Do you want to become a Private Equity Consultant but need to know- How?

Here is my solution for you:

You can become a Private Equity Consultant with a solid educational background in finance, economics, or related fields and relevant work experience in investment banking, consulting, or finance roles.

To succeed as a Private Equity Consultant, you need networking skills within the industry and demonstrate prowess in financial analysis, due diligence, strategy, and deal structuring.

While that all sounds great:

Where do you start?

How can you effectively build a Private Equity Consulting career strategy that drives revenue?

In this guide, you will learn to become a “Freelancer Private Equity Consultant” and know how to make money in this career in the digital space.

It’s no longer a secret that the digital transformation space is one of the best places to reach your target audience.

But how can you effectively find, communicate with, and close deals with your most– Private Equity clients and consulting customers through digital transformation?

Do you want to learn the dealmaking journey? The answer is in this guide.

How to Become a Private Equity Consultant?

Let’s have an intelligent overview of the steps to become a freelancer Private Equity Consultants:

Practical Steps to Be a Private Equity Consultant

| Steps | Action Plan | Descriptions |

| Step 1 | Educational background and certifications | A finance or business administration degree and certifications like Chartered Financial Analyst (CFA) and specialized Private Equity courses can enhance your credibility. |

| Step 2 | Essential skills and qualifications | Develop financial analysis, deal sourcing, valuation, communication, industry expertise, and problem-solving skills to excel in this role. |

| Step 3 | Networking and building relationships | Effective networking and relationship-building are crucial for attracting clients and opportunities. |

| Step 4 | Setting up your remote office | Create an environment that fosters efficiency and work-life balance. |

| Step 5 | Finding clients and projects | Leverage platforms like Toptal, Upwork, Fiverr, and Freelancer to connect with potential clients and projects. |

| Step 6 | Crafting proposals and pitches | Tailor your proposals and pitches to highlight your expertise and demonstrate the value you can provide. |

| Step 7 | Getting hired | Utilize freelancing platforms and networking strategies to secure consulting projects. |

| Step 8 | Delivering value | Understand client needs, conduct due diligence, and provide actionable insights to deliver value consistently. |

| Step 9 | Market research and financial analysis | Thorough market research and financial analysis are essential for making informed investment recommendations. |

| Step10 | Challenges and opportunities | Embrace the growing demand for Private Equity Consultants and leverage your expertise across various sectors and regions. |

You will learn about the detailed steps in the next segment.

But before moving into that, understand the private equity firms, industry insights, and your role as a Private Equity Consultant in a PE firm first.

Private Equity Firms and Industry Insights

Alright, let’s start with an overview of the Private Equity industry. It’s all about investing in private companies, not public companies.

These are companies that are not publicly traded on the stock exchange.

Over the recent decades, PE firms have broadened their business scope, transitioning beyond their traditional focus on leveraged buyouts.

They have ventured into venture capital funding, angel investing strategies, and turnaround initiatives.

What’s the goal? To buy, grow, and then sell those companies at a profit.

In this game, private equity (PE) firms play a vital role by spotting investment potential, thoroughly researching target companies, and orchestrating acquisitions for ownership stakes.

PE engagement covers a range of actions, including discovering promising portfolio companies, conducting thorough due diligence, enhancing value within these companies, and offering exit support.

They secure hedge funds from notable institutional investors such as pension funds and wealthy individuals. With these funds, they purchase ownership stakes in private portfolio companies. These firms oversee the raised funds and determine where to invest.

Private Equity Consultants’ Role in PE Firms

As a Private Equity Consultant, you play a vital role by offering strategic advice to Private Equity firms and their portfolio companies.

You will provide industry acumen, resources, and guidance to align management with private equity strategic priorities, enhance operations, foster growth, and boost the overall portfolio company’s value.

Your involvement aims to maximize value within a specific investment timeframe, typically 4 to 7 years, ultimately leading to profitable stake sales.

