Are you interested in becoming a freelance Financial Modeling Consultant? If your answer is Yes, this guide is for you.

Zippia says over 179,689 finance consultants are employed in the United States.

So, what does this mean?

The financial services consulting services market is booming with solid growth prospects.

This turn of events that has led to a significant gain in the popularity of financial advisors over the various financial institutes is because of the following:

Demographic shifts

Social change

The acceptance of new technology to deliver financial services

This shift in demand means there will not be a need for you as a financial modeling consultant to work from a physical office, but a possibility of Working from Anywhere in the world.

If you want to be your own boss, set your own work hours, and go around the world networking and creating job opportunities, opting for consultation instead of the traditional working style is the vehicle that can help you achieve that goal.

While it might sound too good to be true, in this guide, I’ll share with you the following:

A realistic overview of what it’s like to be a financial modeling consultant (hint: it still requires hard work)

A proven step-by-step process to help you become a successful Financial Modeling Consulting entrepreneur.

Success stories and case studies you can follow for inspiration.

Sounds good? Let’s start by first understanding the basics.

Financial Modeling Consultant Career

So, what’s financial modeling? Financial Modeling Consultation is when a business or an individual seeks your professional advice and assistance to create, analyze, or improve financial models.

These models are mathematical representations of a company’s financial situation, typically including projections, forecasts, profitability ratios and other critical financial data.

For example

Imagine you have a business and want to make informed decisions about your future finances.

You might need to become an expert in building complex financial models, and that’s where financial modeling consultation comes into play.

You’d contact a financial expert or a consulting firm specializing in this area.

As a Financial Modeling Consultant, you’ll work closely with the business to understand their needs and objectives.

Then, you’ll craft a detailed financial model tailored to the business, taking into account factors like:

Revenue

Expenses

Cash flow

Growth projections.

The goal is to help your clients make strategic decisions based on your data science and analysis, whether it’s for:

Budgeting

Forecasting

Valuation

Investment planning or other financial scenarios.

In that case, you ensure that the model is accurate, reliable, and reflects the real-world dynamics of the client’s business.

This can be particularly useful when making critical choices like:

Expanding to new markets

Taking on debt

Taking significant investments

As I hinted in my introduction to this guide, it is increasingly becoming flexible for financial modeling consultants to work from anywhere in the world. Leading companies and business houses hire financial modeling consultants to manage their budgets financial projections & forecasts, mergers & acquisitions , capital raising, and other financial transactions.

If that didn’t sink well into you, or you didn’t get the perspective right, I’ll use the following section to paint the picture.

Practical Action Steps to Be Financial Modeling Consultant

Perhaps this is the most important question I will answer in this guide, so pay attention.

How do you get down into business as a financial modeling consultant?

What do you need in terms of qualifications and skills?

How can you get experience that sets you apart from the neck-breaking competition?

Those details and many more have been captured in this guide, so let’s uncover them one by one below.

Step 1: Education and Degrees

To start with qualifications, I want to be clear: any financial analyst can become a financial modeling consultant—if you set your mindset that you want to be different and explore unknown opportunities.

Financial modeling consultants often pursue educational paths that provide them with a strong foundation in finance, accounting, economics, or related fields.

These disciplines are essential because financial modeling requires a deep understanding of accounting principles of:

Financial concepts

Analysis techniques and

Economic principles

Here’s a closer look at the typical educational paths you can follow as an aspiring financial modeling consultant:

#1. Bachelor’s degree in finance

To become a financial modeling consultant, you must typically pursue a bachelor’s degree in finance.

This degree will equip you with the essential knowledge of:

Financial concepts

Analysis techniques

Economic principles necessary for financial modeling

#2. Degree in Accounting

Alternatively, you may consider obtaining a degree in accounting, which also provides a comprehensive understanding of:

Financial reporting

Auditing

Taxation, and

Financial analysis

Such knowledge will be valuable when creating and interpreting financial models based on historical financial data and historical performance.

#3. Degree in economics

Another educational path you can explore is obtaining a degree in economics.

This field focuses on studying how:

Individuals, businesses, and governments make choices regarding resource allocation

Providing insights into the broader economic context in which companies operate

#4. Mathematics and statistics

If you have a strong affinity for mathematics and statistics, degrees in these disciplines can also be advantageous.

They emphasize the following:

Quantitative skills

Data analysis and

Modeling techniques

All the skills above are highly relevant when building complex financial models and conducting sensitivity analyses for investment analysis.

#5. Business administration or MBA

Considering a degree in business administration or pursuing an MBA is another option.

These programs offer a well-rounded understanding of various business functions.

This helps you develop models that incorporate financial factors and operational and strategic aspects of a full on business development plan.

#6. Financial engineering or quantitative finance

This degree is vital for specialized roles, particularly if you’re interested in financial modeling within investment banking or complex financial products.

These programs focus on advanced mathematical and computational financial modeling and risk analysis methods.

Apart from formal education, specific finance career skills are crucial for becoming a successful Financial Modeling Consultant.

Step 2: Essential financial skills

To excel in a career as a financial modeling consultant, you’ll need to possess diverse skills that enable you to create accurate and insightful financial models.

Let’s take a look at some of the critical skills required for success in this profession:

#1. Proficiency in excel

Excel is the foundation for creating complex financial models, performing calculations, and organizing large datasets.

