. Because Brian (BIWS) has created world-class online financial modeling training programs that will be with you FOREVER.

If you purchase BIWS courses through FinanceWalk links, I’ll give you a FREE Bonus of FinanceWalk’s Prime Membership ($397 Value).

I see FinanceWalk’s Prime Membership as a pretty perfect compliment to BIWS courses – BIWS helps you build financial modeling and investment banking skills and then I will help you build equity research and report writing skills.

To get the FREE $397 Bonus, please purchase ANY BIWS Course from the following link.

Breaking Into Wall Street Courses – Boost Your Financial Modeling and Investment Banking Career

To get your FREE Bonus, you must:

- Purchase the course through FinanceWalk links.

- Send me an email along with your full name and best email address to avadhut@financewalk.com so I can send you the course login details.

Hi, I have a bachelor’s degree in education (Maths/business), can I pursue a master’s degree in financial engineering?

Hi James,

Each University/Institute has different eligibility criteria. I suggest you get information from the Institute directly.

I really love this course am yet to join school and was wondering if an average student in mathematics can take the course of financial engineering because am not so good in mathematics

Hi Jennifer,

If you have interest in Math, then you can go for this course.

Hii sir, i completed my BTech in mechanical engineering. Will it be good to go for masters in financial engineering (or) operations management?

Hi Sandipani,

Choosing between Financial Engineering (MFE) and Operations Management (OM) depends heavily on your career goals. Let’s explore both briefly:

1. Financial Engineering:

Pros: Highly quantitative, lucrative career options in banking, risk management, trading. Aligns with analytical bent of engineering background.

Cons: Requires strong math and coding skills, intense one-year program, limited to finance domain.

2. Operations Management:

Pros: Broader scope, applicable across industries, focuses on efficiency and process improvement. Leverages problem-solving skills from engineering.

Cons: Less specialized than MFE, potentially lower starting salaries than finance roles.

Which aligns better?

Without knowing your exact goals, it’s tough to say. If you crave finance and high-intensity math, MFE could be ideal. But if you prefer broader industry options and process optimization, OM might suit you better.

Do more research on specific programs and career paths in each field before deciding!

I have a diploma in tax administration.

Is Bachelor of science in financial engineering a good course to persue?

Hi Lydiah,

Yes, a Bachelor of Science in Financial Engineering could be a good option for you, considering your background and potential career goals:

Why it might be a good fit:

Complementary knowledge: Your tax administration diploma provides a foundation in financial regulations and processes, which aligns well with financial engineering’s focus on quantitative analysis and modeling.

Career expansion: Financial engineering opens doors to diverse careers beyond tax, like risk management, quantitative investing, and algorithmic trading, leveraging your analytical skills further.

Technical expertise: The program equips you with strong math, programming, and financial modeling skills, valuable assets in the quantitative finance world.

Things to consider:

Math and programming intensity: Be prepared for demanding coursework in these areas, potentially requiring additional preparation if they weren’t your strengths previously.

Career alignment: Ensure the program aligns with your specific career aspirations. Research potential roles and required skillsets to confirm this path aligns with your vision.

Overall, with your existing financial knowledge and willingness to delve deeper into technical aspects, a Bachelor of Science in Financial Engineering could be a rewarding step towards your desired career path.

Hie i did Insurance and risk Management is it possible to do masters in financial Engineering without the knowledge of programming

Hi Terrence,

While programming is common in Financial Engineering (FE), an Insurance and Risk Management background offers valuable quantitative and analytical skills. It’s possible to pursue an FE Master’s without prior coding knowledge, but be prepared to:

1. Address the gap: Many programs require foundational programming courses. Consider online resources or preparatory programs to catch up.

2. Focus on strengths: Highlight your risk management expertise and transferable skills in your application.

3. Target programs: Research programs with less emphasis on coding or offering support for beginners.

Remember, success hinges on your dedication to learning new skills and leveraging your existing knowledge. Aim for programs with strong career placement support to navigate the job market effectively.

Hello Avadhut,

I’m a CA and currently pursuing FRM. Looks like Financial Engineering has a tilt towards candidates having an engineering background. Reaching out to understand if the FE courses (specifically CQF) would be appropriate for a student like me, with absolutely no background on advanced mathematics. Does industry have a demand for candidates like me who are more dominant on the Finance side than Engineering? My only concern is – will it be the best possible action to go for FE courses with a commerce background?

Hi Madhur,

CQF with CA and FRM: Weighing In:

While CQF leans towards engineers, your CA and FRM combo offer strong finance expertise. Focus on bridging the math gap: online courses, textbooks.

Demand exists for finance-heavy FE profiles, especially in risk management, portfolio construction, and FinTech.

Evaluate your career goals: CQF deepens technical skills, but specialized finance certifications in your desired area might suffice.

Ultimately, it’s your decision. Consider the math commitment and align it with your aspirations. Good luck!

hi,had bachelor in science. actuarial science and economics education.

am i fit to purse financial engineering as my master degree, if yes, can you put a guide through what and what i can do to achieve this?. also can give guide to

best universities.