As a consultant within the private equity sector specializing in functional and management team proficiencies, your expertise encompasses various management team aspects within the field. These include:

- Deal sourcing

- Due diligence on target companies

- Analyzing financials

- Market trends

- Competition

- Valuation

- Post-investment management

Private Equity Consultant’s Functions and Roles

In a PE firm, you function as a covert asset for the firm’s portfolio companies, wielding a unique arsenal of skills and functional expertise.

Your role as a team encompasses the following:

Precise opportunity detection: Your specialized mastery enables you to uncover lucrative investment prospects precisely.

Risk appraisal: You skillfully analyze potential pitfalls, ensuring that investment choices are informed and cautious.

Flawless Execution: You mobilize seamless transactions, providing that deals are consummated successfully.

But your influence on private companies extends beyond this.

As a top PE firm and expert, you also furnish invaluable support to your portfolio company and public companies.

You cultivate growth strategies, refine operations, and enhance the portfolio company PE firm’s allure to potential future buyers.

In this capacity, your contribution to the PE firm, the entire team, the firm’s portfolio companies, and the sector is immeasurable. Your absence would make identifying opportunities and maneuvering the intricate investment landscape significantly more arduous for your PE clients and firms.

How Much Does a Private Equity Consultant Make?

As the Private Equity Market is projected to grow at a CAGR of over 10% during the forecast period (2023-2028), the demand for skilled private equity consultants is rising.

As the industry experiences significant growth, PE firms increasingly seek an entire team of expert professionals to help them navigate the dynamic and complex market landscape.

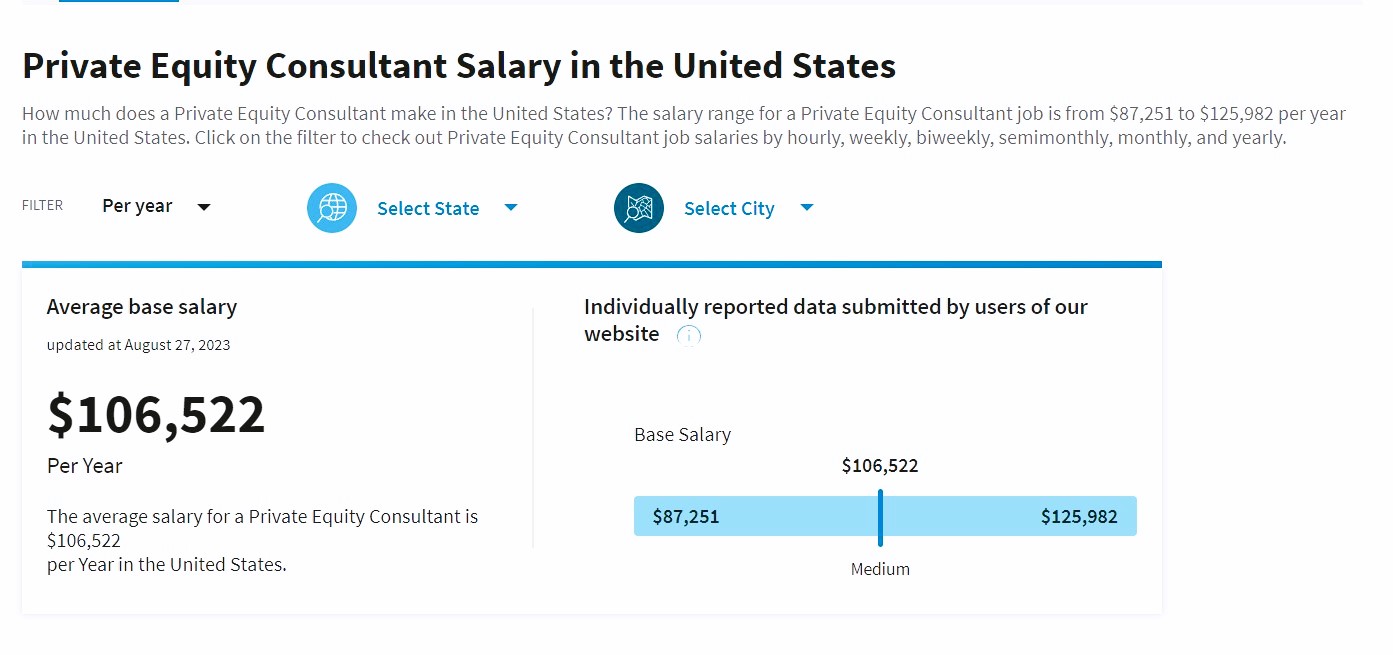

According to salary.com, the salary range for a Private Equity Consultant job in the United States is from $87,251 to $125,982 annually.