You should be adept at using:

Formulas

Functions

Data manipulation and

Creating visual representations of financial data

#2. Financial analysis

Sound financial analysis skills are crucial for:

Interpreting financial statements

Assessing performance metrics and

Identifying trends and patterns

Computing Key Performance Indicators (KPIs)

Analyzing financial data will help you make informed recommendations and develop accurate client forecasts.

#3. Data interpretation

As a financial modeling consultant, you must be skilled at interpreting both qualitative and quantitative data.

This includes understanding:

Industry trends

Market dynamics based on data analysis and data driven insights

Inteerpreting Income statement, Balance Sheet and Cash Flow statement

Implications of financial information and data collection process

Macroeconomic factors to make sound financial decisions

#4. Modeling techniques

You should be well-versed in various modeling techniques, such as discounted cash flow (DCF), a sensitivity analysis, and scenario analysis.

These techniques will help you to make a project’s future financial performance and assess the impact of different variables on your business plans and outcomes.

While the skills closely tied to the finance career are necessary, you must also have other common soft skills if you want to impact your clients and grow your career.

I’ll list some of them below.

Attention to detail

Problem-solving skills

Communication skills

Business acumen

Adaptability

Time management

Ethical conduct

By honing these specific skills and your academic background, you’ll be well-equipped to tackle diverse financial modeling challenges and provide valuable guidance to clients and small businesses themselves in making informed decisions.

Let’s now turn the pages to how you can gain experience that will set you apart in the ever-blazing Financial Modeling Consultant career.

Step 3: Gain relevant experience through Internships

Internships play a crucial role in helping you gain practical experience and exposure to real-world financial modeling projects.

Here’s why:

#1. Hands-on learning

Internships provide a hands-on learning experience that goes beyond theoretical knowledge gained in classrooms.

These real financial modeling projects allow you to apply your skills to actual business scenarios, enhancing your understanding of financial concepts and modeling techniques.

Internships also give you a glimpse into the day-to-day responsibilities and challenges Financial Modeling Consultants face.

This firsthand experience allows you to assess whether this career path aligns with your interests and aspirations.

Finally, after successfully completing an internship, it gives you a sense of accomplishment.

It boosts your confidence in your abilities as a Financial Modeling Consultant.

#2. Exposure to industry practices

During internships, you get exposed to the current practices and methodologies used in the financial industry.

This exposure helps you understand how financial models are developed, analyzed, and utilized in making critical business decisions.

Additionally, internships expose you to the expectations of clients or employers in the financial modeling domain.

Understanding client needs and preferences can help you align your skills and expertise accordingly, making you a desirable candidate for future roles.

#3. Mentoring and guidance

Replace with: After college, you only meet seasoned professional guides and supervisors offering valuable feedback and insights.

This mentorship accelerates your learning and provides a supportive environment for skill development.

On top of that, these connections can open doors for future job opportunities or even potential collaborations as a freelance financial modeling consultant.

#4. Building a strong portfolio

Internships provide tangible examples of your work that you can include in your portfolio.

A well-documented portfolio showcasing your contributions to real projects during your internship can make a significant impression on potential employers and clients.

#5. Potential job offers

You might not know this, but many companies use internships to evaluate potential candidates for full-time positions.

Doing well during your internship may lead to a job offer, providing a direct pathway into the financial modeling industry.

Isn’t that encouraging? Yes, it is.

So, the best thing to do when still in college or after completing your undergraduate is to pursue internship and volunteer opportunities that can give you essential experience.

After that, you may consider going for entry-level jobs that can give you more specialized experience—especially if you want to work for a firm.

However, suppose you want to venture independently and start your financial modeling consultation agency or firm. In that case, the next section is for you.

Step 4: Freelance work and personal projects

Taking on freelance financial modeling projects and engaging in personal projects like writing free blogs and local media commentaries can offer you valuable experience and diverse opportunities.

Let’s take a look at the following case scenarios.

#1. Practical application of your skills

Freelance financial modeling projects provide a real-world platform to apply the skills and knowledge acquired during formal education or previous experiences.

You get to work with a diverse client base that allows you to understand unique business challenges, industry-specific dynamics, and various financial aspects across different sectors.

#2. Building a portfolio

Freelance projects and personal projects, such as writing blogs and commentaries, can help you build a strong portfolio of work.

A portfolio showcasing various projects in different industries can attract potential clients and employers, highlighting your versatility and expertise.

Later in this guide, I’ll dive into some freelance financial modeling opportunities you can leverage as you kickstart your career as a financial modeling consultant.

Are you intrigued by what you’ve learned so far?

We’re still going. My last recommendation in this section is as follows.

Step 6: Pursue relevant career certifications

Refrain from relying solely on your degrees to stand out as exceptional before your clients and the world.

Relevant certifications can significantly enhance your credibility and demonstrate your expertise in specialized areas.

Some valuable certifications include:

#1. Certified Financial Modeling Professional (CFMP)

This certification focuses on financial modeling skills, validating your ability to build accurate and effective financial models.

#2. Chartered Financial Analyst (CFA)

While not solely focused on financial modeling, the CFA designation is highly regarded in finance.

It covers various finance topics, including financial analysis and modeling.

#3. Certified Corporate Financial Planning & Analysis Professional (FP&A)

FP&A certification focuses on financial planning and analysis, which is essential for consultants in forecasting business valuation and budgeting models.

#4. Certification in Microsoft Excel

Specialized certifications in Microsoft Excel, such as Microsoft Office Specialist (MOS) or Microsoft Certified Excel Expert, demonstrate advanced proficiency in Excel, a crucial tool for financial modeling.

