Are you interested in becoming a financial modeling analyst? Well, you’ve found your luck.

In this guide, I will break down all you need to know about being a financial modeling analyst.

Welcome to the world of corporate finance again, where everything boils down to numbers and calculations.

Being a financial modeling analyst is an important job in a company because it helps the company get a clearer view of its finances.

First of all, what is financial modeling?

In simple terms, it is the process of creating a summary of the expenses and total earnings of a company.

This summary is usually compiled in the form of a spreadsheet and can be used to determine the impact of a future financial crisis or financial decision.

So, what does a financial modeling analyst do?

A financial modeling analyst is responsible for:

- Performing analysis of financial data and transactions.

- Establishing links between financial statements.

- Preparing presentations.

- And performing sensitive financial analysis, among other tasks.

In this guide, I will be walking you through the basics and complexities of what it means to be a financial modeling analyst.

I have been giving tips on investment banking for over a decade, so you can trust me with my tips on the financial services sector.

Stick till the end, and I will leave you with some top websites where you can likely get employed as a financial modeler.

However, in order not to put the cart before the horse, let us explore everything you need to know about being a financial modeling analyst.

Key Takeways of Financial Modeling Analyst

- Financial Modeling Analysts play a critical role in creating and analyzing models for strategic financial decision-making.

- Required skills include Excel proficiency, accounting knowledge, and effective communication.

- Educational qualifications include a bachelor’s degree in relevant fields, with certifications like CFA, CFP, or FRM being advantageous.

- Job responsibilities encompass building financial models, analyzing data, forecasting, valuations, financial reporting, and risk assessment.

- Top job-search websites for financial modeling analysts include LinkedIn, Google Jobs, Glassdoor, eFinancialCareers, and the Association for Financial Professionals.

Financial Modeling Analyst – Meaning

Financial Modeling Analyst

A Financial Modeling Analyst is a professional who specializes in creating and analyzing financial models.

- They use mathematical and statistical techniques to forecast financial performance, assess risk, and make informed business decisions.

- Financial analysts are financial professionals who use mathematical models to analyze and forecast financial data.

- They build complex spreadsheets and models to evaluate financial performance, assess risks, and make informed business decisions.

- This role involves expertise in accounting, finance, strategy and advanced Excel skills to create accurate financial representations that aid clients in strategic planning, capital raising and investment decisions.

So, what does it mean to work as a financial modeling analyst?

Well, you will be charged to perform the following responsibilities:

1. Build financial models

As a financial analyst, you will be tasked with creating financial and business models that can help the company get a clear view of its income and expenses.

- Usually, you will make use of spreadsheets to represent the economic policy financial structure of the whole business model.

- You will also ensure that every cent received and spent in the company is documented so they can make a calculated financial prediction about the future of the company.

Various financial models can be used to achieve this. You can read up on my guide to know the various types of financial models and how you can build one.

These models include income statements, balance sheets, and cash flow statements, and with this information, they can understand the financial standing of the company.

2. Analyze data

As a financial analyst, you will also be responsible for examining data to ensure that it is accurate, complete, and relevant.

- The type of data collected includes historical financial reports, accounting data from the general ledger, the company’s stock price information, statistics and macroeconomic data, industry research, and just about any other type of quantitative data.

- The process of data analysis contributes to the reliability of data visualization in the financial models and, subsequently, the quality of insights derived from them.

3. Forecasting/Assumption

Forecasting is the heart of the job. You will be responsible for making assumptions based on the available data provided.

Assumptions are key inputs that drive the calculations and projections of the financial model.

Analysts use a combination of historical data analysis, market research, and industry knowledge to make informed estimations about various factors influencing a company’s financial performance.

There are various types of assumptions, and they include:

- Revenue assumptions

- Expense assumptions

- Capital Expenditure (CapEx) assumptions

- Working capital assumptions

- Interest rates and financing assumptions

- Tax assumptions

- Market assumptions

- Macroeconomic factors

4. Valuation

Valuation is a key responsibility of an analyst, and it involves determining the economic value of assets, projects, operations, or entire companies.

It is an important task for you as an analyst because it helps companies during mergers and acquisitions, financial reporting, investment analysis, and strategic decision-making.

Also, you can use different valuation methods depending on the nature of operations of the company being valued. These value using methods include:

- Asset Valuation

- Business Valuation

- Earnings Multiples

- Discounted Cash Flow (DCF)

- Market Approach

- Income Approach

- Cost Approach

5. Financial reporting

As a financial modeling analyst, you will prepare various financial modelling reports to communicate the outcomes of their analyses to stakeholders, the asset management, investors, and regulatory bodies.