In 2023, this expansion process is fueled by the following factors:

- Increased investor interest in private markets

- Favorable regulatory environments and

- The availability of ample capital

As a freelancer, this presents an excellent opportunity to tap into the expanding market and offer your professional value from anywhere in the world.

Now, you can collaborate with firms PE clients and companies across the globe without being bound by physical location.

Practical Action Steps to Be a Freelancer Private Equity Consultant

Let’s explore the step-by-step action plan to become a Private Equity Consultant.

Step 1. Educational background and certifications

While there is no specific educational or career path for becoming a Private Equity Consultant, specific backgrounds and certifications can enhance credibility:

Finance or business degree: You need a bachelor’s or master’s degree in finance, business administration, or a related field to have a solid academic foundation in PE.

Chartered Financial Analyst (CFA): Earning a CFA designation demonstrates your mettle in financial analysis, investment management, and portfolio strategy, which are highly relevant to private equity.

- Private equity courses: Completing specialized courses focused on PE, such as BIWS, can provide valuable knowledge and practical insights.

If you want more curriculum-based courses, here are my exclusive suggestions:

1. Private Equity and Venture Capital – The Wharton School, University of Pennsylvania: This online course delves into PE and venture capital principles, valuation techniques, and deal structuring.

2. Masterclass in Private Equity (London Business School): This course covers various aspects of private equity and mergers and acquisitions, including deal sourcing and value creation, which are essential for your PE Consultant career.

Suppose you want to learn more about your academic qualifications to pursue a PE or career path.

In that case, I recommend you read the following articles:

Step 2. Essential skills and qualifications

Specific skills and qualifications are essential to becoming a successful freelancer Private Equity Consultant. They include:

Financial analysis: You need a solid financial analysis foundation, a fundamental tenet for evaluating potential investments, conducting due diligence, and understanding a company’s financial health.

Deal sourcing: Identifying and sourcing attractive investment opportunities is vital. It would be best to be adept at market research and networking as a consultant to discover potential deals.

Valuation knowledge: Understanding valuation methods such as Discounted Cash Flow (DCF) Analysis and Leveraged Buyout (LBO) Analysis and accurately assessing the value of target companies is vital for you to make informed investment decisions.

Communication skills: As a consultant, you must communicate complex financial concepts and recommendations effectively to customers and stakeholders. You can avoid jargon and use visual aids where necessary.

Industry expertise: You must stay up-to-date with trends, regulations, and sector developments to provide valuable insights to your customers and inform data-driven decisions.

Problem-solving skills: You need the ability to think critically and find creative solutions to portfolio companies’ challenges, which is highly valuable.

Step 3. Importance of networking and building relationships

As a freelancer, networking and relationship-building are crucial for Private Equity Consultant future success.

Here are some of the tips you can leverage through networking:

Networking for opportunities: Connect with potential customers, investors, and partners by participating in events and online platforms, leading to valuable opportunities.

Trust and reputation building: Deliver high-quality work, exceed client expectations, and share success stories to build trust and enhance your industry reputation.

Insights and market knowledge: To make informed investment decisions and identify emerging opportunities, stay informed about market trends through networking.

Collaborative growth: Partner with professionals from different fields for innovative growth, offering comprehensive services to customers and reaching new audiences.

Niche specialization: Focus on specific finance niches aligned with your talent to become a recognized authority and attract customers seeking specialized knowledge.

Virtual networking: Engage in online forums and webinars for global insights, connecting with professionals worldwide.

Reciprocal relationships: Offer assistance, share knowledge, and provide value to foster stronger relationships and position yourself as a helpful contact.

Long-term approach: Invest time cultivating lasting relationships, understanding that networking’s benefits might take time to materialize.