Yes. Go ahead and start applying to institutes/Universities. Good luck.

Dear Avadhut

One of the IIT i.e. IIT Kharagpur offers Masters in Financial Engineering.

The list of university/college giving Masters in Financial Engineering need to be updated in your article.

rgds

Sanjay

Thanks Sanjay. Included and updated the list. 🙂

PLEASE CAN I STUDY FINANCIAL ENGINEERING AS AN UNDERGRADUATE COURSE?

Please read the guide again.

Hi , Am BE computer ,Master in finance . Can u guide What else i can do for get into financial engineering.I do know coding .If there is any online course which could help me.

Hi Sai,

I suggest you do only a classroom course in Financial Engineering.

I am a commerce graduate with Maths Background from DU and currently pursing PG Diploma in Data Science and got myself placed in Ernst and Young. Is this course good enough for me? And what’s the difference between MS in Financial Engineering, MS in Computational Finance and MS in Quantitative Finance? Are these all are the same?

Hi Swetha,

Apparently they look the same. I suggest you check the syllabus of each course and industry relevance too.

Hi

I am university student in financial engineering I am not good at math also I think I do not know any thing about it I really need to know how I can be good and professional in this field

would you please help me what should I do ?

Hi Sadaf,

May I know your intention to join Financial Engineering?

is physics required in financial engineering?

sir i am a bba graduate with 4 papers of actuarial science cleared. so can i apply for financial engineering in good colleges ?although, my bba involves some subjects of computer science, maths.

Hi Alisha,

Please contact the University/Institute directly and check the eligibility criteria.

I am commerce student.

Can i go for this course ?

My aim is to become quantitative trader.

Yes. Please check the eligibility of the course.

If I have don MS in FE from US and have 3 years of experience in US, what would be my average salary in India?

The one-word reply is: DEPENDS.

The long answer is it depends on 10-15 different factors. I suggest you make use of sites like Salary.com to have an idea. 🙂

Hello sir,

I have done mechanical engineering from Pune university but I am unaware of programming and financial backgrounds so I want to know do in this field require financial background which is mostly present with commerce students. My intention to work as a financial engineer is just for a good package.

Hi Ashish,

Career Discovery is a long and intentional process and should not depend on outside objects like money and prestige.

Go inside and check your feelings and be realistic.

You can email me for career guidance.

That was a great article there. I loved it. Please could my BSC in actuarial science qualify me for finance engineering ? And do you think it’s the best thing to do?

Hi Sabrina,

Yes. Go ahead.☺️

Being a mechanical engineer i am unaware of programing languages( c,c++,…).so will it be easy for me to purse financial engineering or i’ll have to learn any one of the above language first

Hi Sairaj,

As you go along, you can learn the skills required.

Hi I’m Duneesha perera,

It is a very important & useful article for students like us.

I wanna know that among managmnt, b.com & financial engineering what’s the most valuable degree?

And what are the current salary stages for them?

Hi,

The scope is in the person, not in any certification.

Your question requires a detailed discussion.

Book a Career Coaching session with us.

hello Sir,

Thanks for your wonderful article

Just, want to know if my BSc in Accounting could qualify me for the masters programme in Financial Engineering

Dear Ashu,

It depends on the University/ Institute eligibility criteria.

I loved the accurate analysis of the course.I am studying a bachelor of financial engineering in Kenya.maybe you can talk about Kenya as well.

I am a graduate with bachelor’s in accountancy and finance. How apt would this course be for me to widen my career opportunities?

Dear Asma,

What’s your career goal?

Want to join finance industry so need some clarifications on that. Please help.

Dear Ravneet,

What clarifications you’re seeking?

hiii…..I am saikat karmakar from Kolkata(West Bengal)……..I have completed my B.Sc in Computer Sciences……..Currently i am working with Angel Broking Pvt. Ltd. as a Sales Executive………I want to do a master degree in Financial Engineering……….Because i want to go in the field of Investment Banking………..So please help me to find a way ,is this financial engineering course help me to get a place in the field of investment banking……………please help me out soon with proper guidance……I am waiting for your response soon………

Dear Saikat,

You don’t need to do Financial Engineering to get into Investment Banking. I invite you to join our program for Investment Banking roles.

Hi

please can someone with a Bsc in accounting and mathematics background though no programming language do financial engineering?

Yes.

Can commerce students do Financial engineering?

Yes. Some institutes will focus on your Maths and Quantitative subjects grades and knowledge in graduation in selection process.

thanks for sharing such a nice article ,

hey please advice I am grauduate National Diploma in Electrical Engineering(heavy current ) with valuable experince in panel wiring and currently in 3rd year towards obtaining Bachelor of accounting scieneces in Financial accounting (CA stream ) and am interested in Financial engineering so if I do financial engineering which area should I merger in ?

Depends. Please study the curriculum and specialisation of course given by different institutes and then decide which resonates with you.