One of the most exciting careers in corporate finance now is equity research.

Here’s the complete equity research course for you.

As an equity researcher, you’re going to help investors pick profitable stocks.

If you are a good equity researcher, you will be constantly sought after by investors who are looking to maximize their investments.

Who knows, you can even appear on Bloomberg TV.

But how do you become one? That’s our main agenda here. Before we dig deeper, let’s start with what equity research is.

What Is Equity Research?

Equity research is the process of determining the fair value of publicly listed stocks to determine if they are overpriced or underpriced.

Overpriced stocks are stocks whose market value is higher than their fair value. On the opposite side, underpriced stocks are stocks whose market values are lower than their fair value.

Because of market corrections, overpriced stocks are expected to go down in value, and underpriced stocks are expected to get higher.

Clients of Equity research include stockbrokers and investment banks. Equity analysts at research firms are usually paid on a per-report basis or sometimes by brokerage trades.

Clients on the buy side firms include insurance companies, hedge funds, private equity funds, mutual funds, and pension funds.

These firms need research so that they will have a better idea of buying and selling company shares.

Sell-side entities like Goldman Sachs use equity research to convince buy-side entities to buy stocks.

That’s why companies like Goldman Sachs have equity research departments. Research departments earn indirectly through commissions earned by their sales and trading divisions.

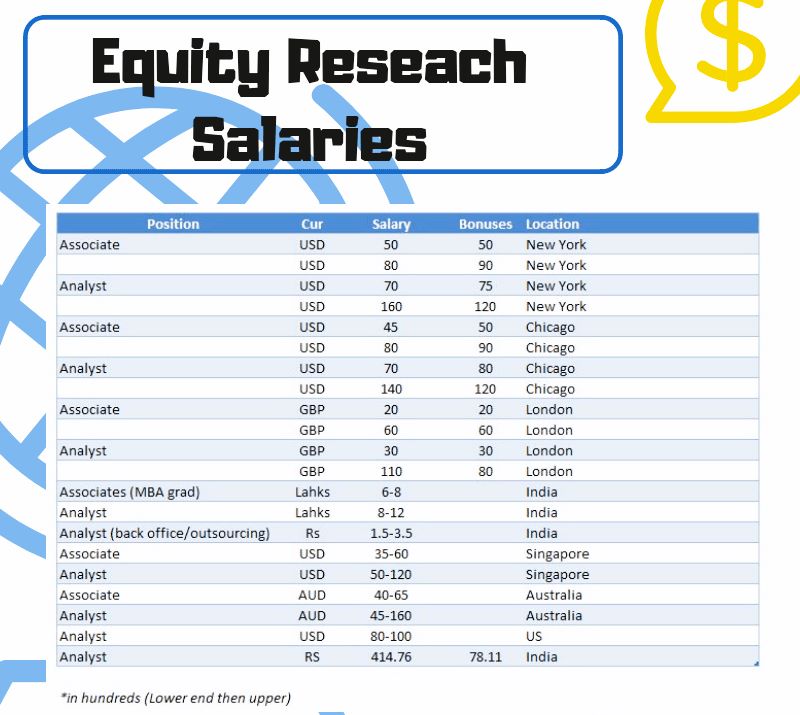

Equity Research Firm Salaries and Bonuses

Equity researchers enjoy a fairly high amount of salaries and bonuses. However, they are relatively lower than those in investment banking.

Equity Research Firm Hierarchy

The organizational structure of an equity research firm is simple. Here’s an overview of what it usually looks like.

The equity research hierarchy is quite similar to investment banking.

There are several senior analysts under the head of research. Usually, each senior analyst covers one to two industries. Under each senior associate are equity research associates as well.

Each associate heads junior analysts.

Junior analysts cover around 10-20 companies in the industry they are assigned to.

1. Head of Equity Research

The head of equity research is like the captain of a team at a brokerage firm. They help the team reach their goals and follow their game plan.

- One of their important jobs is to make sure that they’re using the best methods to figure out how much things are worth. It’s like making sure they’re playing by the rules.

- They also check and give the green light to research reports that the team writes. These reports are like guides that tell people what to do with their money. Some of these guides are for people in the company, and some are for people outside.

- The head of equity research also talks to other companies and experts. It’s a bit like the captain of a sports team talking to coaches and other teams.

- To become the head of equity research, you usually need to work in this field for a long time, like 10 years or more. It’s like becoming a pro at a sport after many years of practice.

2. Senior Analyst

- They make sure research reports are ready to be published.

- This means they add notes, extra information, comments, and make changes to reports written by other researchers.

- They also control how these research documents are shared, making sure they follow the rules and laws of the company.

- To do this job, they need to know a lot about rules and also be really good with finance stuff.

- Normally, companies want people to have worked for 5-10 years in Equity Research before they can do this job.

3. Equity Research Associate

An associate’s work is usually not too far away from those that are being done by their subordinates (which are the analysts).

They usually maintain files of companies under the sector they are assigned to.

They provide a fundamental analysis of those companies consistently.

They develop financial models, industry analyses, and sector databases.

They must always be in the loop in terms of news related to the companies and sectors they cover.

It is very crucial as it is part of their fundamental analysis.

They assist the heads in the publication of research reports.

To be qualified, usually, 2-3 years of experience are needed. It’s not required to be an MBA or CFA.

4. Junior Analyst

They are entry-level positions in equity research firms. They cover 10-20 companies at a time.

Firms do not require past work experience but rather internships for all applicants.