This involves translating complex financial models and analyses into clear and concise reports that facilitate decision-making and transparency.

6. Risk assessment

You will also be responsible for identifying, evaluating, and reducing risks with whatever financial model they choose to use.

- Risk assessment involves a comprehensive analysis of potential uncertainties and adverse events that could impact the financial performance of the company.

- By integrating risk assessment into financial modeling and strategy, analysts contribute to informed decision-making and help businesses develop strategies to navigate through present trends and future uncertainties.

Financial Modeling Analyst-Educational Requirements

1. Bachelor’s degree

To be a financial modeling analyst, you must have a bachelor’s degree. The Chartered Financial Analyst (CFA) Institute requires you to have a degree in any of the courses below:

- Accounting

- Finance

- Statistics

- Economics

- Business administration

2. Master’s degree

A master’s degree is not usually required, but if you would love to advance in your various career paths, you should consider getting one.

And if you play your games right, with a solid, proven track record first, you can advance from being a financial analyst to working as a portfolio or fund manager for wealthy investors.

Skills You Need For Financial Modeling Analyst

To Excel as a financial analyst, you need the following financial modeling skills:

- Excel proficiency

- Accounting knowledge

- Finance acumen

- Attention to detail

- Analytical thinking

- Data interpretation

- Industry-specific expertise

- Model building experience

- Effective communication

- Diligence

- Extreme focus

Qualifications and Credentials For Financial Modeling Analyst

There are several financial analyst certifications available, such as:

- Chartered Financial Analyst (CFA)

- Certified Financial Planner (CFP)

- Financial Risk Manager (FRM)

Let us talk about each of them in detail:

1. Chartered Financial Analyst (CFA)

The CFA certification is globally recognized and focuses on investment management and financial analysis.

To earn the CFA charter, you must pass three levels of exams covering topics like Ethics, Economics, Portfolio management, and more.

It is often pursued by professionals aiming for roles in Investment management, Portfolio analysis, and Financial research.

2. Certified Financial Planner (CFP)

The CFP certification is for financial planning professionals. It covers areas like Retirement planning, tax planning, Insurance, and Estate planning.

If you want to get the CFP certification, you would have to complete coursework, pass an exam, and meet experience and ethical requirements.

CFP certification is valuable for those who want to work in financial planning, where they would be advising individuals on their overall financial situation.

3. Financial Risk Manager (FRM)

The FRM certification is for professionals specializing in risk management.

It is offered by the Global Association of Risk Professionals (GARP) and involves two levels of exams.

- First—Topics include quantitative analysis, financial markets

- Second —risk management tools

FRM holders often pursue careers in risk assessment, risk modeling, and financial regulation.

Top Financial Modeling Courses

Here are some of the top financial modeling courses globally if you are just starting:

- BIDA®: Business Intelligence & Data Analyst

- CBCA®: Commercial Banking & Credit Analyst

- CMSA®: Capital Markets & Securities Analyst

- FPWM™: Financial Planning & Wealth Management

- FTIP™: FinTech Industry Professional

- FMVA®: Financial Modeling & Valuation Analyst

Frequently Asked Questions

1. Do you need CFA for financial modeling?

While a Chartered Financial Analyst (CFA) certificate is valuable and can enhance your financial knowledge, it is not strictly required for financial modeling.

Proficiency in accounting, corporate finance principles, and advanced Excel skills are more important.

However, obtaining a CFA can signal a high level of expertise and commitment, potentially opening doors to advanced roles.

2. What is the difference between a CFA and financial analyst?

The Certified Financial Analyst (CFA) is a professional designation, while a financial analyst is a broader job role. A financial analyst analyzes financial data, prepares reports, and helps in decision-making.

On the other hand, a CFA is a specific qualification awarded by the CFA Institute, indicating a higher level of expertise in investment management and financial analysis.

3. How long does it take to get a CFA?

The Chartered Financial Analyst (CFA) program is rigorous and usually takes around four years to complete.

This duration includes passing all three levels of exams, gaining the required work experience, and adhering to the CFA Institute’s professional conduct requirements.

The exams are held annually, and you often need to spend a recommended minimum of 300 hours preparing for each level.

