Are you currently exploring your career options and toying around with the idea of becoming an investment banking analyst?

Today is your lucky day because I’ll walk you through what it entails. Ask yourself:

Do you enjoy thinking profoundly and have a knack for numbers?

Is your Inner GPS geared towards becoming an investment banking analyst?

Before becoming an investment banking analyst, you must be clear on your- Why?

Why become an investment banking analyst?

When you become an investment banking analyst,

You can become an investment valuation company analysis expert by creating complex financial models early in your career.

You will gain valuable experience in financial valuation and enhance skills in assessing company and asset worth.

You will get lucrative finance career opportunities, like private equity, hedge funds, and corporate finance, due to the solid analytical foundation and industry connections gained.

If you want to learn-How? then this guide is perfect for you. You will learn in this guide:

What is an investment banking analyst?

How to become an investment banking analyst?

Practical action steps to become an investment banking analyst

Is an investment banking analyst career right for you?

Are you ready to explore the potential of an investment banking analyst career? Let’s get started!

What Is an Investment Banking Analyst?

Investment banking analysts are usually fresh graduates who join investment banks to raise capital for individuals and businesses by selling equity and issuing debt.

You prepare complex financial transactions and legal documents, conduct research relating to mergers, and review financial information and market trends.

Becoming an investment banking analyst gives you vast exposure to the finance industry. It equips you for higher roles in the future.

Before you get into the technical aspects of an investment banking analyst career, let me answer your big question:

What is the difference between an investment banker and an investment banking analyst?

The difference is that:

Most investment bankers spend most of their time communicating with stakeholders and making critical decisions on behalf of the company.

On the other hand, as an investment banking analyst, you spend your time digging through data and creating financial models for the rest of the team members.

Now, let’s go deep into your pathway as an investment banking analyst!

How Do You Start as an Investment Banking Analyst?

The first step to determine whether an investment banking career path is right for you is –

“Learning what it takes to become an investment banking analyst.”

According to statistical research by Zippia, nearly 16,218 investment banking analysts are currently employed in the United States alone.

What do you decipher from the above data?

The above data indicates that you can explore investment banking analyst as a career option.

However, you must know that to become an investment banking analyst must be in your Inner GPS.

Once you know it is in your Inner GPS, you can be prepared to become an investment banking analyst and take the required efforts and actions.

To tap your Inner GPS, you can take our Inner GPS Career Coaching, where you will get all the clarity on this path.

Having shared that, you must know that Investment banking is a competitive career path because it often comes with sizable compensation.

Investment banking analysts work in an investment banking team with financial statement analysis, project valuation, financing, financial modeling, and accounting skills.

Investment banks seek educated, competent, skilled candidates who understand quantitative skills and financial modeling.

An investment banking analyst possesses in-depth Excel knowledge and market data analysis skills.

- Investment banking analysts engage in analytical work like creating financial models relating to infrastructure like real estate, power projects, etc.

Investment Banking Analyst Job Description

Investment banking analysts possess various attributes, including the necessary educational qualifications, skills, foresight, network, and a tad more than sheer luck to succeed.

What does an investment banking analyst do?

As an investment banking analyst, you’ll be responsible for accounting for the following:

Meet with bank representatives or clients to understand their financial goals and needs.

Serve as intermediaries between corporations looking for capital and investors.

Research historical and current stock, bonds, and markets performance.

Collect and analyze financial data to review portfolios and opportunities.

Assist investment bank representatives in creating up-to-date financial offerings.

Compile reports relating to projections, transactions, and portfolios using spreadsheets and other finance-related software.

Perform administrative tasks, like scheduling meetings, when needed.

Now that you know who an investment banking analyst is and what they do, let’s evaluate what it takes to become an investment banking analyst.

How to Become an Investment Banking Analyst?

Candidates who successfully land investment banking analyst jobs at top Wall Street investment banks share a few common attributes.

They:

Get a helpful bachelor’s degree.

Do a finance internship.

Get industry certifications.

Worked as an investment banking analyst.

Get licensed.

Think about a master’s degree.

By investing your time, money, and energy in the right direction, you, too, can become an investment banking analyst.

Practical Action Steps to Become an Investment Banking Analyst

Here’s a general outline of the process of how to become an Investment Banking Analyst:

Step 1: Obtain a Relevant Educational Qualification

Whether a graduate or undergraduate, you must qualify to become an investment banker analyst. This step will answer your two questions:

What qualifications do I need to be an investment banking analyst?

What can I do after the 12th to become an investment banking analyst?