A Day in the Life of an Equity Researcher

As an equity research professional, you are generally responsible for your equity research associates making recommendations on whether to buy, sell, or hold shares of stocks. You will likely be working 10-15 hours a day. Here is a typical day for an equity researcher.

7:30 – 8:00 AM

What you do first is check the emails sent to you the night before. These are mostly from stock traders inquiring about your research reports.

Next, you take a quick look at stock markets. Asian markets like Hong Kong and Singapore start first. Along with all these things, the TV is usually on for you to check the news related to your sector. You also check newspapers or websites related to your industry. Tools like Bloomberg also provide you with great updates related to the sector you are working on.

8 AM

Morning call usually starts your working hours. Each one will give quick updates about the sector they are holding on to. It makes the other teams, especially the head, be updated overall.

There will also be a sharing of recommendations for research reports.

9 AM

Trading starts. Though there are different markets, the focus will likely be the city you are in. Then, other sectors will be taken on later. You will monitor the market, and you will try to find KEY or big developments in your industry.

You study why the stock market behaves that way. It is where you will use your tools, such as valuations, fundamental analysis, and industry analysis.

11 AM

Based on your latest figures, you estimate or predict the next movements of the stocks of the companies you are monitoring.

You will create updates on your recommendations, valuations, or Client Requests. You continue to keep track of the data.

By this time, you will receive calls from buy-side clients to discuss market movements. You will be asked about certain details of your investment recommendations found in your research reports.

3:00-3:30 PM

Your local stock market’s usual close at this time. You can finalize your stock movement data for that year. You will compare it with your expectations and make the necessary changes as possible. If there are significant differences with your projections, you must create an explanation of why.

You also update your clients regarding the recent stock market movements, especially the significant ones.

3:30-4 PM

You finalize your reports for submission and review by senior associates. Those publications will be published the next day, so you need to be fast. You will probably be making 1-3 reports hours per week per analyst.

8:00 PM

It’s now safe to go home. Review meetings are usually finished already. And most especially, you wouldn’t be accused of having too little work.

It would be best if you showed them you have a lot of loads, and you are hardworking, that’s why you cannot go home early.

Equity Research Course and Financial Modeling

If you want to study Equity Research in-depth, here are the courses:

- Excel and Financial Modeling Fundamentals

- Advanced Financial Modeling

- Bank and Financial Institution Modeling

- Oil and Gas Modeling

- Real Estate and REIT Modeling

Equity Research Lingo

1. Sell-side vs Buy-side

In equity research, the sell side and buy side refer to the type of clients the professional serves. Sell-side firms are like the middlemen in the world of buying and selling stocks and other financial assets. They include banks and stockbrokers, and they’re the ones who make it easier for you to trade your investments.

They sell stocks to gain profit.

Buy-side entities buy stocks to add to their investments. Think of buy-side companies as groups of people and businesses who are like smart money managers. They use their money to try and make even more money. They work really hard to help their investments grow so they can achieve their financial dreams, kind of like growing a money tree.

2. Industry Analysis

Industry analysis is a method of understanding a company’s health in terms of how well it performs compared to companies operating in the same industry as it is.

3. Primary Market vs Secondary Market

The main difference between these two is where the institutional investors have bought the stocks.

In primary capital markets however, investors buy the stocks from the companies issuing them. Whereas in secondary markets, investors buy securities from one another.

4. Fundamental Analysis vs Technical Analysis

Fundamental analysis is a way of analyzing stocks by looking at the different external factors affecting them. Examples include economic conditions, industry trends, and market share.

Technical analysis is like studying a stock’s history through its price charts to guess how it might perform in the future. People do this to spot patterns and trends that could help predict if the stock’s value will go up or down. It’s a bit like looking at the past to guess what might happen next with a stock.

5. Bull Market vs Bear Market

A bull market is a stock market condition wherein prices are generally going up. On the contrary, bear markets experience continuous loss of values of stocks trading on them.

6. Growth Stocks vs Blue Chip Stocks

These two classify companies based on the risks and rewards associated with them.

Blue-chip stocks are shares of stock of big companies that are already stable and have proven historical performance. They are relatively less risky, and as such, the expected return on investment is lower than other stocks.

On the other hand, growth stocks are shares of companies that still need to be stable. Because of this, investing in these companies is risky. However, they present a high potential for great profits once these companies take off.

7. SEC Filings

SEC filings are publicly available financial documents filed to the government (SEC in the U.S.) by regulated companies. They are often sources of data for valuations and financial statements analysis.

Some of the documents that can be found are Registration statements for securities offered, a 10K Report (business summary, management discussion and analysis, and financial statements), and an 8K report which details major developments of the company.

8. Financial Modeling

Financial modeling is a method used to forecast or project a business’s future financial performance. Determining future performance is critical in estimating what will be a stock’s future value. As such, financial modeling is a must-learn for equity researchers.

9. Equity Research stock pitch

A stock pitch is a report that will entice an investor to buy a certain security. It is usually done through an equity research report.

Technical Skills Needed

1. Macroeconomic analysis

Before you get to the business sector, you need to see first the overall health of an economy. From there, you will be able to determine which sectors are likely to perform and those that will not.

If you are assigned a sector, you will be able to understand deeply why your industry behaves like that.

2. Industry Analysis

As a beginner equity analyst, you will be assigned to a specific industry or sector. That’s why you should be able to do your industry research and analysis. You must be able to do competitive analysis and study industry dynamics.

3. Company Analysis: Fundamental Analysis and Ratio Analysis

Now that you have studied the external factors affecting a company through macroeconomic analysis and industry analysis, it’s time to explore the internal factors using fundamental analysis.