Step 6: Continuous learning for growth

Ongoing learning can help you stay relevant and up-to-date with industry developments.

It can be pursued through:

#1. Workshops and webinars

Attending workshops and webinars hosted by industry experts or training organizations offers you insights into new financial tools, modeling and valuation techniques, and best practices.

#2. Online courses and tutorials

Online platforms offer a vast array of courses covering topics such as:

Advanced Excel functions

Data analysis

Programming languages (e.g., Python), and

#3. Industry publications and research

Regularly reading industry journals, financial news, and research papers informs you about the latest trends and cutting-edge financial modeling techniques.

#4. Industry associations

Joining relevant industry associations provides access to resources, webinars, and networking platforms, fostering ongoing professional growth.

Step 7: Responsibilities of a financial modeling consultant

As a Financial Modeling Consultant, it is expected of you to perform the following functions:

Building different financial models based on historical data of a business and providing forecasts based on the analysis of historical data and industry metrics.

Carry out a scenario analysis to determine the risk a business might face based on different factors.

Ensuring implementation of processes to improve budget and prepare the company’s forecasts.

Identifying the risks a business faces, both financial and non-financial, and curating a mitigation strategy for the same.

To update the financial models as and when required at different periods.

Carry out company valuations, capital structure studies, and comparable companies analysis

That’s a wrap about how you can get relevant academic qualifications and experience to pursue your career as a Financial Modeling Consultant.

Let me explain what you must do when starting your career—Working from Anywhere.

Step 8: Setting Up Your Remote Workspace

As a Financial Modeling Consultant working remotely, setting up an effective and conducive workspace is crucial for you to maintain productivity and focus.

In this section, I’ll share some tips to create a minimalistic and efficient remote workspace tailored to your financial modeling work and lifestyle:

#1. Choose the right location

Select a quiet and dedicated space in your home, hotel, or homestay booked from Airbnb in your Work-from-Anywhere setup that allows you to concentrate without distractions.

Ensure good lighting and a comfortable chair to maintain your focus during extended work sessions.

#2. Organize your desk

Keep your desk clutter-free and organized. Have only the essential items within reach, such as your computer, notepads, pens, and any physical documents relevant to your current projects.

If you like taking snacks while working, consider having a plate of apples or dry fruits and a water bottle to minimize movement when needed.

#3. Utilize dual monitors (if possible)

Using dual monitors can enhance your productivity when working on financial models.

This suggestion you can implement if you are still working from home remotely.

It allows you to open multiple spreadsheets and data sources simultaneously, improving efficiency.

#4. Data security

As a Financial Modeling Consultant, you’ll likely deal with sensitive financial information.

Ensure that your workspace is secure and you have the necessary measures to protect client data.

Use strong passwords, encryption, and reputable VPN services when accessing sensitive information.

For example, instead of having weak passwords such as your name or those of your pet, consider using solid passwords with multiple features such as double spaces.

#5.Backup your files

Financial models and data are valuable assets.

Regularly back up your work to secure Cloud storage or external hard drives to prevent data loss in case of technical issues.

#6. Utilize productivity tools

Use productivity tools and apps like Trello and Google Workspace to streamline your workflow.

Project management tools, time trackers, and collaboration platforms can help you stay organized and efficient.

#5. Software and tools

Ensure you have access to the necessary financial modeling software and tools.

Microsoft Excel is a fundamental tool, but you might also need other specialized software like financial modeling platforms or data analysis tools.

#6. Organize files and folders

Establish a logical and consistent system for organizing your files and folders.

Categorize and label them appropriately to make locating specific financial models and related documents easy.

#7. Time management

Working remotely requires effective time management and self-discipline.

Set precise work hours and establish a daily routine that includes breaks to prevent burnout.

During your free time, consider doing what you like the most, e.g., solving some puzzles.

#8. Personalization

While minimalism is essential for an efficient workspace, don’t hesitate to add a personal touch to make it more comfortable and motivating.

Consider adding a motivational quote, hanging a wall picture of yourself or someone you admire, or a small plant to uplift your spirits.

That’s so inspiring, isn’t it?

Let’s shift our focus to something important in your career as a financial modeling consultant.

Building a Strong Online Presence as a Financial Modeling Consultant

Sometimes, you may need to remember why you’re in business.

But why are you in business?

The short answer is to serve your customers by continuously devising mechanisms to communicate with them effectively.

Customers expect prompt and friendly service no matter where they’re located—social media can help you with that.

A robust online presence through platforms like LinkedIn and a personal website increases your visibility to a global audience.

It allows potential clients to find you easily when they search for financial modeling experts.

For example, according to GlobalWebIndex, 2018, over half (54%) of browsers use social media to search for new products.

Additionally, a report by Curalate found that 76% of consumers have purchased a product they’ve seen in a social media post.

That’s now encouraging, right?

Yes. Now, let’s take a look at the benefits you’d expect.

Benefits of having a digital presence as a financial modeling consultant

Here are some of the top benefits of having a digital presence:

1. Credibility and trust

An optimized online presence builds credibility and trust.

A well-curated profile and portfolio demonstrate your expertise, experience, and professional achievements, instilling confidence in potential clients that you can deliver high-quality financial modeling services.

2. Effective communication

Being active on social media and maintaining an informative website enables you to communicate with clients effectively.

You can share valuable insights, industry trends, and updates to showcase your knowledge and thought leadership.

3. Networking opportunities

A professional online presence opens doors to networking opportunities.

Connecting with peers, industry professionals, and potential clients can lead to collaborations, referrals, and new business prospects.