Soft skills matter: Develop interpersonal skills, active listening, and empathy to forge deeper connections beyond superficial interactions.

That is the secret sauce to getting into Private Equity Consultation as a freelancer. Let’s look at what it takes to have an office anywhere.

Step 4: Setting your office

Let’s be upfront.

Setting up your remote office as a frrelancer Private Equity Consultant working from anywhere can be challenging.

But you don’t have to go for it alone.

In this section, I’ll provide tips you can follow immediately.

Private Equity Consultant Office Setup

| S. No. | Ideas | Action Plan |

| 1. | Creating a productive workspace | Find a quiet and comfortable spot in your home with good lighting and minimal distractions. Invest in a quality desk and ergonomic chair to support your posture and overall well-being. Keep your workspace clutter-free and away from high-traffic areas.Invest in proper lighting for a comfortable working environment. |

| 2. | Choosing the right tools for communication and collaboration | Select a reliable video conferencing platform for virtual meetings with clients and team members. Utilize project management tools to track various project tasks, deadlines, and progress. Invest in cloud storage and file-sharing solutions to access and share documents securely. |

| 3. | Mastering time management for remote work | Set daily or weekly goals to stay focused and organized with your work tasks.Use time-blocking techniques to focus on essential projects and allocate time for breaks. Concentrate on one task at a time to increase productivity. Communicate with family and friends about your work hours to minimize interruptions. Use time-tracking tools to monitor your productivity and identify areas for improvement. Schedule regular breaks to recharge and avoid burnout during long work hours. |

| 4. | Maintaining a healthy work-life balance | Set precise work hours and stick to them to prevent overworking. Designate a separate space for work and avoid mixing personal activities during work hours. Incorporate regular physical activity into your routine to reduce stress and improve focus. |

The goal is to find what works best for you and adapt your remote office operations strategy, management, and support setup to create an environment that fosters employee business efficiency and work-life harmony.

If you do that, you can be sure of a successful working relationship with employees serving businesses and your customers.

And with that, let’s find out how to find customers as a remote Private Equity Consultant.

Step 5: Finding clients and projects

As a freelancer Private Equity Consultant, finding customers and projects is essential to growing your consulting business.

Here are some first-hand strategies to help you successfully prospect and attract institutional investors, PE customers themselves, and potential risks in the private equity sector:

Tap your network: Contact connections, colleagues, and peers for potential consulting gigs. Utilize your network to uncover opportunities in private equity, enhancing your reputation and referrals.

Specialize: Focus on a niche within PE, like healthcare investments. Become an expert in that area to stand out and attract customers seeking specialized guidance.

Share insights: Develop content such as blogs and videos showcasing your dynamism. Regularly share these on your site and LinkedIn, positioning yourself as a thought leader. Clients will be drawn to your problem-solving skills.

Showcase success: Collect and display client testimonials on your website or LinkedIn. These endorsements amplify your credibility, enticing new clients to seek your strategic advice.

Step 7: Crafting practical proposals and pitches

Crafting practical proposals and pitches to win consulting clients and projects is how you package and present yourself to them.

Since most potential customers want to see your value, here are some tips you can follow in your pitches.

Tailored approach: Create proposals that fit clients’ needs. For a private equity firm eyeing tech, customize your plan using past tech successes. It gets their attention and wins projects.

Show impact: To win a supply chain consulting gig, prove past gains. Outline cost savings and efficiencies from similar jobs. Numbers speak, convincing the client of your value.

Compelling stories: Craft clear, story-driven proposals. Are you pitching to a PE firm for consumer goods expansion? Share success stories in simple terms. Showcase growth after your guidance.

Your storytelling leadership approach will convey your wisdom and persuade potential customers to engage your complete services management team for their business venture.

So, where will you put talent to be hired? More in the following section.

Step 8: Getting hired

In addition to your company having more significant impact, influence, leverage, and increased accountability to investors, you’ll work with and support a broad range of businesses on a deep level in private equity.

Source: salary.com

However, they won’t all be high-growth businesses and initial public offerings (IPOs) engaged in new markets.