Fundamental analysis involves analyzing the company’s financials (and non-financial data) to determine the overall health and future of the company.

Fundamental analysis includes ratio analysis vertical and horizontal analysis. The analysis also involves non-financial data, for example, frequent labor strikes that could affect the production of the company reports earnings in the future.

When you do analysis, you usually need at least three consecutive years to make a good estimate of financial movements. In this regard, you need the three basic financial statements: income statement, balance sheet, and cash flow statement.

4. Valuation

You need valuation skills to estimate the future performance of the company. The future performance will determine if you will buy, sell, or hold to your clients.

You use your financial planning models to do this.

Here are the two most commonly used valuation models, Discounted Cash Flows and Comparable Companies Analysis:

4.1 Discounted Cash Flows

DCF involves discounting the future cash flows of the company using an applicable interest rate (computed using WACC) to determine the current value of the company.

For example, if the company estimates USD10M in sales for the next 5 years, this is not their value for today because of the cost of equity. There would be a cost-of-money component that must be deducted.

If the computed DCF value is higher than the current stock price, then you should say BUY or HOLD (if bought already) because the value is expected to appreciate. Otherwise, you recommend selling.

How do you do DCF?

Step 1. Compute WACC

WACC, which stands for “Weighted Average Cost of Capital,” is like a special recipe made up of three ingredients:

- Cost of Debt: This is like the interest you pay when you borrow money, like taking out a student loan or a car loan.

- Cost of Preferred Shares: Think of this as the price you need to pay for a fancy membership that gives you certain privileges in a club or group.

- Cost of Common Shares: This is like the price you pay for a share of a company’s stock when you want to own a piece of that company.

So, to figure out the WACC, you need to calculate these three costs and mix them together in the right proportions, just like creating a special recipe with different ingredients.

1. Cost of Debt

The cost of debt is simply the after-tax rate of your debt security. It is computed by multiplying the before-tax interest rate by (100%-tax rate).

2. Cost of Preferred Shares

The cost of preferred shares is equal to the dividend per share divided by the share price for preferred shares.

3. Cost of common shares

computation of the cost of common shares is a little tricky. Suppose re is equal to the cost of common shares:

re = rf +ß x (rm + rf)

Where:

rf = Risk-free rate

ß = Predicted equity beta (levered)

(rm + rf) = Market Risk premium

The risk-free rate is the rate given to securities that have almost no risks involved. The interest rate of long-term government bonds normally presents it.

Beta is the measure of systematic risk of a security. In other words, it is a measure of how changes in the stock market affect the movement of such security.

A market risk premium is the difference between the risk-free rate and the market rate. Meaning it is the added cost due to additional risks involved.

4. Computation of WACC

WACC can be computed by simply multiplying each security’s cost by its % share in the total overall funds of the company. To calculate that %, you will need to use market values instead of book values.

Step 2. Compute FCF

It would be best if you computed unleveled Free Cash Flows. This FCF is the total amount of cash a business has before paying any financial obligations.

a. To compute FCF, we will start with After Tax Operating Income.

b. We will now add back effects of non-cash items into the income.

c. Take into consideration other adjusting items.

A decrease in assets must be deducted because they reduce cash but do not affect net income. The opposite happens when assets increase.

An increase in payables decreases cash but does not affect net income, so we must deduct it. The opposite has the opposite effect.

d. Capital expenditures must be deducted because they decrease cash but do not affect net income. It is the last adjustment you will make to compute FCF.

e. Project all these figures 5 years ahead using the average growth rate of the historical figures you have.

f. Using the WACC as the discount rate, compute the present value of the FCFs you calculated for each year. The total of those present values is equal to the Free Cash Flow.

Step 3. Terminal Value

Terminal value is the present value of all cash flows beyond your projection period. In our example, it is equal to the free cash flows of all cash flows beyond YEAR 5.

It is how we compute Terminal Value.

Get the long-term growth rate of the company. In our example, we will assume that the long-term growth rate is equal to the average sales growth rate.

Get the Free Cash Flow for Year 6 by multiplying the FCF of Year 5 by (1 + long-term growth rate)

Get the present value of Year 6 FCF by using the WACC as the discount rate. The PV is now the Terminal Value of our valuation.

Step 4. Diluted Shares

The total diluted number of shares is equal to all common shares outstanding plus the dilutive effect of convertible securities.

It is how to compute the dilutive effect.

From options and Warrants: If the strike price of the share is less than the current stock price, we assume it will be taken advantage of by the holder, meaning he will convert those to common shares. What we do is multiply the number of shares to be converted and multiply by the strike price. We assume that this is equal to the amount that is going to be used to buy shares. We then divide this amount by the current strike price to compute the number of diluted shares.

Convertible Debt Securities: We assume that the convertible debt will be converted to common shares

Convertible Preferred Shares: We assume that the shares will be converted to common shares

Get the sum of all common shares outstanding and potentially dilutive items to get the TOTAL number of fully diluted shares:

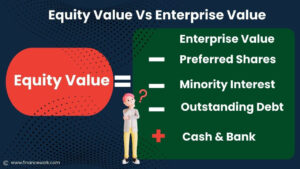

Step 5. Equity Value and Enterprise Value

To compute Equity Value, we will add the following:

a. Enterprise Value

Add the FCF we got in Step 2 and the Terminal Value we got in Step 3.

b. Net Debt

Imagine you’re looking at a company’s financial situation. To figure out how much money they really owe and have, you’d start by adding up all their short-term debts (which are the debts they need to pay back soon), their long-term debts (the ones they’ll pay back over a longer period), any money owed to outside investors that don’t have control in the company, and any preferred shares they’ve issued.