4. Showcasing expertise

Your online profiles and portfolios act as a showcase of your expertise.

They allow you to highlight past financial modeling projects, successful case studies, and client testimonials, providing concrete evidence of your capabilities.

One thing that must be clear with you is that, in this case, you’re not tied to a physical job—but working from anywhere.

That means you have to be on the lookout for clients online.

In that case, it’s about something other than having a profile on social media and posting a few times but actively optimizing it for visibility before your prospects.

Let’s take a look in more detail.

Guidance on Optimizing Online Profiles and Portfolios

To make the most of your online presence and attract clients effectively, consider the following tips:

#1. Social media profiles

Use a professional photo and write a compelling headline that showcases your expertise.

Craft a well-written summary highlighting your essential skills, experience, and achievements.

List your relevant work experience, focusing on financial modeling projects and notable accomplishments.

Request recommendations from previous clients or colleagues to build social proof.

#2. Personal website

Create a clean and professional website that reflects your brand and services and optimize it for Search Engines (SEO).

Showcase a portfolio of your financial modeling projects with detailed descriptions of the challenges and outcomes.

Include a blog section to share industry insights and expertise, demonstrating your thought leadership.

Provide clear contact information such as emails and a simple way for potential clients to contact you.

#3. Consistency and engagement

Maintain consistency across all your online profiles to reinforce your professional brand.

Regularly engage with your audience by responding to comments, sharing relevant content, and participating in industry discussions.

#4. Professional content

Share informative content related to financial modeling on social media platforms and your website to position yourself as an industry expert.

Publish articles, whitepapers, or case studies to demonstrate your in-depth knowledge and problem-solving skills.

If you follow the approach I’ve discussed above, you will surely reap significant rewards from social media.

Now that we’ve looked at how to get yourself in front of prospects on social media, it’s time to explore job opportunities.

Navigating Freelancing Market as a Financial Modeling Consultant

Working from Anywhere as a Financial Modeling Consultant requires hard work and dedication to navigate this new world, yet it is full of opportunities.

Navigating the Work-from-Anywhere work market as a financial modeling consultant requires a strategic approach to finding remote opportunities.

You must showcase your expertise and build a successful portfolio presence, especially in freelancing.

Here’s a step-by-step guide to help you navigate the market effectively:

Step 1. Define your niche and expertise

Identify your specific area of expertise within financial modeling.

Determine the industries you want to work with and the projects you excel in.

Focusing on a niche allows you to stand out and attract clients seeking your specialized skills.

Step 2. Explore freelance platforms

In the past, businesses outsourced very few of their tasks to freelancers. Things have changed today; companies hire freelancers to do almost all their duties, and the financial modeling process is no exception.

To put this into perspective, let’s look at some recent statistics about freelancing.

Approximately 1.57 billion people in the global workforce are freelancers.

Worldwide, the total freelance platform market is estimated to be worth $3.39 billion.

Last year, annual earnings by US freelancers grew by $100 million, now totaling $1.3 trillion.

Worldwide, the average freelancer earns $21 per hour.

Over half of freelancers have postgraduate education, up 6% from 2020 to 2021, while freelancing for those with a high school diploma or less declined from 37% to 31%.

By 2027, the global freelance platform market will reach $9.19 billion.

What do all these facts mean?

Freelancing will be the workforce’s future, and businesses are poised to do it. Your future performance as a financial modeling consulting firm depends on informed financial decisions.

Therefore, I can confidently say you have higher chances of securing multiple consultation opportunities as a Financial Modeling Consultant.

You only need to create compelling profiles highlighting your expertise and actively search for relevant projects or bid on job postings.

Best Freelance Platforms for Financial Modeling Consultants

Let’s look at some freelance platforms where you can find job opportunities as a Financial Modeling Consultant.

#1. Upwork

#2. Freelancer

#3. Toptal

#4. Paro

#5. Truelancer

Above are some freelancing sites worth exploring for other financial modeling consulting services roles. But that’s not all. It is essential to do more background research to identify more opportunities.

Now that we’ve looked at some freelance platforms available, it is time to learn how to move the needle.

Getting Freelancing Financial Modeling Consulting Clients

Networking and reaching out to potential clients globally as a financial modeling consultant can significantly enhance your chances of securing remote projects. You can become one of the successful financial modeling consulting firms by building your own client base.

Provide specialized financial modeling services by creating reliable financial models.

Here are effective strategies for networking through freelance marketplaces and direct client outreach that you can use:

1. Optimize your online presence

Ensure your profiles on freelance marketplaces like Upwork, Freelancer, and LinkedIn are complete and showcase your expertise.

Use a professional photo, write compelling headlines, and craft engaging summaries highlighting your financial modeling skills and experience.

2. Use specialized keywords

When creating your profile and bidding on projects, use relevant keywords that potential clients might search for when looking for financial modeling consultants.

It will improve your visibility and increase the chances of being discovered by the right clients.

3. Create a strong portfolio.

Build an impressive portfolio showcasing your past financial modeling projects.

Include case studies, before-and-after scenarios, and detailed descriptions of your contributions.

A well-curated portfolio demonstrates your capabilities and adds credibility to your profile.

4. Personalize your outreach

Personalize your messages when reaching out to potential clients directly or bidding on projects.

Show that you’ve researched their business and understand their specific needs.

Tailor your proposal to address their pain points and demonstrate how your expertise can provide solutions.

5. Network on social media

Engage with financial professionals and potential clients on social media platforms like LinkedIn, Twitter, and Facebook.