Educational Qualifications

Bachelor’s degree: Complete a bachelor’s degree from a reputable college or university. Your coursework should include business administration, economics, statistics, mathematics, finance, and accounting. While not always required, a degree in these fields is highly recommended by business schools and preferred by most investment banks.

MBA: Get a master’s degree in finance, economics, business administration (MBA), or a related field from a reputable business school.

- CFA: With certifications like the Chartered Financial Analyst(CFA) designation, you enter the career without much hustle. Your coursework includes risk and portfolio management, tax laws, options pricing and trading, and bond valuations.

Step 2: Develop critical skills and knowledge

Financial acumen: Gain a strong understanding of financial concepts- financial statements, valuation methods, financial modeling, and investment analysis.

Quantitative skills: Develop proficiency in quantitative analysis, mathematics, and statistics, as investment banking involves working with complex financial data and models.

Communication skills: Hone your written and verbal communication skills because clear communication is essential for creating reports, pitching ideas, and interacting with clients and colleagues.

Computer skills: Be familiar with relevant software tools, such as Microsoft Excel, financial modeling software, and data analysis tools.

Step 3: Gain relevant experience

Internships and working experience: Secure a relevant working experience like a summer internship at a top investment bank during your undergraduate years. Look for positions at investment banks, financial firms, or corporate finance departments where the experiences you get provide valuable exposure to the industry.

Professional registration and licensing: Once employed, get professional registration and licensing with the Financial Industry Regulatory Authority (FINRA).

Step 4: Networking

Build connections: Networking is critical when you intend to venture into this career. It’s even more important if you’ve not graduated from an Ivy League university or have someone close to the industry.

Professional network: Establish a professional network by attending industry events, conferences, and career fairs. Connect with professionals already working in the investment banking industry and seek mentorship.

Step 5: Prepare your application

Resume and cover letter: Create a well-crafted resume and cover letter highlighting your relevant skills, experiences, and academic achievements.

Step 6: Apply for positions

Entry-level positions: Look for entry-level analyst positions at investment banks. These positions are often titled- “Investment Banking Analyst” or “Financial Analyst.” Apply directly through the bank’s website or through job boards.

Step 7: Ace interviews

Interview preparation: Study common interview questions for investment banking roles. Be ready with answers that showcase your financial knowledge, analytical skills, and ability to work under pressure.

Technical questions: Be prepared to answer technical questions about financial modeling, valuation, and market trends.

Behavioral questions: Practice answering behavioral questions that assess your teamwork, leadership, and problem-solving skills.

Step 8: Secure the position

Interview rounds: Successfully navigate the interview process, which may involve multiple rounds of interviews, including phone screenings, technical discussions, and in-person or virtual consultations.

Receive an offer: If you perform well during interviews, you may receive a request for the investment banking analyst position.

Step 9: Begin your career

Training: Upon accepting the offer, you’ll likely undergo training to familiarize yourself with the bank’s procedures, software tools, and expectations.

On-the-job learning: Embrace continuous learning as you work on various financial projects, assisting senior analysts and building your skills.

Remember that the path to becoming an Investment Banking Analyst can vary depending on the bank, location, and background. Your flexibility, determination, and strong work ethic are essential for success in the highly competitive field of investment banking.

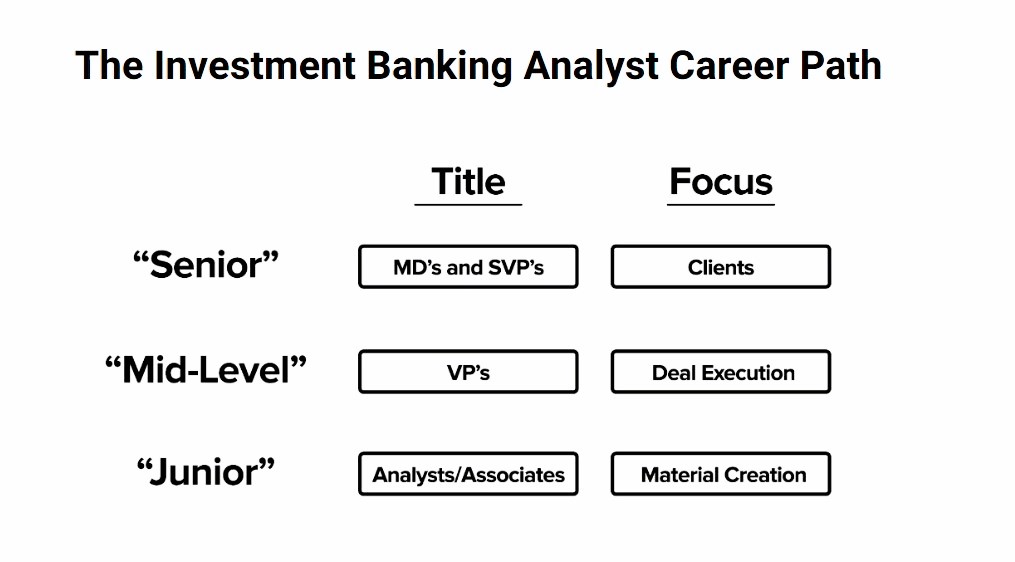

The Investment Banking Analyst Career Path

Image Source: Finance-able

An investment banking analyst’s corporate hierarchy and career path haven’t changed much over the last few years and are well-defined as follows:

Intern

Investment Banking Analyst

Associate

Vice President

The Senior Vice President or Director

Managing Director

While titles may vary depending on the organization, this is the expected investment banking analyst career path.

What have you imagined the benefits and challenges of being an investment banking analyst to be? Well, let’s find out.

Benefits of Being an Investment Banking Analyst

A valuable career like an investment banking analyst has numerous benefits and opportunities as you reap those potential investments and benefits. Here are the benefits of pursuing this career:

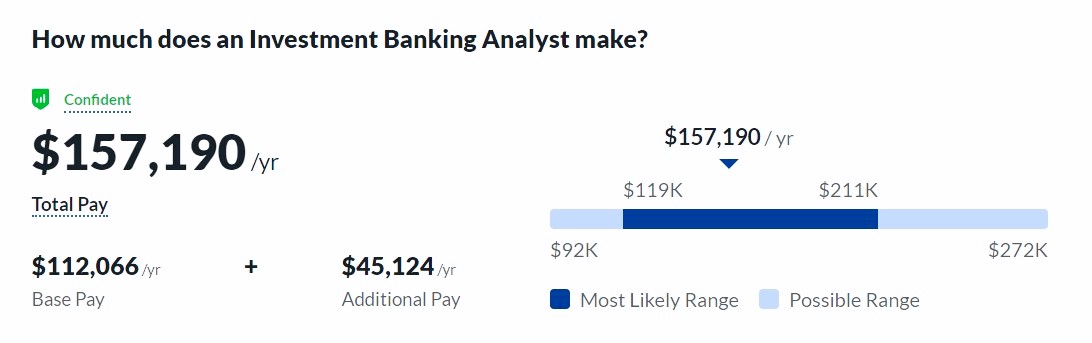

#1. High salary potential: The average salary of an investment banking analyst is $157,190 per annum. A successful investment banking analyst earns both a high base salary and commissions.

#2. Good benefits package: The benefits package is another appealing aspect of this career choice. They receive, along with salary, compensation such as bonuses, commissions, insurance covers, and stock options, making the career worthwhile.

#3. Working in a competitive environment: Investment banking requires brilliant individuals with excellent analytical capabilities. Everyone has to perform at high levels to remain competitive. Working with driven colleagues leaves you no choice but to challenge yourself to exceed expectations.

#4. Influential networking: Analysts interact with the senior management of companies they work with, which allows them to create professional and personal relationships with high-ranking officials. The networking opportunity benefits your career, mainly by serving as a reference or when you’re looking for a new job opportunity.

#5. Continued development: Investment banking analysts’ work dynamics constantly change, and the field is always evolving. So, as much as the skills you learn at the onset of your career are necessary, there’s a need to learn from the new developments in the field.

Challenges of an Investment Banking Analyst

Suppose you wish to make an informed career choice. In that case, it’s essential to consider the potential challenges of being an investment banking analyst.

Some challenges you’re bound to encounter include:

#1. Long working hours: When working a full-time position part-time as an investment banking analyst, you’ll realize that you must make substantial time commitments because you might be required to work beyond 40 hours. Sometimes you may work long shifts or on weekends.

Although this might be a challenge, it may also be the reason for the competitive salaries, giving you a financial trade-off to these work expectations.

#2. Round-the-clock availability: Besides regular working hours, your client or employer might require you to be available outside formal working hours. It may include responding to emails, making or receiving calls, responding to inquiries, etc. In the long run, it leaves a favorable impression while improving your earning potential and long-term career prospects.

#3. High competition: You’re likely to experience increased pressure due to the competitive nature of the job. The high levels of competition may also lead to you creating strong interpersonal relationships, providing you with the resources needed to succeed.

Now that you understand the ups and downs to expect in this career, let’s look at what it takes to succeed as an investment banking analyst.

How to Succeed as an Investment Banking Analyst?

Before you decide on becoming an investment banking analyst, take a pause to ponder over the following aspects:

1. Is investment analyst a difficult job?

Yes, being an investment analyst can be challenging, requiring a solid understanding of financial markets and economic trends and the ability to analyze complex data.