Once you’ve got that total, you’d then subtract the cash they have on hand, including any easily accessible money like cash in the bank. This gives you a better picture of the company’s financial health, showing how much they owe versus how much money they have readily available.

After which, divide the total Equity Value by the number of totally diluted shares. We’ll get the Equity Value per share.

Step 6. Compare and Recommend

Compare the Equity value per share with the current market share price.

If the Current Market value of the share is higher than the Equity Value per share, then the stocks are overvalued. It will lose its value soon. Recommend to SELL the stocks.

If the Current Market value of the share is lower than the Equity Value per share, then the stocks are undervalued. Soon enough, the stock’s value is expected to go up. Recommend to SELL or HOLD the stocks.

4.2. Relative Valuation/Comparable Companies Analysis

Relative valuation is the use of valuation multiplies in comparing one company vs another. Valuation multiples used usually include EV, EBITDA Price-Earnings, EV/EBITDA, and Book value, among others.

It is how you do a Comparable Companies Analysis:

Download Comparable Companies Analysis Excel File.

Collect Shares information

First, you need to collect information about the equity shares. Here is the data you need to make a comparable public companies analysis:

Company name

Company Ticker (For easier labeling)

Date of latest filing with Securities/Exchange government agency (so that the users of the report will know from which period the financial statement data were taken)

Date of latest fiscal year-end

Basic common shares outstanding

Other common shares outstanding (Class A, B, C, etc)

Potentially dilutive items. (You will need to compute this one. Potentially dilutive items come from Options, Warrants, Debt securities convertible to common shares, and Preference shares convertible to common shares)

Income Statements

When you get income statement data, you don’t just get the data of earnings season the last available fiscal year. You need the following set of income statement data:

Latest Available Fiscal Year Data

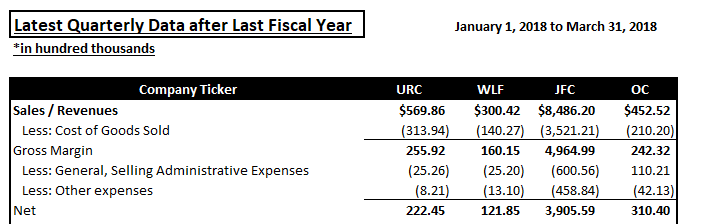

Latest Quarterly Data after Last Fiscal Year

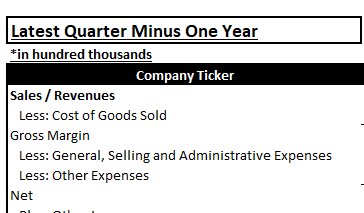

Latest Quarter Minus One Year

Trailing Twelve Months

How about the income statement itself? What are the income and expense accounts that we need to include?

We need to include everything. However, we will have to make adjustments. Also, you can make your analysis by group of income/expense rather than being specific with each account. Here’s the format in our example:

Here are the parts of the income statement that you need to provide:

Sales/Revenue – It is the gross income of businesses. Sales are for manufacturing and merchandising businesses. Revenues are for service businesses.

Cost of Goods Sold – these are the costs of producing or the cost of purchasing inventory items. It applies only to manufacturing and merchandising businesses.

Gross Margin –It is the difference between Sales/Revenues and Cost of Goods Sold.

General, Selling, and Administrative Expenses – these are the operating expenses of the company. In our example, we had it lumped into one account. In actual practice, you are more likely required to separate each.

General expenses – are operating expenses that cannot be allocated in any department. Examples are utilities, janitorial services, and security services.

Selling expenses – These are expenses that are directly related to selling products or services. Examples are delivery trucks and sales agent payroll.

Administrative expenses – expenses related to managing the business. Examples are the payroll of the general manager.

Other expenses – These are various expenses that cannot be classified as general, selling, or administrative. These are usually small in amount.

Other income – income not related to the main business of the company.

Non-operating losses – these are losses not related to the ordinary course of business of the company. Examples are losses on the sale of assets or business units.

Earnings Before Interest Expenses – It is the net income of the company before deduction of interest expenses and taxes.

Interest Expense – interest on various loans

Pretax income – net income before deducting taxes

After-tax income before adjustments –It is the income before we make adjustments that extraordinarily affect net income. We remove them because they will affect the results of our operations and, consequently, the decisions of the managers.

Examples of adjustments are one-time losses or one-time gains on the sale of business assets. These items are removed because they are extraordinary, meaning they are made outside the usual course of the business.

Net Income after Adjustments – It is the net income we are going to use for our valuation.

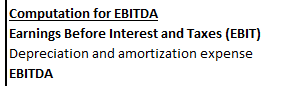

We will compute EBITDA for purposes of our valuations. It is done by simply deducing depreciation and amortization expenses from Earnings Before Interest and Taxes.

We will also be needing the available data for the latest quarterly period after the fiscal year.

As well as the data from the latest Quarter Minus One Year

You also need data from the trailing twelve months. You can do this by simply adding the data figures from the Latest Fiscal Year and the Latest Available quarterly period. You then deduct the data for the trailing twelve months from the sum of the two.

Check out the Excel companion of this guide so that you can see the formula used.

Get the Enterprise Value

It is simple to get the Enterprise Value. Just add these two:

Total Market Value (TMV) – It is the product of the current stock price and diluted number of shares.

To determine Net Debt, you combine short-term debt (including a fraction of long-term debt), long-term debt, non-controlling interest, and preferred shares, and then subtract the amount of cash and cash equivalents.