Participate in industry groups, share valuable content, and join relevant discussions to expand your network.

6. Attend virtual networking events

Participate in virtual networking events, webinars, and finance and financial modeling conferences.

These events offer excellent opportunities to connect with industry professionals and potential clients worldwide.

7. Offer free webinars or workshops

Organize free webinars or workshops on financial modeling topics and invite your target audience.

Providing valuable content for free can attract potential clients and position you as an industry expert.

8. Leverage your existing network

Reach out to your current contacts, colleagues, and past clients.

Tell them about your freelance financial modeling work availability and ask for referrals or recommendations.

9. Be responsive and professional

When potential clients reach out to you, respond promptly and professionally.

Demonstrate your reliability and commitment to providing excellent service.

10. Follow up strategically

Be encouraged if you hear back from a potential client initially.

Follow up strategically, demonstrating your continued interest and availability to discuss their financial modeling needs.

11. Offer value first

When networking or reaching out to potential clients, focus on providing value first.

Offer insights, tips, or resources related to financial modeling without immediately pitching your services.

Building a relationship based on trust and value can lead to more meaningful client connections.

In the next section, I’ll briefly mention how you can build a never-ending client base.

Building a Reliable Client Base as a Financial Modeling Consultant

Building a reliable client base as a Financial Modeling Consultant involves targeting specific industries or niches to differentiate yourself in the market.

Here’s how you can tailor your services to stand out and attract clients:

1. Identify your target industries or niches

Research and identify industries or niches that align with your expertise and interests.

Consider your past experience, knowledge, and the industries where your financial modeling skills can make the most significant impact.

2. Understand industry-specific needs

Once you’ve identified your target industries or niches, thoroughly understand their unique financial modeling needs and challenges.

Familiarize yourself with the specific financial metrics, regulatory requirements, and key performance indicators (KPIs) relevant to each industry.

3. Showcase industry-relevant experience

Highlight your experience in working with clients or projects within your chosen industries.

Emphasize how your financial modeling solutions have helped businesses in these sectors make informed decisions and achieve their goals.

4. Customize your offerings

Tailor your financial modeling services to address clients’ specific pain points and objectives in your target industries.

Offer customized solutions that align with the financial modeling needs of businesses within these sectors.

5. Develop case studies and success stories

Create case studies and success stories showcasing your successful financial modeling projects in each industry.

Demonstrating tangible results and positive outcomes will inspire confidence in potential clients seeking expertise in their sector.

6. Offer industry-specific insights

Share valuable industry-specific insights through blogs, articles, or webinars.

Providing valuable content will position you as an authority in your chosen industries, attracting clients seeking specialized knowledge.

7. Collaborate with industry experts

Collaborate with professionals and experts within your target industries.

Joint projects or partnerships such as podcasts can help you gain credibility and access a broader client base in those sectors.

8. Showcase relevant certifications

Do you remember the certifications we talked about earlier on? Obtaining certificates or training relevant to your target industries can help you stand out.

Certifications in specific financial domains can enhance your credibility and demonstrate your commitment to staying updated in your chosen fields.

9. Provide exceptional client service

Consistently deliver exceptional service to your clients in your target industries.

Positive word-of-mouth referrals from satisfied clients can be a powerful marketing tool within specific industries.

Now, you’re fully equipped with relevant skills to remain abreast in your journey as a Financial Modeling Consultant.

But there is one thing: if you get a project to carry out on behalf of your clients, how will you ensure you finish the project in time and communicate efficiently throughout the process?

More in the next section.

Financial Modeling Consultant- Client Communication and Project Management

As a Financial Modeling Consultant working remotely, effective client communication and project management are vital to ensuring successful outcomes and maintaining strong client relationships.

Here are some best practices to achieve both:

1. Clear and timely communication

Respond promptly to client inquiries, whether it’s through email, messaging platforms, or video calls. Avoid delays in communication, as timely responses build trust and show your commitment to the project.

Be clear and concise in your communications, avoiding technical jargon when explaining financial concepts.

Ensure that your messages are easily understandable by clients who may need a financial background.

2. Establish clear expectations

Set clear expectations with your clients at the beginning of the project. Outline the scope of work, deliverables, timelines, and any potential challenges during the project.

Provide regular progress updates to inform clients about the project’s status and any adjustments to the timeline or scope.

3. Utilize project management tools

Implement project management tools to track tasks, deadlines, and milestones. Tools like Trello, Asana, or Monday.com can help you stay organized and ensure nothing falls through the cracks.

4. Break down the project into milestones

Divide the project into smaller, manageable milestones. This approach allows you and your client to monitor progress and provides opportunities for feedback and adjustments as needed.

5. Agile approach for adaptability

In financial modeling, clients’ needs or market conditions may change, and being able to adjust the project plan accordingly is essential.

Adopt an agile project management approach that allows for flexibility and adaptability.

6. Set realistic deadlines

Set realistic deadlines that take into account potential challenges or unforeseen delays.

Avoid overpromising and under-delivering, as meeting deadlines is crucial for client satisfaction.

7. Regular check-ins

Schedule regular check-in meetings with your clients to discuss progress, address concerns, and provide updates. These meetings foster collaboration and ensure everyone is on the same page.

8. Document everything

Maintain clear documentation of the project’s progress, decisions made, and changes requested.

This documentation helps avoid misunderstandings and provides a reference point for future discussions.

9. Manage client expectations

Be proactive in managing client expectations.