It involves researching and evaluating investment opportunities, making recommendations, and staying up-to-date with market developments.

2. How to be a good investment banking analyst?

Success as an investment analyst often requires analytical skills, technical skills, industry knowledge, and the ability to manage risks effectively.

Success in investment banking requires dedication and hard work. Continuous improvement, adaptability, and a commitment to excellence will position you for a rewarding career in this competitive field.

I hope you understand by now that you must have the zeal to become an investment banking analyst along with the skills I have covered in the next section.

What Skills Do Investment Banking Analysts Need?

To succeed as an investment banking analyst, you need the following necessary skills:

# 1. Industry regulations: Help ensure your employer and clients operate within federal laws. Thus, as an investment banking analyst, you must use your knowledge of the rules to collect data and make recommendations.

# 2. Financial modeling: An in-depth knowledge of financial models and the capability to create new ones helps you manipulate data and give the most reliable projections.

# 3. Spreadsheet software: Apart from general computer knowledge, as an investment banking analyst, you must have an in-depth understanding of using complex spreadsheet visualization processes, formulas, and functions.

# 4. Mathematics and statistics: Investment banking analysts use basic and advanced math skills in developing and using financial models. You also evaluate securities and investments, review and draw conclusions from data, and create projections to see the outcomes of investment decisions.

# 5. Critical thinking: After researching and using models, an investment banking analyst must conclude the data to know the effects of the data on institutional or other transactions and client goals.

# 6. Research: An investment banking analyst must use reliable information resources like government-regulated financial reporting websites.

# 7. Organization: An investment banking analyst must possess strong organizational skills to work on different projects simultaneously.

# 8. Public speaking: Investment bankers and banking analysts often present their research, investment portfolios, and recommendations. So, you must hone your public speaking skills because of the small and large groups you will address.

# 9. Communication: Because they must present in informal and formal setups, investment banking analysts must have strong verbal and written communication.

# 10. Active listening: An investment banking analyst uses active listening to understand what institutions and corporate clients need.

The above pointers will help you stay ahead, leading to your success as an investment banking analyst.

Do you know what to expect regarding salary and compensation in this career? Let’s find out.

Investment Banking Analyst Salary and Compensation

Here, I will address your most prominent question:

Where do investment banking analysts make the most money?

According to a report by Zippia, Investment banking analysts make the most money in California, United States. The average investment banking analyst’s salary is $102,980.

Is investment banking a high-paying job?

Here are the average annual salary and expectations for higher compensation at each level:

| Position | Base Salary (USD) | Promotion Timeframe |

| Investment Banking Analyst | $100-$125K | 2-3 years |

| Associate | $175-$225K | 3-4 years |

| Vice President (VP) | $250-$300K | 3-4 years |

| Senior VP/Director | $300-$350K | 2-3 years |

| Managing Director | $400-$600K | Not Applicable |

The above figures are according to pay in the U.S., especially top investment banks in NYC. So, the salary will be lower in other areas and smaller banks.

How much does an Investment Banking Analyst make?

According to Glassdoor, the average pay per year is $157,171, with the base pay being $112,054 and additional bonuses of $45,117.

Based on the above information, you can conclude that your salary as an investment banking analyst depends on the following:

Your work experience

The organization you’re working for

The position you hold in the firm

Based on real-world practical experience and the figures above, an investment banking career is worth exploring.

Let’s look into how to effectively communicate with clients and stakeholders as an investment banking analyst.

How to Communicate with Clients and Stakeholders in Investment Banks

Communication is crucial, especially in keeping clients and stakeholders like senior bankers, lawyers, accountants, regulators, etc., engaged and informed.

Effective communication with stakeholders helps you build trust, collaboration, and feedback while managing boundaries and expectations.

Communication strategies to help you actualize these outcomes while improving the stakeholder relationships include:

Knowing your stakeholders and what they care about

Planning your communication objectives, methods, messages, and frequency of communication

Using the appropriate communication channel depending on the communication objective and stakeholder preference

Strive to remain clear and concise using techniques like the 5 Ws (who, what, when, where, why), the inverted pyramid, or the SMART (specific, measurable, achievable, relevant, time-bound) criterion.

Listen and engage the clients and stakeholders to know what they’re saying and ask questions so that you can provide the appropriate feedback.

Adapt and improve your communication based on the results and feedback received from your contact.

Communication is critical in investment banking management because it ensures that all parties remain informed.

Let’s discuss managing time and prioritizing tasks to create a work-life balance in your career.