Determine the total number of Diluted Shares.

There are different methods to compute diluted items depending on where the shares will be coming from.

From options and Warrants: If the strike price of the share is less than the current stock price, we assume it will be taken advantage of by the holder, meaning he will convert those to common shares. What we do is multiply the number of shares to be converted and multiply by the strike price. We assume that this is equal to the amount that is going to be used to buy shares. We then divide this amount by the current strike price to compute the number of diluted shares.

Convertible Debt Securities: We assume that the convertible debt will be converted to common shares.

Convertible Preferred Shares: We assume that the shares will be converted to common shares.

Calculate Forecasts and Multiples

It is simple to compute multiples. You will have to use the formulas and link them to the proper accounts.

Likewise, projections are 100+growth rate, which, in our case, we use the average growth rate of the past 3 years.

Compute Valuation of companies.

To compute the valuation of each company, use the AVE, MIN, and MAX multiples. Through these multiples, you can estimate the average price of each stock, as well as the minimum and maximum values in the range.

For example, we have an average Last Fiscal Year + 1 EV/Revenues of 3.4x.

If the first company has a Revenue of 100, we multiply 100 by 3.4. The resulting value of 34 is the estimated average Enterprise Value of the company.

Evaluate results and make recommendations.

Based on the different values of the companies, you are now ready to make a comparison. Based on the comparisons, you will recommend which stocks to BUY, SELL, or HOLD.

Equity Research Report Writing – Sample, Format, Template

It is your main output for equity research analysts.

Industry Overview

In this portion, you will learn the major trends affecting the industry currently. It also involves competitive analysis and how the industry affects the company in the subject.

The analysis involves factors like the current state of the economy, interest rates, technology, and social trends, among others.

1. Management

Who are the members of the management team, and their expertise and experience?

It is important for securities research and for investors who are not active with the company. Equity researchers have frequent attendance at meetings involving company management. They know how their leadership is and their capabilities.

Investors cannot do this on their own; that’s why they rely on equity researchers.

2. Company Financials and Ratios

In this portion, equity researchers put key historical figures of the company. Accounts that are usually included are Sales, Cost of Sales, Revenues, and OPEX. They also provide ratio analysis, vertical analysis, and historical analysis of those figures to make more value.

Researchers usually focus on profitability (Income statement) together with short-term and long-term liquidity (balance sheet and cash flows).

3. Projections

Projections are where the most value of research reports comes from.

Researchers would put here their estimated future value of the company.

There are generally two ways to do forecasting.

First is the bottom-up method wherein you start with the drivers of revenue like customer base, number of products, or price and then determine the revenues and expenses associated with it.

The second type is to use the top-down approach wherein you start with the industry, then the market share of the company, and from there determine how much revenue the company will be getting.

In actual practice, both methods have influenced every forecast that is being presented.

4. Valuation

Here, the researcher presents the value of the company using methodologies such as DCF or Comparable Companies. These methods take forecasting up a notch by adding more assumptions like the cost of equity or cost of money.

Go to the section for valuation methodologies to learn more.

5. Recommendations

Finally, based on the valuation figures and market values, the researcher would recommend investors buy or sell stocks. There are three common recommendations:

BUY – if the valuation is higher than the market value. It means the stocks are expected to rise in price in the future.

SELL – if the valuation is lower than the market value. If this is the case, the researchers expected that the stock is overvalued and, thus, will go down in value.

HOLD – when you already have the stocks, hold them because it is expected that they will rise in value.

Sample Equity Research Reports

Tips on How to Write a Good Research Report

Here are good ways to create a research report that will be read and based upon by clients and potential clients.

1. Have a good view of the company.

What’s a good view?

The analyst must present complete and relevant information about the company. We’re not talking about just financials but also non-financial data as well.

Other information that must be included is revenue drivers, market shares, investment rationale, growth, and cost drivers, as well as an enumeration of risks.

Create a clear discussion of the business model of the company and its major targets in the next 3 to 5 years. It’s important to give a brief background of who will run these strategies (e.g., members of the executive management)

It would be best if you also discussed pending large legal matters that the company is facing and how they could affect the income and operations of the company.

2. Create a non-confusing recommendation.

Recommendations used are usually BUY, SELL, and HOLD. However, some analysts use terms like underperforming or outperforming.

To avoid creating confusion with clients, follow the format of your company. That format is the one clients are already used to. Changing the format will create confusion among clients.

Indicate the target price together with the recommendation.

3. Provide key ratios.

Along with financial statement figures, there should be vertical and horizontal ratios. Vertical rations are reactions wherein the amount is presented as a percentage of the total value (e.g., Sales, Total Assets, Total Liabilities, Total Equity).

Other ratios that investors usually look for are EBIT/Sales, EBITDA/Sales, Return on Equity, Return on Assets, Quick ratio, Current Assets ratio, Debt to Equity Ratio, and Dividend Yield.

4. Provide Share Price Charts.

Investors are usually concerned with the price of the stock for the past 52 weeks. They tend to look for trends that they can ride. Along with it, present the 52-week low and 52-week high for the stock.

Should it be better to include a short-term chart, do so. Whatever the client needs, provide it.

5. The investment rationale should be well-supported.

The investment rationale is the reason why you made such investment recommendations. You need to put all supporting details, just the relevant ones. Remember, your clients are busy people; don’t feed them with too much information.

Internships

Internships are very important for those who are eyeing full-time research jobs. Almost 100% of the time, firms are looking for applicants who already have working experience as interns.