If a deadline is at risk of not being met, communicate this early on and propose a revised timeline or solution.

10. Quality assurance

Prioritize quality in your deliverables. Thoroughly review your financial models and analyses to ensure accuracy and reliability.

Credibility is the currency for long-term business growth.

Credibility can take you months, if not years, to build.

Creating meaningful interactions takes time, but it will ensure long-term gains, often exponentially.

So, be sure to work on yourself to meet the current industry standards for long-term success in your business.

Let’s now talk about how to price your services as a consultant.

Pricing Your Services as a Financial Modeling Consultant

As a Financial Modeling Consultant, pricing your services appropriately is essential to ensure fair compensation for your expertise and to attract potential clients.

Here’s a step-by-step guide to help you determine your consulting rates and understand different pricing models:

Step 1: Assess your experience and expertise

Consider your experience, education, certifications, and past successful projects.

This is because consultants with extensive experience and a strong track record may command higher rates than those just starting in the field.

Step 2: Evaluate the complexity of the projects

Assess the complexity of the financial modeling projects you typically handle.

For example, projects that require specialized knowledge, in-depth analysis, and complex financial modeling may justify higher rates.

Step 3: Research market demand

Research the market demand for Financial Modeling Consultants in your niche or target industries.

Determine the average rates charged by other consultants for private companies and firms with similar qualifications and experience.

Step 4: Calculate your desired income

Decide your desired annual income, considering your living expenses, business costs, and financial goals.

Desired Annual Income = (Living Expenses + Business Costs + Financial Goals)

Divide this figure by the billable hours you plan to work yearly to get your target hourly rate.

Target Hourly Rate = Desired Annual Income ÷ Number of Billable Hours per Year

Step 5: Consider overhead and business expenses

When setting your consulting rates, factor in any overhead costs and business expenses, such as software licenses, marketing, and insurance.

Step 6: Determine your billing method

Choose between billing hourly, project-based, or retainer-based rates. Each method has its pros and cons:

Hourly rates:

Pros: Hourly rates are straightforward and easy to track. Clients pay for the actual time spent on their projects.

Cons: Clients may be concerned about the unpredictability of costs, and they might try to limit billable hours.

Project-based rates:

Pros: Project-based rates clarify the total cost, which can appeal to clients. You are compensated for the value delivered rather than the time spent.

Cons: Estimating project scope accurately can be challenging, and unforeseen complexities might lead to scope creep.

Retainer-based rates:

Pros: Retainers provide a stable income stream and foster long-term client relationships.

Cons: Clients may hesitate to commit to ongoing retainers without a proven track record.

Step 7: Offer tiered pricing (optional)

Consider offering tiered pricing with different service levels to cater to various client needs. This allows clients to choose the level of service that aligns with their budget and requirements.

Step 8: Be transparent and negotiate thoughtfully

Be transparent about your rates with potential clients, and justify your pricing based on your expertise and the value you bring to their projects.

If needed, be open to negotiating your rates thoughtfully to accommodate the client’s budget while ensuring your services are fairly compensated.

In the next section, I open another chapter—of inspiring success stories and testimonials.

Finance Modeling Consultant- Success Stories and Testimonials

Let’s look at some top success stories from consultants like you who have made a significant impact through freelancing and Working from Anywhere.

