Want to know more about the financial advisor career path?

Read this guide completely to know about how to become a financial advisor.

Last Monday, I visited my insurance company office to inquire about insurance products that suit my needs.

There, I met a senior financial advisor, who gave his valuable time and made me realize the importance of the financial advisory business.

Financial Advisor Career Path

In the meeting, he ran me through my financial responsibilities, financial needs and explained how investing and planning at an early age are not only important but beneficial too.

When the meeting ended, I was happy that I understood the importance of financial planning and also met a wise financial planner.

I am writing this post specifically for those who want to make a career in financial planning.

There are some careers in finance where you can work in the financial services industry or on your own. Financial planning is one of them.

Yes, you can work as an independent financial advisor and earn well too.

Details about Financial Advisor Career

The job is called by a lot of names, including a financial planner, financial advisor, portfolio manager, and personal financial consultant, but it’s rarely known and called what it actually is, “Financial Products Sales”.

Financial Planning professionals are uniquely qualified and earn a living by helping individuals and investors pull all their finances together, solve financial problems, and make a plan to achieve their personal financial goals and strategies.

Financial Advisor Job Responsibilities

A financial advisor helps individuals in setting personal financial goals and strategies.

As an advisor, one must help investors decide and choose what kinds of investments, insurances and other financial products are best.

It is the duty of a financial advisor to advise people on different types of investments, helping in retirement planning, estate planning, as well as the timing of major expenditures too, such as buying a house, kids’ education, their wedding, retirement, medical expenditure, etc.

Day to Day Tasks to be done by Financial Advisors

- Follow-up with clients on plans monitors successes and information about any modifications which are required in their investment portfolio.

- Assist clients with estate management, tax returns, planning budgets, or other financial tasks.

- Guide and advise clients on financial self-analysis, including goal setting and strategies to reach financial goals.

In short, the advisor has to advise clients in creating personal budgets, control expenditures, and create wealth.

Financial Advisor Personality Traits/ Skills

If you want to become a financial advisor, you should be articulate, persuasive and have sales ability to build a client base.

Finding clients who need these services and building a customer base is very crucial to succeed in a career as a financial advisor because referrals from satisfied clients are an important source of building and expanding new business.

You can find new clients by writing articles, giving seminars or lectures, through social or business contacts.

Having a broad and active social network is one of the reasons that many successful financial planners enter this field after working in a related occupation such as accountant, auditor, insurance sales agent, lawyer or securities, commodities, and financial services sales agent.

Work schedule

You can work as a part-time or full-time financial planner/financial advisor, based on the work and clients.

Most of the time, you need to be available for at least 10-12 hours a day, based on the client’s time for meetings. Normally, financial advisors work for 40-50 hours a week.

Where do Financial Advisors work?

More than half of all the financial advisors work for finance and insurance companies, including securities and commodity brokers, banks, insurance carriers, and financial investment firms.

However, four out of 10 personal financial advisors are self-employed, operating small investment advisory firms, usually in urban areas.