Here are the usual requirements found in job postings for Equity research internships:

Passionate about financial markets, especially equity markets

Graduate from a good university (preferably target universities)

Strong knowledge of Excel, accounting, and valuation methods

Excellent analytical, organization, and communication skills, and interpersonal skills

Very proficient with Excel

Here are the usual tasks of interns:

Active participation in recurring regular meetings with the team to discuss market updates and report submissions

Conduct fundamental research reports

Use resources like SEC Filings, Bloomberg, and other research tools

Track stock and earnings movements of companies

1. Allowances

Here are the estimated allowances for equity research interns in different countries:

UK – GBP 3,000/mo

SG – SGD1,000/mo

US – USD2,500/mo

India – INR30,000/mo

2. How to get into an equity research internship?

Getting into an equity research internship is not standardized. Your best bet to get an internship is through the following:

You graduated from a well-known business school. The firms will most likely visit your school to recruit interns.

Browse online job boards, especially for big firms.

For smaller firms, your best chance of getting in is through networks, cold emails, and cold calls. They don’t usually post their need for interns because, in the first place, they need to look for one actively.

Making the first move can convince them that you are worth their time to be their intern.

Equity Research Job- How to Get hired?

Before you apply for a job, there are two differences you need first to learn.

The difference between sell-side analysts and buy-side analysts,

The difference between equity research analysts and other investment banking analysts and how investment bankers work.

1. Sell-side Equity Research Analyst vs Buy-Side Equity Research Analyst

Sell-side Equity Research Analyst:

The sell-side analyst typically focuses on providing analysis on all companies under a sector to provide it to investors or brokerage firms.

They don’t have preferences as to which companies they will be making reports on.

It’s up to the clients to decide their companies based on the research reports. Their earnings are based on the reports they give.

If they are an in-house research department helping the Sales and trading team, then their services are merely support. They earn based on how the Sales they are supporting perform.

They usually cover 2-3 companies at a time.

Buy-side Equity Research Analyst:

These analysts have similar skill sets as the sell-side. However, their focus is to find the best-performing stocks.

They will recommend these stocks to their companies for them to purchase.

Because of this difference in focus, they tend to cover more sectors than sell-side analysts. The more sectors they cover, the higher their chance of getting stocks that are undervalued in the market.

It’s not surprising if they cover more than 20 companies at a time.

2. Equity Research vs Trading vs Investment Banking

Often, applicants need clarification with these three. It would be best if you learned that although they are all in finance, they are entirely different.

Here are the primary differences between equity research, trading, and investment banking.

4 Strategies to Get into Equity Research Firms

1. Stock research reports and valuations.

Attach your stock research reports and valuations (from Excel) on your application form.

It will show your capacity and will make you stand out from all other applicants.

2. Take outside University courses Equity Research Training

University education usually needs to be more focused. Taking extra classes targeting a career in equity research and investment banking will create a huge boost in your CV.

3. Internships at Asset Management Firms or Small Hedge Funds

Getting internships from asset management firms or hedge funds will help you a lot in landing a job in Equity Research firms.

This kind of company will give you experience in building financial models and valuations that are crucial in making equity research reports.

However, only a few applicants can find internships at hedge funds, etc. It’s because those spots are not usually advertised, but rather, they are not.

You will find it by hard means: cold calling, cold emails, and networking.

4. Professional networking using LinkedIn

LinkedIn is the best social media platform to network professionally. It allows you to see connections between you and your target firm easily.

Recruiting Process

The following technical topics are covered in entrance exams:

Economics, especially macroeconomics or the part of economics dealing with large-scale economic factors such as national income, inflation, and interest rates

Stock market

Industry Analysis

Valuation methodologies such as DCF and Comparable Companies’ analysis

Accounting, with a focus on analysis and interrelationships of the three basic financial statements (Income Statement, Balance Sheet, and Cash Flow Statements)

A word on Stock Pitches

Using these financial research tools, you can be asked to pitch a particular stock to your interviewer or a panel. As such, it’s important to know by heart how equity research is done on the job, not just in theory.

To prepare for this, do some practice reports on your own.

Equity Research Interview – We Have a Guide

Interviews are centered mostly on topics of exams we mentioned above. In some cases, stock pitches are included in interview sessions.

They are looking for people who can communicate well because, as an equity research analyst, you tend will spend a lot of time communicating with clients.

Equity Research Interview Questions

You can answer technical questions if you study our guides on valuation. Here are some more questions you might get asked.

1. If you had $1 million to invest, what would you do with it?

You must always be 100% ready with this question. How do you get ready? Pick up some stocks ahead of time, study them, and when this question comes, answer them.

Say to them your rationale, that you did research about them, valuations, etc.

You must not only talk about stock. You must also include debt securities to improve diversification. Describe to them your risk appetite and your knowledge of stocks. Ideally, you will pick a portfolio mix that is risky because you are very knowledgeable in finance and securities.

This portfolio mix would include a relatively large percentage of stocks, a lower portion of bonds, and an even lower percentage of safe securities such as government bonds and bills.

2. Tell me about a company you admire and what makes it attractive.

It is a question that tests your technical knowledge.

Prepare ahead of time by knowing relevant valuations, multiples, and news management of the company you would like to present.

You can bring your report and your working papers and show them. It’s better to show that.

3. Pitch me a stock (typically will be followed up with a challenge – e.g., why has the market not priced this in? etc.)

Prepare at least 5 stocks. Those stocks should be composed of Small-cap stocks and Large-cap stocks and stocks for short selling.

Use valuations, multiples, key metrics, the background of the company, as well as the management to support your recommendations.