I know you’ve been patiently waiting for this section.

Here are some of the freelancing sites where you can get hired as a PE Consultant:

1. Toptal

2. Upwork

3. Freelancer

It would help if you leveraged the freelancing support sites above and the tips and business strategies I gave you earlier in this guide. In that case, you’ll be able to break into success easily.

Let’s look at a strategy and process for consistently delivering client results.

Step 9: Delivering value

Delivering value as a professional involves a comprehensive approach that begins with understanding client needs, conducting due diligence, and culminates in providing actionable insights and building long-term client relationships.

This section is the foundation of delivering pure-gold value to your clients. Let’s take a look.

To provide exceptional value and support to your customers serving clients, follow this foundational approach:

Understand client needs: Discuss client goals, risk tolerance, and interests. For example, a client keen on renewable energy investments seeks guidance.

Conduct due diligence: Thoroughly investigate investment possibilities. Analyze financials, market trends, competition, and growth potential. For instance, evaluating a healthcare target involves assessing revenue growth, market share, and regulations.

Develop recommendations: Craft well-founded investment suggestions considering risk tolerance and portfolio strategy. Present a detailed report explaining your reasoning and potential risks. For example, advise acquiring a tech firm due to strong market presence and growth potential.

Step 10: Market research and financial analysis

Market research is the backbone of operations of a PE firm, analysis, technical priorities, and decision-making.

Therefore, you must grasp the concept of delivering quality client work.

Market research: To provide valuable insights, conduct thorough market research to identify emerging trends and potential disruptors. Utilize reports, economic data, and competitor analysis to support your recommendations—for instance, research consumer behavior and growth forecasts when advising clients on entering the e-commerce market.

Financial analysis: To evaluate investment viability, perform detailed financial analysis, including revenue projections, cost analysis, and financial modeling. Utilize valuation methods like DCF or CCA to determine the intrinsic value of potential investments. For example, when analyzing a potential acquisition target, perform a DCF analysis to estimate its future cash flows.

Private Equity Consultants – Growing Demand

Unlike in the past, today, the growing demand for Private Equity firms continues as a flourishing consulting industry, driven by various factors:

A PE firm seeks consultants’ insights to identify lucrative investment opportunities and make data-driven decisions.

With the market’s rapid growth, the need for specialized knowledge and strategic guidance has become more crucial than ever.

As PE investments span diverse fields and geographies, firms require consultants who understand different sectors’ unique challenges and opportunities.

Your ability to provide targeted advice to specific industries or regions can give you a competitive advantage as a freelancer.

Let me put that into perspective.

According to recent studies, Asia is estimated to be the fastest-growing region in Private Equity, with the highest CAGR over the forecast period (2023-2028).

Yet, North America accounts for the largest market share in the PE Market.

Source: Mordor Intelligence

So what does all that mean?

It’s increasingly becoming more accessible and necessary for PE Consultants like you in Asia and North America to work together and exchange ideas and growth concepts.

At the end of the day? There is a surge in demand for PE consultants (particularly mobile experts available for consultation across the time zones) from both regions.

And who are they? Those who choose to embrace digital nomadism today.

Sounds interesting? Yes. Let me take you through a quick way to build your foundation for success in the next section.

Private Equity Consultants’ Success Stories and Testimonials

In this section, I’ll highlight the company with top talent- PE professionals working as freelancers and their success stories.

1. PE Management Consulting Expert, WA, US

| Private Equity Consultant | Location | Profile |

| 1. Anuar Heberlein | USA | Anuar, with an MBA from INSEAD and a B.Sc. in economics from ITAM, brings over 15 years of leadership experience leading 100+ projects for diverse Fortune 500 firms and startups. He’s the founder partner of STRATYGIKA, an international strategy consulting boutique company focused on go-to-market strategies, led by ex-consultants from Bain & McKinsey. |