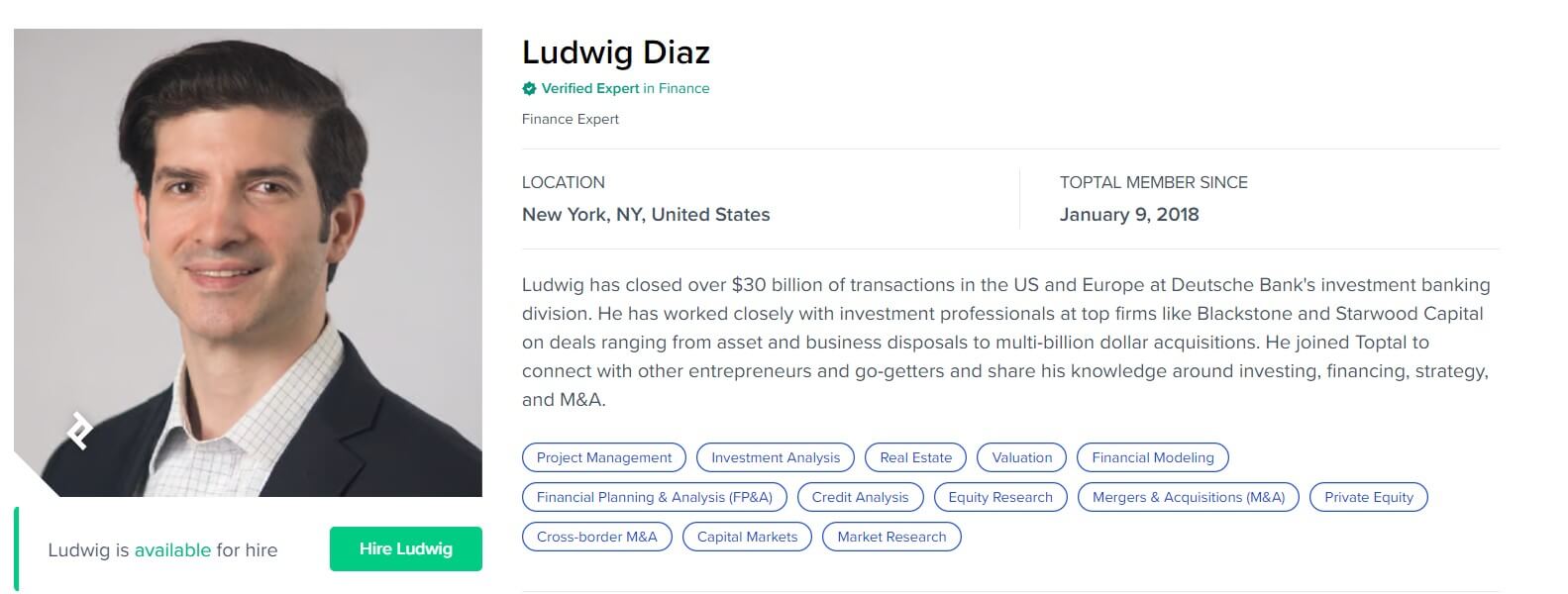

1. Ludwig Diaz

Location: New York, NY, United States

Ludwig has closed a record transaction of over $30 billion in the US and Europe at Deutsche Bank’s investment banking division. He has also worked with top firms like Blackstone and Starwood Capital on deals related to asset and business disposals and multi-billion dollar acquisitions.

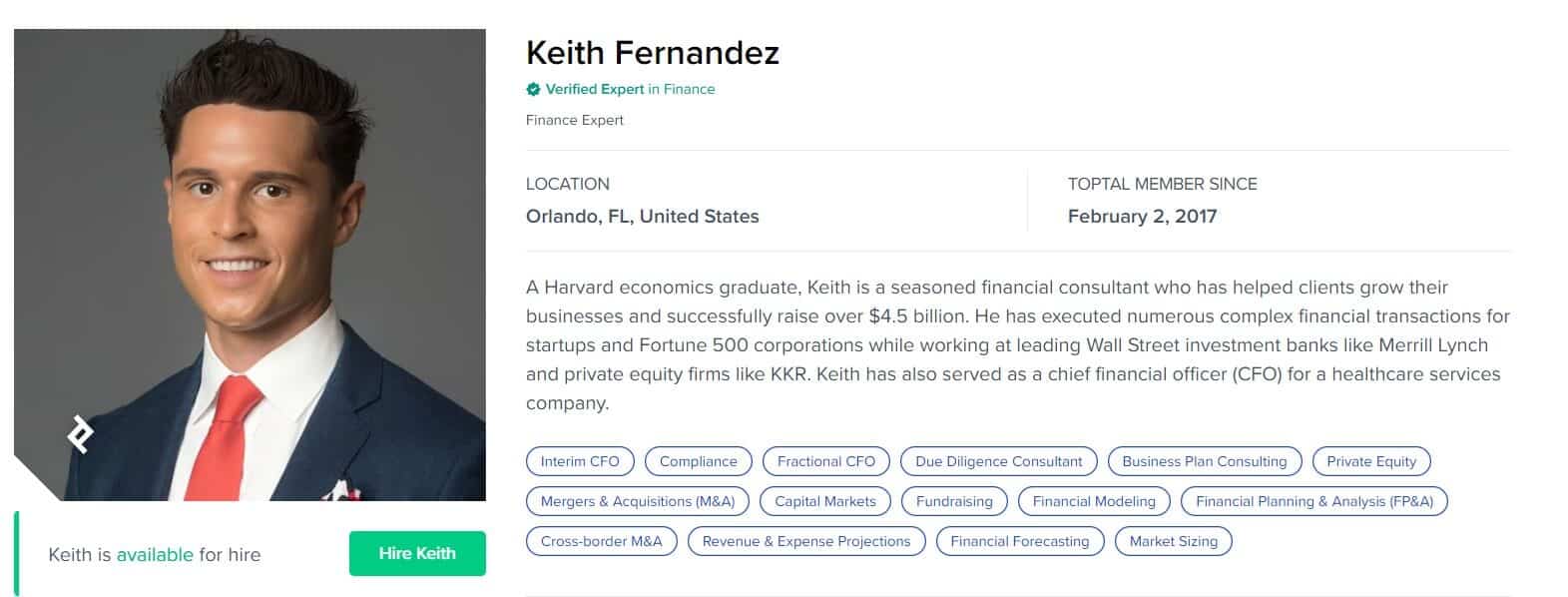

2. Keith Fernandez

Location: Orlando, FL, United States

Keith is a Harvard economics graduate, former chief financial officer (CFO) for a healthcare services company, and a seasoned financial consultant who has helped clients grow their businesses and raise over $4.5 billion. He has also executed numerous complex financial transactions for startups and Fortune 500 corporations while working at leading Wall Street investment banks like Merrill Lynch and private equity firms like KKR.