Well, follow the steps in doing equity research for you to capture all the things needed to answer the question effectively.

4. How do you value a stock?

We use valuation methodologies. What are valuation methodologies? These are the valuations used to value stocks.

Examples are Discounted Cash Flow, then discuss how it works. You can refer to our discussion on discounted cash flows.

There is also a Comparable Companies analysis. (refer to our previous discussion.)

Multiples are very useful as well in determining the future value of a stock.

5. What are the major valuation methodologies?

6. When would you and when would you not use a DCF valuation methodology?

Discounted cash flow is usually the most used and, therefore, the most asked methodology in equity research. You must be ready for all sorts of questions about DCF.

One of the common questions about DCF is about its strengths and weaknesses

7. When should you use DCF?

DCF is usually preferred because it greatly reduces the effects of non-economic factors, subjective accounting policies (e.g., Accruals), and short-term market movements

DCF is effective when the company is already operating for at least three years.

This method is also reliable if the analyst can reliably measure the future cash flows of the company. As such, if the company or the industry is so erratic, it’s better not to rely on DCF.

If the analyst is confident with the assumptions that will be going to be used

8. When should you not use DCF?

If the analyst cannot reliably create reliable financial and market assumptions

If the company is a start-up, since cash flows cannot be easily projected

DCF must not be used if the company does not practice a high level of transparency in its financial statements and relevant data

If there’s not much time, especially since DCF is time-consuming

9. What are the most common multiples used to value a company?

Here are the common multiples used to value a company:

Enterprise Value Multiples: these are multiples that consider both creditors and shareholders. Remember that Enterprise Value is Equity value plus net debt.

EV/EBITDA

EV/EBIT

EV/Sales

EV/Unlevered Free Cash Flow

Equity Value Multiples

these are multiples concerned only with shareholder’s equity.

Price/Earnings Ratio

Equity Value / Book Value

Price/Earnings Growth Ratio

Jumping from one career to equity research

1. What do firms look for in their equity analyst and researcher candidates?

Good in accounting

Good in investor relations

Good in Sales, for you need to get clients so that your equity research reports will get you income

2. What you must do?

Network with people who already made such kind of transition. They can help you out.

Where can you find them? Through your networks.

You can also search on LinkedIn to find these people and connect with them through common networks.

When you are already connected with them, let your common network introduce you to each other.

Tell that person that you are undergoing a career shift and ask if you can treat them to coffee because you want to learn from them.

If you have done it right, you will be able to sit with them in person.

You can also benefit from that person through his recommendations to the equity research department where they work.

2.1. Study relevant courses and certifications

There’s no way you can cut this one from the process.

Even if you are in the finance investment banking industry, you’ll need to acquire additional knowledge and skills through training. There are relevant courses and certifications you can take to make the jump.

Earn a finance degree.

It is most important if you are a graduate of a non-finance course. Though there could be a possibility a non-finance degree holder will be hired, that possibility is too low. If you want to increase your chances a hundredfold, you must graduate with a finance degree.

Finish your MBA.

It could help, but not a necessity. Most companies look for applicants who have relevant experiences rather than being graduates of MBAs.

Chartered Financial Analyst.

The Chartered Financial Analyst is a popular certification among finance professionals.

It is a designation given by the CFA institutes that guarantees that the professional is highly competent in terms of financial analysis.

Is this required? No. Is this helpful? Yes, but more than working experience is needed.

Though it will look good on your resume, your results in interviews will speak louder than your certification.

Nevertheless, the knowledge you gain from undergoing CFA will increase your competence in terms of company analysis and valuation.

If you aim to improve your skillsets as an either investment banker or banking equity research researcher, BIWS offers a lot of different options for you.

There are courses in Excel and Financial Modeling Fundamentals, Advanced Financial Modeling, Equity Research, and a lot more.

What’s more, is that you’ll get USD397 Prime access as a Bonus!

2.2 Apply for internship

Aside from graduating from a finance course, this could be the 2nd best tool for you to get a full-time private equity analyst or equity research associate job.

Firms are always looking for people with experience already. And as a new professional, there’s no other way to get real-life experience than internships.

That’s why we dedicated a portion of this book to internships. Just follow the steps here on how you can get the internship that will ultimately lead you to your dream job.

How to Succeed at Your Job

1. Equity Research Soft Skills – Report Writing Skills

Writing skills do not necessarily mean being able to use as many technical words as possible; using less jargon is more desirable. Here are the qualities of written communication skills you need to master to create good research consistently

Use technical jargon as fewer as possible. Though your audience is mostly acquainted with these words, a good research report is easily understandable in just one go.

Use as few words as possible. If it’s possible to report on one page, then it would be best. All your clients are busy people.

Use graphs and charts. Be visual. Images are easier to understand than words.

2. Financial Valuation and Modeling

You should know each valuation and modeling method by heart. You must know each other inside and out. Learn when and when not to use each.

3. Accounting

You must know how to read financial statements!

You may not be an accountant, but you need to know at least the nature of each of the accounts found in the financial statements. There are very specialized terms; don’t be afraid to ask. You are not stupid if you ask; you are silly if you don’t ask, but you need to.

Know the interrelationships of each of the basic financial statements (balance sheet, income statement, and cash flow). Know how a change in one of these statements will affect the other two.

Study accounting ratios. When you substantiate your report, often, you also need to use ratios, not just valuations. Know when to use liquidity ratios, solvency ratios, activity ratios, etc.

4. Be a Superstar in Excel

What are the usual things you’re going to use Excel with?