2. PE Finance Expert OH, US

| Private Equity Consultant | Location | Profile |

| 2. Marc Howland | USA | Marc, a distinguished graduate of Harvard Business School, holds a prestigious background as an investment banker at Goldman Sachs and a private equity investor at The Carlyle Group. He has successfully managed over $70 billion for private equity clients in global M&A and financing deals across various industries, including technology, media, telecom, infrastructure, and sports facilities. |

3. PE Finance Expert NY, US

| Private Equity Consultant | Location | Profile |

| 3. Bertrand Deleuse | USA | Bertrand is a seasoned finance professional with 25 years of experience in M&A, corporate development, venture capital, growth strategies, project development, and financing. He has a comprehensive background as an investment banker, venture capital funding advisor, project developer, CFO, and expert witness consultant in international arbitrations. He has played a key role in 100+ transactions and investment projects, amounting to a combined value of $16 billion. |

4. PE Management Consulting Expert, Israel

| Private Equity Consultant | Location | Profile |

| 4. Gavin Glick | Israel | Gavin is a freelance financial expert specializing in optimizing acquisition costs, ROI, and sales for B2C and B2B mobile commerce through data analysis, business modeling, and custom KPI dashboards. |

5. PE Management Consulting Expert, US

| Private Equity Consultant | Location | Profile |

| 5. Sergio de Fuccio Oliveira | USA | GSergio, an MBA graduate from Kellogg at Northwestern University, specialized in strategy, finance, analytical consulting, decision sciences, and marketing. He focuses on assisting portfolio companies of private equity firms, leveraging his background as a former Bain & Company consultant. He also has a history of freelancing after his previous startup venture. |

This brings us near the conclusion of the Private Equity Consultant Practical Action Guide.

Frequently Asked Questions:

Do PE Consultants work independently or with consulting firms?

As Private Equity Consultants, you can work independently with private equity by establishing your consulting firms or investment banks or freelancing. You can also partner with or partner in established private equity consulting firms or investment banks that specialize in providing advisory services to private equity clients.

What is the average compensation for Private Equity Consultants?

The average compensation for Private Equity Consultants varies widely depending on experience, specialization, and project complexity. Compensation can range from hourly rates for short-term projects to retainer-based or success-based fees for long-term engagements. I suggest you to remain updated with the PE industry norms.

What challenges do PE Consultants face while working remotely?

Remote work can pose many challenges and benefits for PE Consultants, including maintaining effective communication with clients and team members across different time zones, ensuring data security and confidentiality, and managing complex deal collaborations and due diligence processes.

What are the key trends and developments shaping PE Consulting?

Critical trends in PE Consulting include a heightened focus on ESG considerations in investment decisions, the adoption of technology-driven data analytics for due diligence, and the need for international competence and cultural understanding due to the rise in cross-border deals.

What are the typical engagement durations for Private Equity Consulting projects?

The duration of Private Equity Consulting projects varies based on the specific engagement. Short-term projects like deal evaluations might last several weeks. At the same time, long-term roles such as advisory, leadership, top management, portfolio company, and management teams could extend over several months or even years.

Let’s summarize this discussion with my final thoughts on this guide.

My Exclusive Insights for You- “Is Private Equity Consultants Career Right for Me”?

After reading this guide, you must know how to build your freelancer Private Equity Consultant career today.

Times are changing. Gone are the days when you had to wait until you got hired by a consulting portfolio company to start your career journey.

Now, you can master the art of Private Equity firms, capture attention, close deals with PE firms, and serve private equity customers through the digital space.

It was a brief, helpful guide for anyone venturing into a Private Equity Consulting career, with practical action guides to working from anywhere.

Before starting your career journey, remember the importance of soul-searching through your Inner GPS. Understanding your passions, strengths, and goals will guide you toward a fulfilling and successful path.

If you need help in this self-discovery process, sign up for our Inner GPS Career Coaching, where Coach Sanju will help you identify your true calling and forge a rewarding career trajectory.

Now is the time to take action! With valuable insights and practical tips, start building your Private Equity Consultant career in the work-from-anywhere model.

Taken on the changing landscape, be adaptable, and confidently embrace new opportunities. Your journey to becoming a sought-after consultant starts today. Go out there and make your mark in Private Equity Consulting.

All the best!