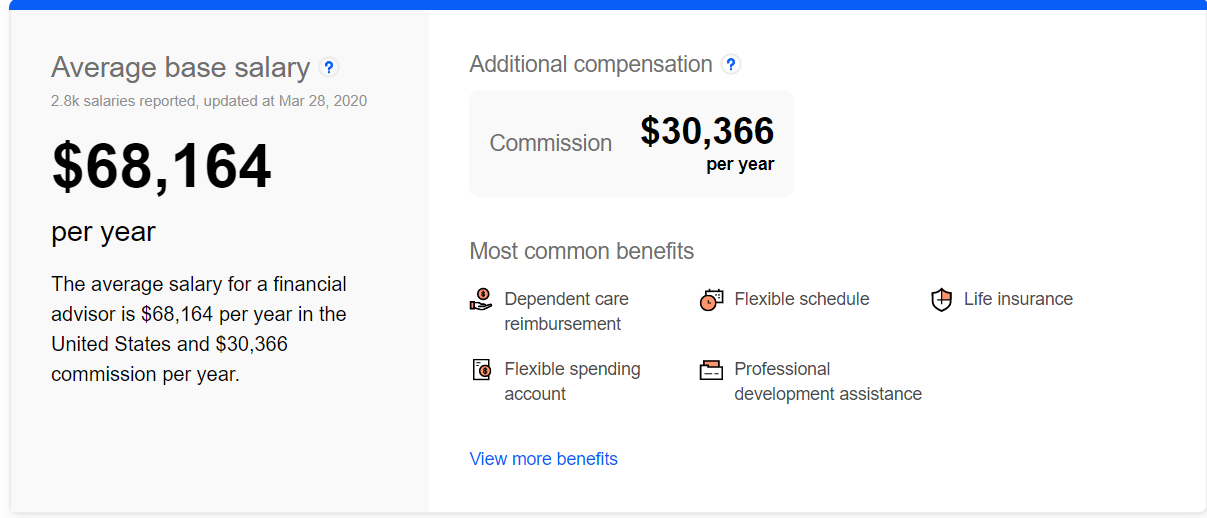

Earnings and benefits

If you are working as an independent financial advisor, you can charge some flat percentage on the investment made by your client.

Secondly, you can charge hourly consulting fees also.

The median financial advisor salary would be around $68,000. On top of their salaries, they earn around $30,000 as a commission per year, too.

Some of the major benefits of choosing a Personal Financial Planner as your career could be as under:

- High-income potential – You can make a huge difference at a time when more people from all over the world are struggling to pull their finances together and plan for the future.

- Dynamic and highly respected profession – It is a career of the long commitment to meeting the ever-changing needs of your clients.

- The satisfaction that comes with helping people plan for their futures – As a financial advisor, you become a coach and problem-solver and can provide truly personalized advice and services to your clients and maintaining high levels of financial planning and professionalism.

As a financial advisor with valuable expertise, you can expect personal satisfaction as well as financial rewards.

Education and Certifications required in financial advisor career

A bachelor’s degree with additional education in financial planning is required.

You can go for a PG program in Financial Planning and Wealth Management or CFP certification that is recognized worldwide.

Financial planning clients or employers or investors look for candidates with a bachelor’s degree in accounting, finance, economics, business, mathematics or law.

Courses in investments, taxes, and estate planning and risk management are also very beneficial.

Programs in financial planning are becoming more widely available in colleges and universities.

Financial advisors may also seek the Certified Financial Planner (CFP), the Chartered Financial Analyst (CFA) and the Chartered Financial Consultant (ChFC) designations.

Initial Certification

To become a Certified Financial Planner, you are required to meet the following initial certification requirements (known as the four “Es”):

- Education – The first step is to acquire the knowledge required to deliver professional, competent and ethical financial planning services to your clients.

- Examination – The examination assesses your ability to apply your financial planning knowledge, in an integrated format, to financial planning situations. Combined with the education, experience, and ethics requirements, it assures the public and clients that you have met a level of competency appropriate for professional practice.

- Experience – CFP Board requires you to have three years of professional experience in the financial planning process or two years of apprenticeship experience that meets additional requirements. Qualifying experience may be acquired through a variety of activities and professional settings including personal delivery, supervision, direct support or teaching.

- Ethics – CFP Board conducts a detailed background check for all the candidates involving any criminal involvement, or inquiry of bankruptcy, customer complaint, by your employer or client.

Financial planning career is an excellent career as there is a good demand for financial planning activities.

Financial planners consistently report an increase in average annual gross earnings after gaining knowledge and experience.

“Build Your Future by Helping Others Build Theirs” – could be the mantra for you to become financial advisor where you make others use their finances in the best possible way and at the same time grow your own finance.

Have queries? Write a comment below.