Modeling

Valuation

Charts and Graphs

Pivots

If you are not good at Excel, it will take you a long time to finish an equity research report. Mind you, you will be covering about 10-20 companies at a time! Imagine how proficient you must be to value all these companies.

Always remember the importance of knowing Excel shortcuts and tricks.

Equity Research- Exit Opportunities

1. Internal Promotion

If you want to go all out in equity research, you can improve yourself inside the firm.

You can go from being an analyst to being the head of the equity research division.

If you want to grow with another company, it’s advisable to stay first in one company for two to three years, especially when you are just starting.

It’s better to be seen as an employee who doesn’t job-hop often. Plus, you get a lot of experience, which you can use as leverage for your next job application.

2. Investment Banking

Though there are a lot of similar skills between investment bankers,the equity analysts and researchers, it’s still quite tough to make the transition.

There are a lot of other skills you must learn and improve, like working on Initial Public Offerings or M&A transactions.

We had previously distinguished the difference between the two fields.

If you want to make the transition, you must first fill the gaps in your skills through continuous learning or, perhaps, going first to an investment bank or banking internship.

3. Private Equity/Hedge Funds

You can use your equity research skills to study potential investments.

You can use your skills in stocks to identify which companies will greatly increase in value in the next years.

It will help you get a higher return on investments of the firm.

Instead of being the head of equity research, you can aim to be a Private Equity Fund Manager.

The same goes with Hedge Funds and other sell-side firms.

4. Corporate Finance

If you’re tired of the finance industry, you can choose to go to private companies.

You can use your skills in financial analysis to do a competitor analysis and find ways to improve the profitability of the company.

You can also use your skills in doing company budgets and determine where the company is going in the next few years. You can also be involved in the financial analysis of planning projects.

You can also go to investor relations, where you can community the company’s health through your skills in analysis and reporting.

Equity Research Careers and MiFID II: Is Equity research growing or dying?

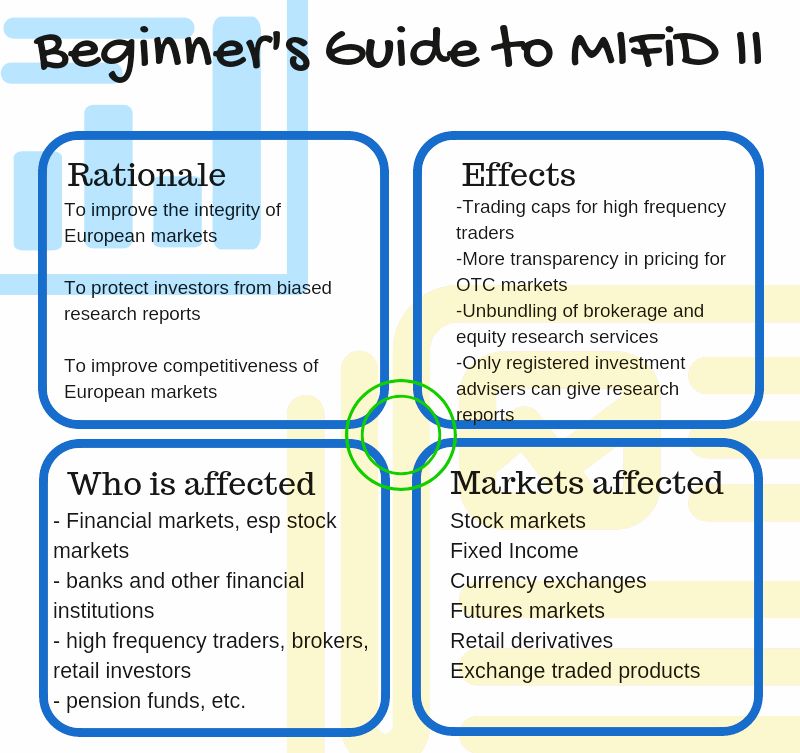

1. What is MiFID II?

MiFID 2 (Markets Financial Instruments Derivative 2) is a legislation by the Europeans that promotes transparency and effective regulation of financial markets.

They aim to protect investors and to make the EU’s financial markets more competitive than the US capital markets are.

Here’s a glimpse of what MiFID II is all about:

2. How does it affect equity research?

One of the main goals of MiFID II is to force firms to charge for their equity research reports rather than giving them for free. It’s not free because it’s part of the brokerage commission paid by investors.

3. So, why does the EU want it charged?

Because if research reports are paid via commission, there could be a tendency for analysts to get biased.

They, of course, want to sell shares so that they can earn.

It could result in a bias in the reports that they will be giving their clients.

With a plan that charges equity research reports, there is a lesser chance of bias since they can earn even though firms can’t sell shares.

There’s also a stipulation that firms cannot provide equity research reports unless they are registered as investment advisors.

The result?

Lots of equity research professionals could lose their jobs. Firms will cut back operations of equity research because they don’t have to monitor every stock out there, but rather, only the requests of clients.

On the other hand, this could help equity research by improving the quality of reports. Those who do equity research can enjoy a higher level of reputation among investors.

So, is equity research dying or growing?

In terms of numbers, it is dying. However, in terms of the quality of the profession, equity research is growing more prominent than ever.

My Exclusive Insights for You- Are you ready to become an equity researcher?

Being an equity researcher is a rewarding one.

But every rewarding career has its costs. You must be willing to pay the costs.

You must be willing to study hard, network professionally, and apply excellently.

What’s stopping you from reaching your dream job?

Is there anything else you want to learn about?

Perhaps you need a practical equity research course, or maybe just a little message will lighten your mood up.