4. How much does a financial modeling analyst make a year?

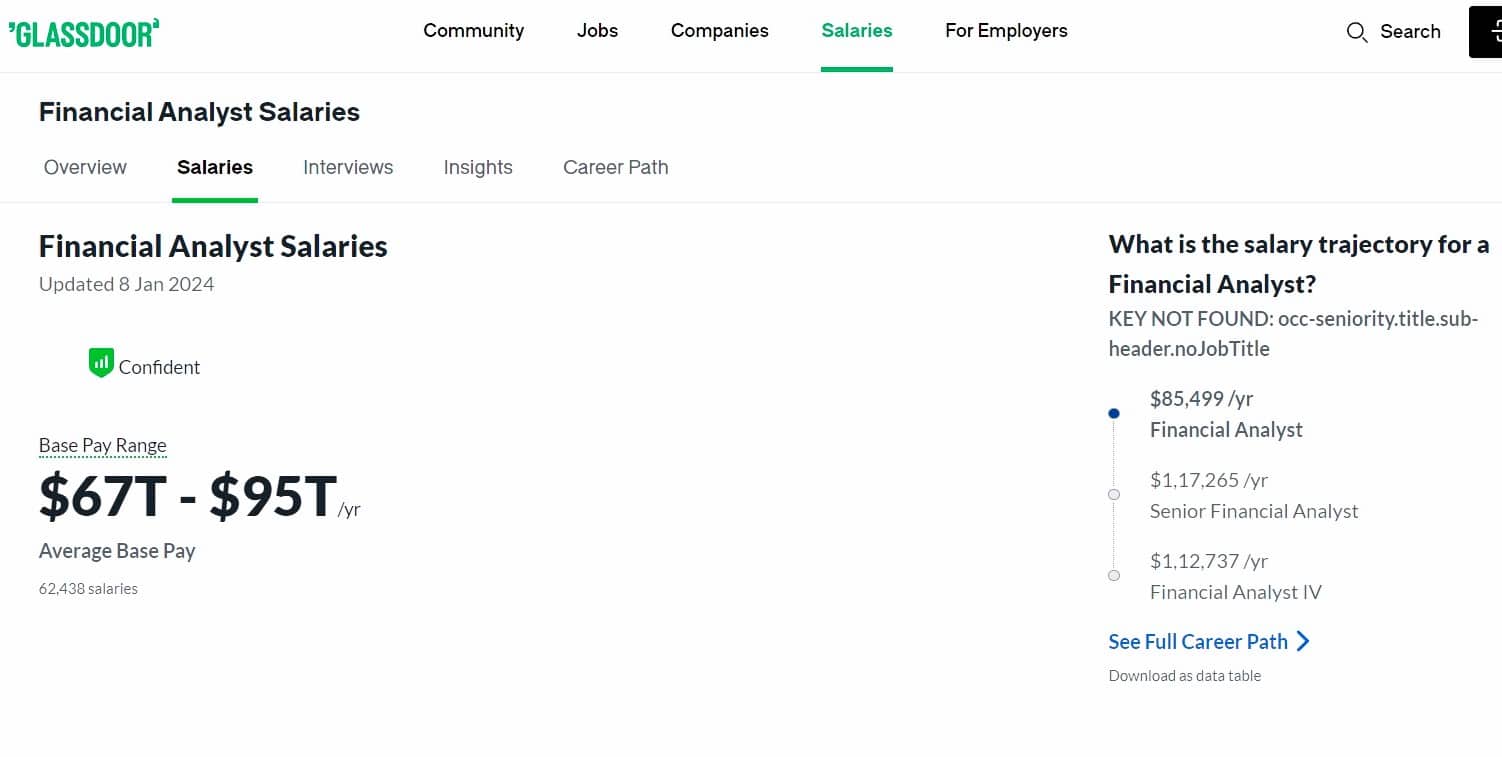

According to Glassdoor, the average salary for a Financial Analyst is $85,518 annually in the United States and the average additional cash compensation is $5,557, with a range from $4,168 – $7,780.

Financial Analyst Salary – Glassdoor

Top 15 Websites To Get Employed As A Financial Modeling Analyst

So, here goes my promise. As an aspiring financial analyst, you can find jobs on these sites:

- Google Jobs

- Glassdoor

- eFinancialCareers

- Association for Financial Professionals

- Financial Planning Association

- CPA Career Center

- Association for Financial Professionals

- USA Jobs

My Exclusive Insights for You

Getting started as a financial modeling analyst is not a day’s job, and you need to go through the thorough process of becoming one.

You can take on some of the top modeling courses listed in this article to broaden your knowledge.

I wish you nothing but the best of luck on your journey to becoming a financial modeling analyst.

Go ahead and crush it!