Time Management as an Investment Banking Analyst

Managing time and prioritizing tasks as an investment banking analyst is critical, given the following:

The high workload

Tight deadlines

Multiple projects you must handle

The ever-changing career demands

Is investment banking analyst a stressful job?

To be in a position to perform your duties effectively without suffering burnout, you must do the following:

Set goals

Plan ahead

Delegate when possible

Avoid distractions

Have downtime to re-energize

As the above pointers help you maintain a healthy work-life balance, below are the career choices to anticipate after serving as an investment banking analyst.

What Are the Career Paths after Being an Investment Banking Analyst?

When working as an investment banking analyst at an established bank, you can opt to stay in investment banking as an associate. Alternatively, you have access to various investment banking exit options as follows:

- Asset management

- Corporate development

- Corporate finance

- Hedge funds

- Private Equity

- Venture capital, etc.

If you’re working for smaller banks, then your growth may be limited to moving to other banks, corporate development, and corporate finance analyst roles.

Investment Banking Analyst Career: Frequently Asked Questions

1. How long is investment banking training?

New analysts recruited into the Investment Banking Division (IBD) undergo an investment banking training program that equips them with the necessary skills to succeed in the investment team. The training programs will take you up to six weeks to complete.

2. How long does it take to become an investment analyst?

Becoming an investment analyst typically takes around 2 to 5 years.

This includes the fundamental level:

Obtaining a bachelor’s degree in a related field (economics, finance, business),

Gaining relevant work experience through internships or entry-level positions

Possibly pursuing certifications like the Chartered Financial Analyst (CFA) designation for career advancement

3. Do I need a CFA for investment banking?

A CFA designation can be advantageous for an investment banking career, as it showcases your knowledge and skills in financial analysis and investment management.

It can help you stand out in a competitive job market and demonstrate your commitment to the field. However, it’s not a strict requirement for entry-level investment banking positions.

Many investment bankers do not hold a CFA. Still, it can certainly provide an edge in specific roles, especially those involving complex financial analysis and research.

4. Is an MBA necessary for investment banking?

An MBA (Master of Business Administration) is not strictly necessary for entry-level investment banking positions.

However, many investment bankers pursue an MBA later in their careers, often to advance to higher-level roles, leadership positions or transition into other areas of finance or business.

An MBA can be valuable if you aim for senior roles or aspire to have a more comprehensive understanding of business and management.

A bachelor’s degree, internships, and relevant certifications are often sufficient for those just starting to enter investment banking.

4. Can I become an investment banker with an online bachelor’s degree program?

Absolutely, but certain crucial factors should be taken into account. Investment banking is fiercely competitive and often demands a robust academic foundation and pertinent skills. Here are key considerations:

An online degree program’s prestige: Opting for an online degree program with a reputable standing, endorsed by employers, is vital. Prioritize accredited institutions with solid recognition.

Significance of online MBA: Prominent investment banks typically seek prospects from esteemed MBA institutions. Consequently, an online MBA holds merit as well. The growing demand for online MBAs in investment banking attests to this fact.

However, I advise you to opt for a classroom MBA program from a reputed institute for practical expertise and skill enhancement.

Key Takeaways

To wrap up, let me recapitulate the critical learning points by answering your most demanding question.

Often, I am asked the following question:

What is the fastest way to become an investment banker?

Well, my answer to your question is that the fastest way to become an investment banker is to follow the action steps diligently and with utmost dedication.

Obtain a bachelor’s degree in finance, economics, business, or a related field.

Build a solid professional network by attending industry events and workshops and connecting with professionals on platforms like LinkedIn.

Secure internships or entry-level positions at financial institutions to gain practical experience and industry exposure.

Pursue a Master’s in Business Administration (MBA) to enhance your credentials and increase your chances of advancement.

Obtain relevant certifications such as Chartered Financial Analyst (CFA) to demonstrate expertise and commitment to the field.

Research and apply to investment banking firms, highlighting relevant skills, experiences, and network connections in your applications.

My Exclusive Insights for You

By now, you already understand that becoming an investment banking analyst isn’t a walk in the park – it takes hard work to earn this position in the cut-throat investment banking industry.

Your prime questions are:

1. Is an Investment Banking Analyst Career Right for Me?

An investment banking analyst career requires you to thoroughly evaluate your skills and interest, to determine whether they align with your career objectives.

2. Is a career as an investment banking analyst worth it?

The above information lets you know the hard facts, like the time you have to invest in your job and the benefits to expect once you choose the career.

You’re, therefore, in a position to make an informed final decision about pursuing a career as an investment banking analyst.

Now you know what to do to become an investment banking analyst. It’s time to dive into the investment banking analyst job and make a lasting impact on financial markets.