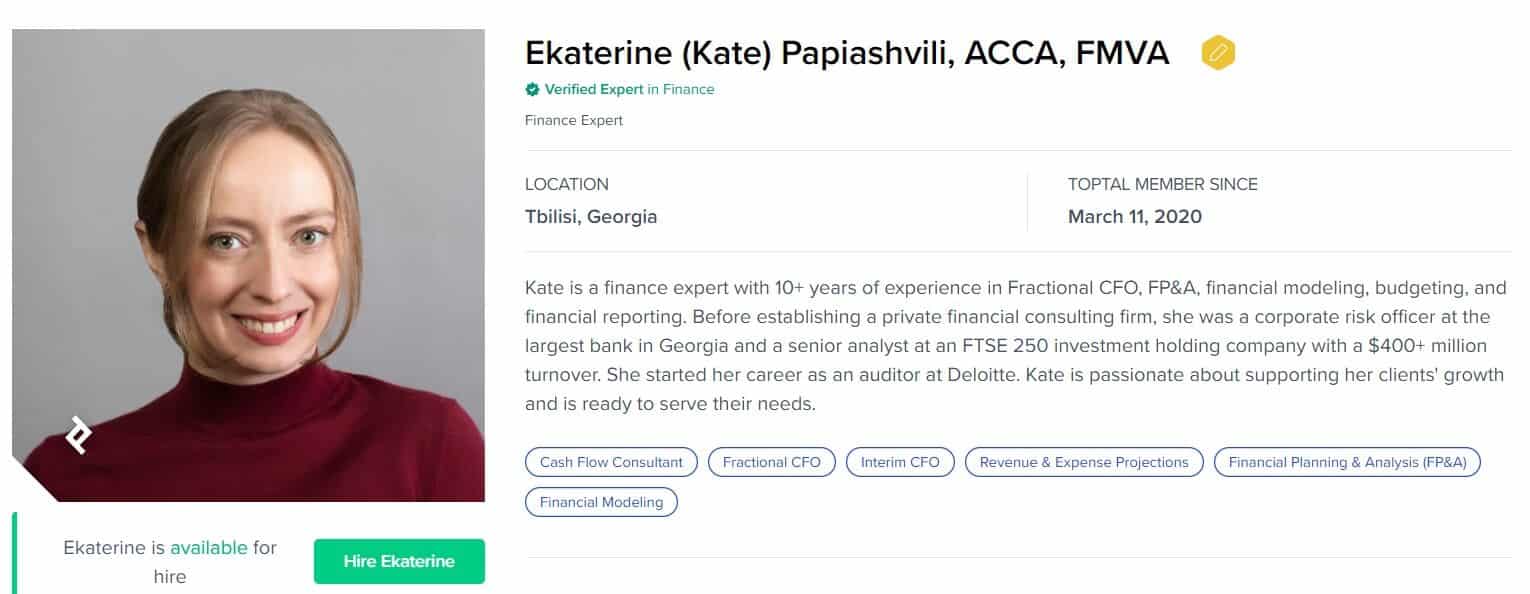

3. Ekaterine (Kate) Papiashvili, ACCA, FMVA

Location: Tbilisi, Georgia

Kate is a finance expert with 10+ years of experience in FP&A, financial modeling, budgeting, financial reporting, and financial and risk management both. She started her career as an auditor at Deloitte, worked as a corporate risk officer at the largest bank in Georgia, and as a senior analyst at an FTSE 250 investment holding company with a $400+ million turnover before establishing a private financial consulting firm.

4. Hennie Fourie

Location: Windhoek, Namibia

Hennie is a qualified CA with a strong background in operational finance, valuations, and various debt and equity transactions. He has been involved in transactions in multiple industries, including an equity transaction by Nedbank in PayToday, Namibia’s first fintech startup.

5. Dhruv Tandan

Location: Hyderabad, Telangana, India

Dhruv has an MBA in finance with more than a decade of experience. He has worked on successful fundraisers and consulting projects worth over $1 billion, focusing on energy, tech, food, and life science projects across Asia, the US, and Africa. He has experience in startup consulting, process improvement, M&A, and project finance.

From the success stories above, one thing is clear—the consultants made their success because of hard work and their outgoing nature.

If you follow the same suit, soon, we’ll be writing about you in top publications, so go for it.

To boost your career path, in the next section, I will give you some inspiring resources and tools to use if you genuinely want to stand out in the ever-dynamic financial world.

Financial Modeling Consultant Career – Frequently Asked Questions

1. How do I handle time zone differences with clients from various parts of the world?

To handle time zone differences, establish precise communication schedules with clients, use scheduling tools like World Time Buddy, and be flexible with your availability to accommodate client meetings.

2. How do I assess the market demand for financial modeling services in specific industries or niches?

Assess market demand by researching industry trends, talking to industry experts, and monitoring job postings or projects in your chosen industries or niches.

3. What strategies can I implement slow business or client acquisition in the financial modeling consulting?

During slow periods, focus on marketing efforts, expand your network, and invest in professional development to stay competitive and attract new clients.

My Exclusive Insights for You

Congratulations on completing this comprehensive guide to becoming a Financial Modeling Consultant in the Work-from-Anywhere model!

You’ve invested much of your time, and the guide is worth it.

You now have the tools, knowledge, and strategies to embark on a flexible, rewarding career path. Embrace the freedom to Work from Anywhere, serving clients globally and making a real impact in their financial decision-making.

As you take the first step towards success, consider harnessing the power of Inner GPS Career Coaching to guide you further on this exciting journey.

Start by identifying your niche, honing your skills through certifications and courses, and building a solid online presence to showcase your expertise.

Embrace challenges as opportunities to grow, learn, and stay connected with peers and industry experts to foster collaboration and support.

As you navigate the financial modeling consulting world, always prioritize clear communication, set realistic expectations, and deliver exceptional service to your clients. I encourage you to continuously learn and adapt to stay ahead in this dynamic field.

Believe in your abilities, be proactive in pursuing opportunities, and never underestimate the value you bring.

Your unique skills as a Financial Modeling Consultant can shape the success of businesses and industries worldwide.

So, take that first step towards the fulfilling and flexible career you dream of.

Seize the opportunities before you, and make your mark as a trusted and sought-after Financial Modeling Consultant.

Your journey awaits, and the world is ready for your expertise!